Hello, YieldAlley readers! In this issue:

Core PCE inflation edges higher.

Calculating Dividend Growth Potential (Part 3 of DDRM Fundamentals).

Average Retirement Savings for Gen X.

The best way to track and monitor the highest cash rates.

And more!

NEWS

Standout Stories

🏖️ The 401(k) Rollover Mistake That Costs Retirement Savers Billions (WSJ)

🕵️♀️ How Kamala Harris Manages Her Money: Index Funds and a 2.625% Mortgage (WSJ)

🚖 Alphabet to invest $5 billion in self-driving car unit Waymo (CNBC)

🇺🇸 What Is the Average Retirement Savings for Gen X? (US News)

🤖 OpenAI announces a search engine called SearchGPT; Alphabet shares dip (CNBC)

MARKET THOUGHTS

Core PCE Inflation Edges Higher to 2.6%, Testing Fed's Rate Cut Expectations

Key inflation measures showed mixed results, potentially keeping the Fed on track for rate cuts.

Core PCE price index rose 2.6% annualized through June, above estimates but flat from the previous month.

Headline PCE decreased to 2.5% year-over-year, meeting expectations.

Consumer spending remained resilient, rising 0.3%, while personal income growth slowed to 0.2%.

Inflation is expected to moderate further in the second half of the year, driven by lower shelter costs and slower wage growth.

Corporate earnings season is showing strong performance relative to expectations.

78% of reporting S&P 500 companies have beaten analyst expectations, with an average upside surprise of 4.4%.

Year-over-year earnings growth for Q1 is at 9.8%, the highest since Q4 2021.

Earnings growth is forecast to accelerate throughout the year, potentially reaching 10.6% annually.

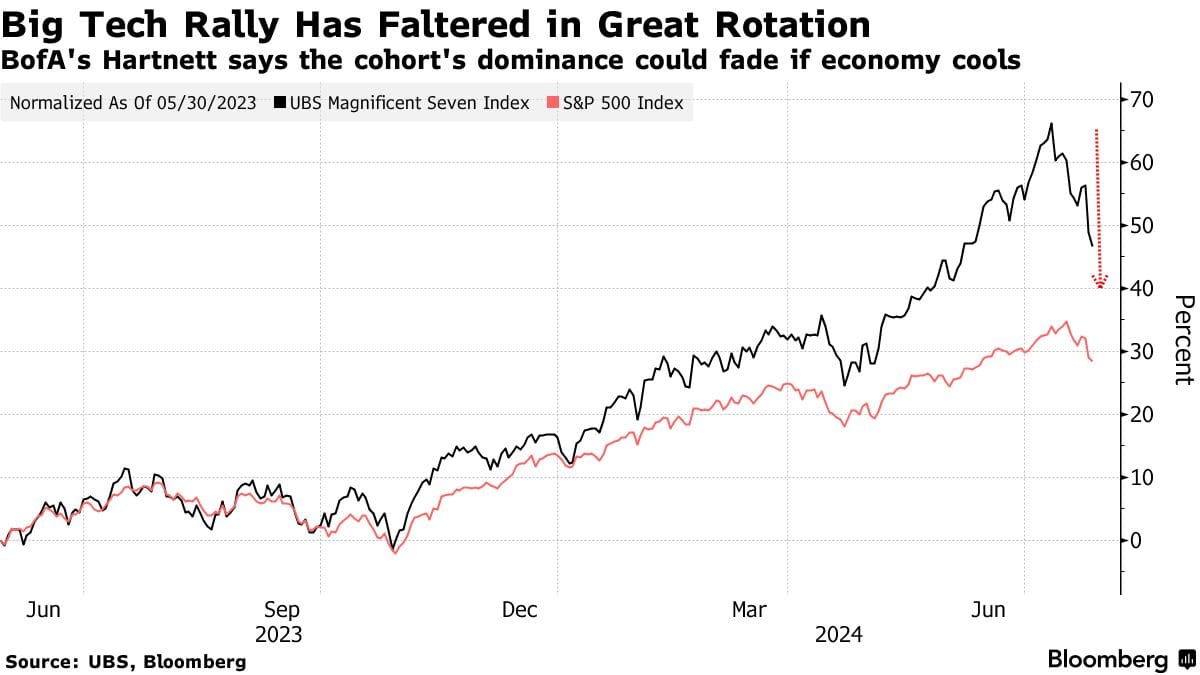

Broad sector performance could lead to catch-up in lagging sectors compared to tech and communication services.

Market sentiment remains cautious following the previous day's tech-induced decline.

Small-cap stocks continued to show strength, with the Russell 2000 Index ending the week 1.5% higher.

Investors are processing disappointing earnings from Tesla and Alphabet, as well as increased AI-related capital spending.

Technical factors, including the Nasdaq bouncing off its 100-day moving average, may have contributed to early gains.

INCOME BUILDING

Calculating Dividend Growth Potential (Part 3 of DDRM Fundamentals)

Welcome to the third installment of our series on the Dividend Drill Return Model (DDRM). In this article, we'll dive deep into how to calculate and interpret dividend growth potential using the DDRM. We'll explore the factors that influence dividend growth and demonstrate how to apply these concepts using real-world examples.

The Importance of Dividend Growth

Dividend growth remains a crucial component of total return for income-focused investors. It helps maintain purchasing power in the face of inflation and can significantly boost long-term returns. The DDRM helps us estimate future dividend growth by considering both the company's capacity to increase dividends and the likelihood that management will actually do so.

Three Categories of Dividend Growth Potential

According to Josh Peters of Morningstar, dividend growth potential generally falls into one of three categories:

Trend

Incentive

Hope

Let's explore each of these categories and how they relate to the DDRM calculations.

1. Trend-Based Dividend Growth

Companies with a long history of consistent dividend increases often strive to maintain that trend. This predictability is valuable to investors and can influence management decisions.

Example: Procter & Gamble (PG) has raised its dividend for 67 consecutive years as of 2023. Even during challenging economic times, the company has continued to increase its dividend to maintain its track record.

DDRM Application: For companies with strong dividend growth trends like P&G, you might adjust your core growth rate estimate upward, assuming management will prioritize dividend increases even if earnings growth slows temporarily.

2. Incentive-Based Dividend Growth

Some companies have structural incentives to increase dividends over time. This is common in certain business structures, such as Real Estate Investment Trusts (REITs) and Master Limited Partnerships (MLPs).

Example: Realty Income Corporation (O), a REIT, has a strong incentive to increase distributions due to its structure. As of 2023, it has increased its dividend for 29 consecutive years and makes monthly dividend payments.

DDRM Application: For companies with clear dividend growth incentives like Realty Income, you might set a minimum dividend growth rate in your DDRM calculations, even if the core growth rate or ROE inputs suggest lower growth potential.

3. Hope-Based Dividend Growth

In the absence of clear trends or incentives, dividend growth potential may be based more on hope or speculation about management's intentions.

Example: Meta Platforms (META) (formerly Facebook) initiated its first quarterly dividend in February 2024. With no dividend history, future growth is based largely on hope and speculation about management's intentions.

DDRM Application: For companies without established dividend growth trends or clear incentives, be conservative in your growth estimates. You might consider running multiple scenarios with varying growth rates to account for uncertainty.

Applying the DDRM: A Case Study

Let's apply these concepts to a real-world example using Johnson & Johnson (JNJ), a diversified healthcare company.

DDRM Inputs for Johnson & Johnson (as of December 29, 2023):

Stock Price: $156.74

Dividend Rate: $4.76 annually

Earnings Per Share (TTM): $6.65

Core Growth Rate: 6% (based on analyst consensus long-term growth estimates)

Return on Equity: 25.5% (TTM, calculated as Net Income / Shareholders' Equity)

DDRM Calculations:

Cost of Growth Per Share = (Core Growth / ROE) EPS = (6% / 25.5%) $6.65 = $1.57

This represents the earnings that must be retained to fund the company's growth.

Funding Gap = EPS - Dividend Rate - Cost of Growth Per Share = $6.65 - $4.76 - $1.57 = $0.32

This is the excess earnings available for share repurchases or other uses.

Share Change = Funding Gap / Stock Price = $0.32 / $156.74 = 0.2%

This represents the potential reduction in share count from buybacks.

Dividend Growth = Core Growth + Share Change = 6% + 0.2% = 6.2%

Total Return Estimate = Dividend Yield + Dividend Growth = (4.76 / 156.74) + 6.2% = 3.0% + 6.2% = 9.2%

The DDRM suggests Johnson & Johnson has the potential to grow its dividend by 6.2% annually. This aligns with the company's historical dividend growth trend, which has averaged around 6% over the past five years. Johnson & Johnson falls into the "Trend" category, with a long history of consistent dividend increases (61 years as of 2023).

Running Multiple Scenarios

Given the inherent uncertainty in forecasting, it's wise to run multiple scenarios with different inputs. For Johnson & Johnson, we'll use historical ROE data from the past five years to create realistic scenarios:

Conservative Scenario: 5% core growth, 25% ROE (based on 2019's ROE)

Base Case: 6% core growth, 25.5% ROE (as calculated above, using 2023's ROE)

Optimistic Scenario: 7% core growth, 29% ROE (based on 2021's ROE)

This approach provides a range of potential outcomes and helps identify how sensitive the dividend growth forecast is to changes in key inputs.

Key Takeaways:

Consider historical dividend growth trends, but don't rely on them exclusively.

Look for structural incentives that might drive future dividend growth.

Be cautious with "hope-based" dividend growth expectations.

Use the DDRM to quantify dividend growth potential, but interpret results in the context of the company's dividend philosophy and history.

Run multiple scenarios to account for uncertainty in your estimates.

Recap of Our DDRM Series

As we conclude this third part of our DDRM Fundamentals series, let's remind ourselves of what we've covered so far:

Introduction to the DDRM concept: We introduced the Dividend Drill Return Model as a powerful tool for analyzing dividend growth potential and forecasting total returns for dividend-paying stocks.

Understanding DDRM inputs: We explored the five key inputs of the DDRM - current stock price, current dividend rate, earnings per share, core growth rate, and return on equity - and discussed how to obtain and evaluate these inputs.

Calculating dividend growth potential: In this article, we've delved into how to use the DDRM to calculate dividend growth potential, considering factors such as dividend growth trends, incentives, and management intentions.

In our upcoming articles, we'll continue our exploration of the DDRM by covering:

Interpreting DDRM results: We'll discuss how to analyze and interpret the outputs of the DDRM to make informed investment decisions.

Practical case studies using the DDRM: We'll apply the DDRM to real-world examples, demonstrating how to use this tool in your dividend investing strategy.

Stay tuned for these upcoming installments as we continue to unlock the power of the Dividend Drill Return Model for dividend investors.

INCOME BUILDING

Cash Rates

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 5.01%

SPAXX (Fidelity Government Money Market Fund): 4.97%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 5.18%

VMFXX (Federal Money Market Fund): 5.29%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 5.11%

E*Trade: 5.00%

Fidelity: 5.05%

Merrill Edge and Merrill Lynch: 5.20%

Vanguard: 5.10%

ETFs

SGOV (iShares 0-3 Month Treasury Bond ETF): 5.24%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 5.19%

USFR (WisdomTree Floating Rate Treasury Fund): 5.32%

TFLO (iShares Treasury Floating Rate Bond ETF): 5.31%

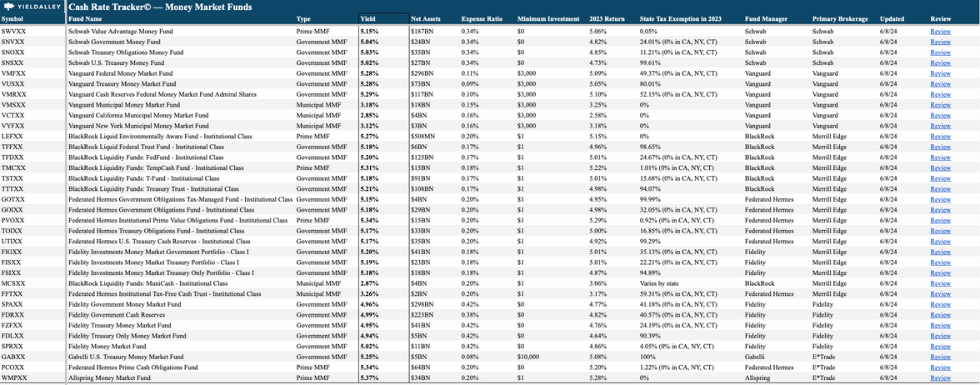

Want To Track the Highest Cash Yields?

Refer just one person to the YieldAlley newsletter for instant access to the YieldAlley Cash Rate Tracker©.

This simple spreadsheet lets you easily compare and track the best cash rates and investments.

Get all the details on the best money market funds and ETFs in a single spreadsheet.

BONUSES

Brokerage, Bank and Credit Card Bonuses

Brokerage Bonuses

E*Trade (still active): Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Bank Bonuses

U.S. Bank (NEW) — Earn up to a $450 bonus when you open a new Smartly checking account when you use promo code 2024JUL. Offer here.

Availability: Nationwide

Soft credit inquiry.

Axos Bank (active) — $500 when you open a new rewards checking account with promo code RC500 and certain requirements. Offer here.

Availability: Nationwide

Soft credit inquiry.

Credit Card Bonuses

Chase Ink Preferred (NEW) — Get 120,000 Ultimate Rewards bonus points when you spend $8,000 in the first three months after account opening. Offer here.

Capital One Venture (NEW) — Enjoy $250 on Capital One Travel in your first year and earn 75,000 bonus miles after spending $4,000 in the first 3 months. Offer here.

Citi Strata Premier (active) — 75,000 points after $4,000 in spend within the first three months. Offer here.

American Express Hilton Surpass Card (active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

Picture of the Week