Hello, YieldAlley readers! In this issue:

Tech Stocks Stumble.

Understanding DDRM Inputs (Part 2 of DDRM Fundamentals).

The AI Mafia.

The best way to track and monitor the highest cash rates.

And more!

NEWS

Standout Stories

🏦 Yes, You Can Save Too Much for Retirement (Bloomberg)

🎢 The Life Cycle of Market Champions (Bridgewater)

📕 JP Morgan 2024 Global ETF Handbook (JP Morgan)

🇺🇸 What Presidential Election? So Far, the Stock Market Doesn’t Care. (New York Times)

🤖 The AI Mafia (Fast Company)

MARKET THOUGHTS

Tech Stumbles as Small Caps Gain, All Eyes on Earnings and PCE Data

Stocks declined as the tech sector experienced a pullback, with the Nasdaq posting its worst weekly loss since late April.

A widespread tech outage on Friday disrupted various services, with CrowdStrike shares falling 11% due to software issues.

The tech weakness coincided with strength in the Dow, cyclical sectors, and small-cap stocks.

WTI oil prices declined 3%, while Treasury bond yields and the dollar finished slightly higher.

A leadership rotation in the stock market is becoming more prominent.

The Nasdaq rose almost 25% this year until early July, led by mega-cap tech stocks.

In the past two weeks, there's been a shift towards cyclical sectors, value, and small-cap stocks.

The Russell 2000 (small-cap proxy) is up more than 10% following recent cooler inflation data.

This shift aligns with expectations as the market approaches a potential Fed rate-cutting cycle.

Upcoming earnings reports and PCE inflation data will be crucial for market direction.

About 30% of S&P 500 companies are expected to report earnings next week, including Tesla, Visa, and Alphabet.

The core PCE price index is expected to decrease to 2.5% in June year-over-year, potentially the lowest since March 2021.

Recent cooling in inflation and the labor market suggest a possible Fed rate cut in September.

INCOME BUILDING

Understanding DDRM Inputs (Part 2 of DDRM Fundamentals)

Welcome to the second installment of our series on the Dividend Drill Return Model (DDRM). In this article, we'll explore the five key inputs that power this analytical tool and demonstrate how they generate dividend growth and total return forecasts. We’ll be using Apple as an example.

The Five DDRM Inputs

Current Stock Price: This is the market price of one share of the company's stock. For example, if Apple Inc. (AAPL) is trading at $192.53 on December 29, 2023, this would be the input value.

Current Dividend Rate: This is the annual dividend payment per share. If Apple pays a quarterly dividend of $0.24, the annual dividend rate would be $0.96 ($0.24 * 4 quarters).

Earnings Per Share (EPS): We use a forward-looking EPS estimate that represents stable, long-term earnings power. For Apple, analysts might project EPS of $6.55 for the next fiscal year.

Core Growth Rate: This represents the expected annual growth rate of the company's overall business. For a mature tech company like Apple, we might estimate a core growth rate of 6% based on factors such as:

Historical growth: 8% revenue growth over the past 5 years

Industry trends: Slowing smartphone market

New product categories: Potential growth from AR/VR devices

Return on Equity (ROE): This measures how efficiently a company uses shareholders' equity to generate profits. Apple's ROE has averaged around 145% over the past few years, but for future projections, we might use a more conservative estimate of 100% to account for potential margin pressure and increased competition.

Case Study: Apple Inc. (AAPL)

Let's apply the DDRM to Apple using data as of the end of December 2023:

Stock Price: $192.53

Dividend Rate: $0.96 annually

EPS: $6.55 (forward estimate)

Core Growth Rate: 6%

ROE: 100%

Now, let's walk through the DDRM calculation step-by-step:

Step 1: Calculate the Cost of Growth Per Share, which is the earnings need to fund core growth

Cost of Growth Per Share = (Core Growth Rate / ROE)

EPS Cost of Growth Per Share = (6% / 100%) $6.55 = $0.39

Step 2: Calculate the Funding Gap, or the excess earnings available for buybacks

Funding Gap = EPS - Dividend Rate - Cost of Growth Per Share

Funding Gap = $6.55 - $0.96 - $0.39 = $5.20

Step 3: Calculate Share Change, which estimates the annual share reduction from buybacks

Share Change = Funding Gap / Stock Price

Share Change = $5.20 / $192.53 = 2.7%

Step 4: Calculate Dividend Growth, which is the projected total annual dividend growth rate

Dividend Growth = Core Growth + Share Change

Dividend Growth = 6% + 2.7% = 8.7%

Step 5: Calculate Total Return Estimate, which forecasts the annual shareholder return

Current Yield = Dividend Rate / Stock Price = $0.96 / $192.53 = 0.5%

Total Return Estimate = Current Yield + Dividend Growth Total Return Estimate = 0.5% + 8.7% = 9.2%

Interpretation of Results:

The DDRM suggests that Apple has the potential to grow its dividend by 8.7% annually. This growth comes from two sources:

Core business growth (6%)

Share buybacks funded by excess earnings (2.7%)

The total return estimate of 9.2% consists of the current dividend yield (0.5%) plus the projected dividend growth rate (8.7%). When we look at Apple’s history, it’s maintained an average annual dividend growth rate of approximately 8-9% over the past decade (2012-2022).

Key Takeaways:

Use current, accurate data for stock price and dividend rate.

Ensure EPS represents stable, long-term earning power.

Be conservative when estimating core growth rates, especially for mature industries.

Consider both historical performance and future outlook when projecting ROE.

The DDRM helps quantify how efficiently a company can turn its earnings into shareholder returns through dividends and buybacks.

In our next article, we'll explore how to estimate dividend growth potential based on historical trends, company-specific dynamics, and other market and industry factors. Stay tuned!

INCOME BUILDING

Cash Rates

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 5.01%

SPAXX (Fidelity Government Money Market Fund): 4.97%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 5.18%

VMFXX (Federal Money Market Fund): 5.29%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 5.22%

E*Trade: 5.20%

Fidelity: 5.15%

Merrill Edge and Merrill Lynch: —

Vanguard: 5.15%

ETFs

SGOV (iShares 0-3 Month Treasury Bond ETF): 5.25%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 5.20%

USFR (WisdomTree Floating Rate Treasury Fund): 5.33%

TFLO (iShares Treasury Floating Rate Bond ETF): 5.32%

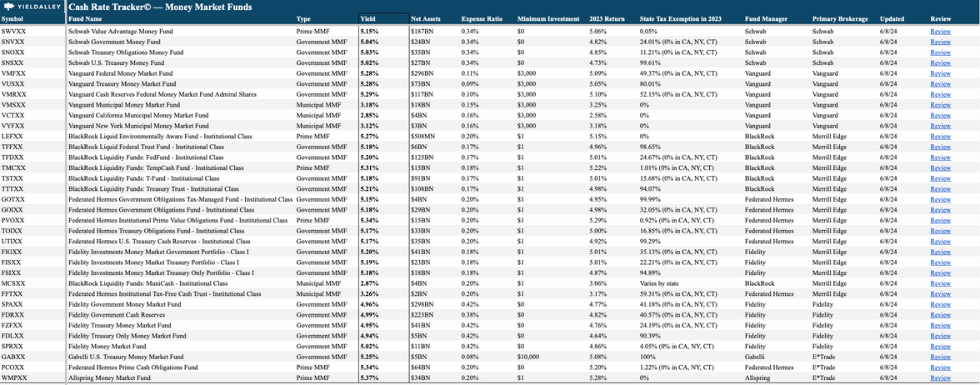

Want To Track the Highest Cash Yields?

Refer just one person to the YieldAlley newsletter for instant access to the YieldAlley Cash Rate Tracker©.

This simple spreadsheet lets you easily compare and track the best cash rates and investments.

Get all the details on the best money market funds and ETFs in a single spreadsheet.

BONUSES

Brokerage, Bank and Credit Card Bonuses

Brokerage Bonuses

E*Trade (still active): Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Bank Bonuses

U.S. Bank (NEW) — Earn up to a $450 bonus when you open a new Smartly checking account when you use promo code 2024JUL. Offer here.

Availability: Nationwide

Soft credit inquiry.

Chartway Federal Credit Union (active) — $200 cash back when you open a new checking account using promo code 200CASH. Offer here.

Availability: Nationwide

Soft credit inquiry.

Axos Bank (active) — $500 when you open a new rewards checking account with promo code RC500 and certain requirements. Offer here.

Availability: Nationwide

Soft credit inquiry.

Discover Savings Account (active) — With your first Discover Savings account, earn a $150 bonus with a $15,000 deposit, or a $200 bonus with a $25,000 deposit. Use offer code GOBP623. Offer here.

Availability: Nationwide

Soft credit inquiry.

USC Credit Union (active) — $250 bonus when you open a new checking account and set up direct deposit with a $1,000 minimum direct deposit every 30 days for the first 90 days of checking account AND make a minimum of ten (10) debit transactions every 30 days for the first 90 days of checking account opening. Use promo code SPRING24. Offer here.

Availability: CA.

Soft credit inquiry.

Credit Card Bonuses

Chase Ink Preferred (NEW) — Get 120,000 Ultimate Rewards bonus points when you spend $8,000 in the first three months after account opening. Offer here.

Capital One Venture (NEW) — Enjoy $250 on Capital One Travel in your first year and earn 75,000 bonus miles after spending $4,000 in the first 3 months. Offer here.

Citi Strata Premier (active) — 75,000 points after $4,000 in spend within the first three months. Offer here.

Bank of America Sonesta (active) — 120,000 points after $2,000 in spend on the first 90 days of account opening. Offer here.

American Express Hilton Surpass Card (active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

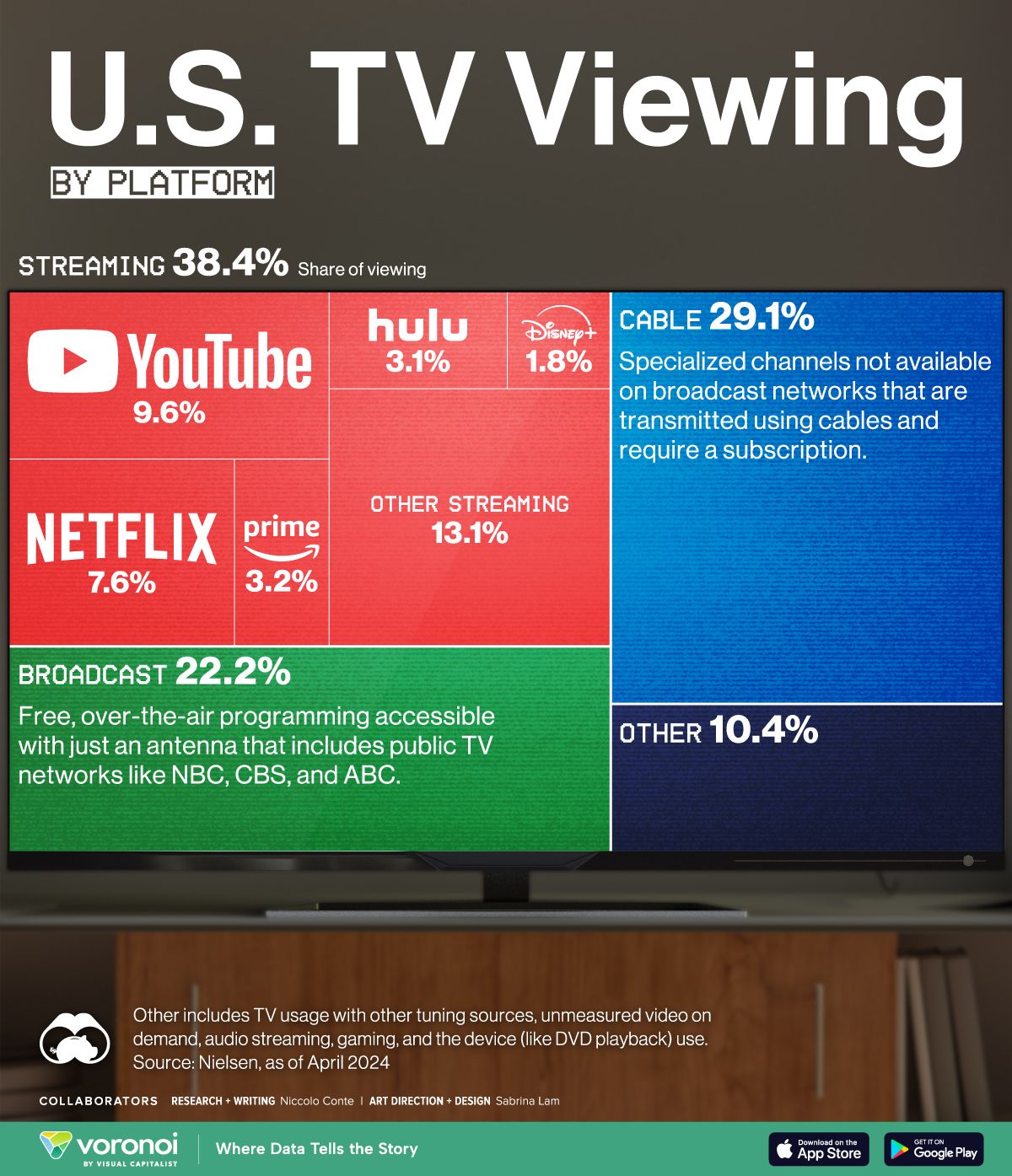

Picture of the Week