Hello, YieldAlley readers! In this issue:

Inflation Dips in June.

Dividend Drill Return Model Fundamentals (Part 1).

How do you know it’s time to retire?

How to track and monitor the highest cash rates.

And more!

NEWS

Standout Stories

📈 How the Largest Bond Funds Did In Q2 2024 (Morningstar)

👎 Vanguard’s Die-Hard Customers Have a Message for New CEO: ‘The Service Is Abysmal’ (WSJ)

💹 Senators strike bipartisan deal for a ban on stock trading by members of Congress (CNBC)

🏈 Greedy Politicians Drive Away Star Athletes and Undermine Local Teams (International Liberty)

🏖️ How do you know it’s time to retire? (Vox)

MARKET THOUGHTS

Inflation Dips in June, Stirring Debate on Fed's Next Move

Consumer prices fell 0.1% in June, which hasn't happened since 2020.

Core CPI (prices without food and energy) went up 0.1%. This is the smallest increase in over two years.

In the last three months, core CPI has gone up at a 2.1% yearly rate.

Inflation (price increases) is slowing down in many areas, including rent and things people buy for fun.

The PCE deflator, which is the Fed's favorite way to measure prices, probably went up 0.2% in June.

Treasury yields went down following the favorable inflation data.

The two-year Treasury yield dropped by more than 0.1% on Thursday, reaching its lowest point since March.

People who watch the markets think the Fed might lower interest rates by 0.25% in September.

The economic outlook is uncertain, with different signs pointing in different directions.

The Consumer Sentiment Index, which shows how people feel about money, fell to its lowest point in 8 months.

But people now think inflation will be lower in the future, expecting prices to go up by 2.9% each year.

The job market is getting a bit weaker, but not enough to say the economy is shrinking.

Most households still have enough money, even though things cost more than before COVID.

INCOME BUILDING

DDRM Fundamentals: Introduction to the Dividend Drill Return Model (Part 1)

Welcome to the first part of our series on the Dividend Drill Return Model (DDRM). This powerful analytical tool was introduced by Morningstar and is designed to help dividend investors assess a stock's potential for future dividend growth and total returns. Let's explore the fundamentals of the DDRM and how it can enhance your investment decision-making process.

What is the DDRM?

The Dividend Drill Return Model is a systematic approach to evaluating dividend-paying stocks. It uses key financial metrics and growth estimates to project future dividend growth and potential total returns. The DDRM provides a structured framework for analyzing the sustainability and growth potential of a company's dividend payments.

How the DDRM Works

The DDRM combines five key inputs to estimate dividend growth potential:

Current Stock Price

Current Dividend Rate

Earnings Per Share (EPS)

Core Growth Rate

Return on Equity (ROE)

These inputs are used in a series of calculations to determine:

The cost of growth: How much earnings the company needs to retain to achieve its projected growth rate.

The funding gap: The difference between earnings and the sum of dividends paid plus the cost of growth.

Potential share buybacks: How the funding gap might be used to reduce share count, potentially boosting per-share metrics.

The DDRM uses the following key formulas:

Cost of Growth Per Share = (Core Growth Rate / ROE) × EPS

Funding Gap = EPS - Dividend Rate - Cost of Growth Per Share

Share Change = Funding Gap / Stock Price

Dividend Growth = Core Growth + Share Change

The model assumes that earnings and dividends will grow at the core growth rate, adjusted for any change in share count due to buybacks or new share issuances.

Why the DDRM Works

The DDRM is effective because it:

Considers both current financial metrics and future growth potential

Accounts for the cost of growth and its impact on dividend sustainability

Incorporates the effects of share buybacks on per-share metrics

Provides a systematic way to compare different dividend-paying stocks

Case Study: Hershey Company (HSY)

Let's apply the DDRM to Hershey using 2023 year-end data:

Inputs:

Stock Price: $227.45 (closing price on December 31, 2023)

Dividend Rate: $4.144 per share (total dividends paid in 2023)

Earnings Per Share: $9.37 (diluted EPS for full year 2023)

Core Growth Rate (estimated): 5% (based on historical growth and analyst projections)

Return on Equity: 64.8% (ROE for full year 2023)

Calculations:

Cost of Growth Per Share = (5% / 64.8%) × $9.37 = $0.72

This means Hershey needs to retain $0.72 per share to fund its 5% growth.

Funding Gap = $9.37 - $4.144 - $0.72 = $4.51

Hershey has $4.51 per share available after paying dividends and funding growth.

Share Change = $4.51 / $227.45 = 2.0%

This indicates Hershey can potentially buy back 2.0% of its shares annually.

Dividend Growth = 5% + 2.0% = 7.0%

The DDRM estimates Hershey's dividend can grow at 7.0% annually.

Total Return Estimate = Current Yield + Dividend Growth = (4.144 / 227.45) + 7.0% = 1.8% + 7.0% = 8.8%

The DDRM projects a potential total return of 8.8% for Hershey stock.

This analysis, based on Hershey's 2023 financial results, suggests the company has the potential for solid dividend growth, driven by both its core business growth and share buybacks. Hershey's high ROE allows for efficient growth funding, leaving ample room for dividend increases and share repurchases.

Case Study: AT&T (T)

Now let's examine a case where the DDRM indicates poor dividend growth prospects using 2023 data. We'll look at AT&T (T), a company that has faced challenges in recent years and cut its dividend in 2022.

Inputs:

Stock Price: $16.50 (as of December 31, 2023)

Dividend Rate: $1.11 per share per year

Earnings Per Share (adjusted): $2.57

Core Growth Rate (estimated): 1% (based on analyst projections)

Return on Equity: 10.3% (trailing twelve months)

Let's apply the DDRM:

Cost of Growth Per Share = (Core Growth Rate / ROE) × EPS = (1% / 10.3%) × $2.57 = $0.25

This means AT&T needs to retain $0.25 per share to fund its 1% growth.

Funding Gap = EPS - Dividend Rate - Cost of Growth Per Share = $2.57 - $1.11 - $0.25 = $1.21

AT&T has $1.21 per share available after paying dividends and funding growth.

Share Change = Funding Gap / Stock Price = $1.21 / $16.50 = 7.3%

This suggests AT&T could potentially buy back 7.3% of its shares annually. However, AT&T has significant debt, so this money is more likely to be used for debt reduction rather than share buybacks.

Dividend Growth = Core Growth + Share Change = 1% + 0% = 1%

Assuming AT&T uses the funding gap for debt reduction rather than buybacks, the DDRM estimates AT&T's dividend can grow at only 1% annually.

Total Return Estimate = Current Yield + Dividend Growth = (1.11 / 16.50) + 1% = 6.7% + 1% = 7.7%

Analysis: The DDRM reveals several concerning factors for AT&T's dividend growth prospects:

Low Core Growth: The 1% estimated growth rate is barely keeping pace with inflation, indicating stagnant business performance.

Low Return on Equity: AT&T's 10.3% ROE is relatively low, making it expensive to fund even modest growth.

High Payout Ratio: The current dividend ($1.11) represents 43% of earnings ($2.57), which is high given the low growth and ROE.

Debt Priorities: While the funding gap suggests potential for share buybacks, AT&T's high debt levels mean this excess cash is more likely to be used for debt reduction, eliminating a potential source of per-share dividend growth.

Minimal Dividend Growth: The projected 1% dividend growth is essentially flat in real terms when accounting for inflation.

The DDRM suggests that AT&T's dividend growth prospects are poor. The company can barely afford its current dividend while funding minimal growth. Any economic headwinds or increased competition could put further pressure on the dividend.

This analysis aligns with AT&T's recent history. The company cut its dividend by nearly half in 2022 as part of the spinoff of Warner Media. While the current dividend appears more sustainable, the DDRM indicates very limited room for future growth.

Comparing AT&T and Hershey

There are a few key reasons why a 7.7% total return estimate for AT&T is less attractive than the 8.8% estimate for Hershey:

Dividend growth rate: The DDRM estimates only 1% annual dividend growth for AT&T compared to 7.0% for Hershey. Dividend growth is a key component of total return, so the much lower growth projection for AT&T makes its total return potential less compelling.

Underlying business fundamentals:

AT&T's low 1% core growth estimate indicates a stagnant business with little fundamental growth potential. Hershey's 5% core growth suggests a healthier business with opportunities to expand.

AT&T's 10.3% return on equity is relatively low, making it expensive for the company to fund even modest growth. Hershey's 64.8% ROE for 2023 allows it to fund growth very efficiently.

So while AT&T's 6.7% current yield is attractive on the surface, its weak growth prospects and stretched payout ratio make the dividend's long-term sustainability and growth potential questionable. The DDRM reveals underlying concerns about AT&T's ability to deliver satisfactory total returns going forward.

In contrast, Hershey's lower 1.8% current yield is well supported by its strong business fundamentals, high ROE, and ample room for both core business growth and dividend increases over time. This gives Hershey better visibility for delivering the estimated 8.8% total return over the long run compared to AT&T.

So the DDRM shows how looking beyond the headline yield to assess dividend growth potential based on financial strength and business quality is crucial in projecting total returns and identifying the most attractive dividend stock investments. Current income is important, but sustainable growth is really the key to superior total returns.

Wrapping It Up

This example demonstrates how the DDRM can identify potentially problematic dividend situations. For AT&T, the model reveals a combination of low growth, poor capital efficiency, and competing financial priorities that constrain dividend growth. For income-focused investors seeking growing dividend streams, the DDRM suggests that AT&T may not be an attractive option despite its high current yield.

What's Coming Next?

In the upcoming parts of this series, we'll delve deeper into each DDRM input:

Current Stock Price and Dividend Rate

Earnings Per Share: Choosing the right earnings figure

Core Growth Rate: Estimating future growth potential

Return on Equity: Assessing capital efficiency

We'll also explore how to interpret DDRM results and apply them to your investment decisions. As we continue this series, you'll gain the knowledge to apply this tool effectively in your own dividend investing strategy.

INCOME BUILDING

Cash Rates

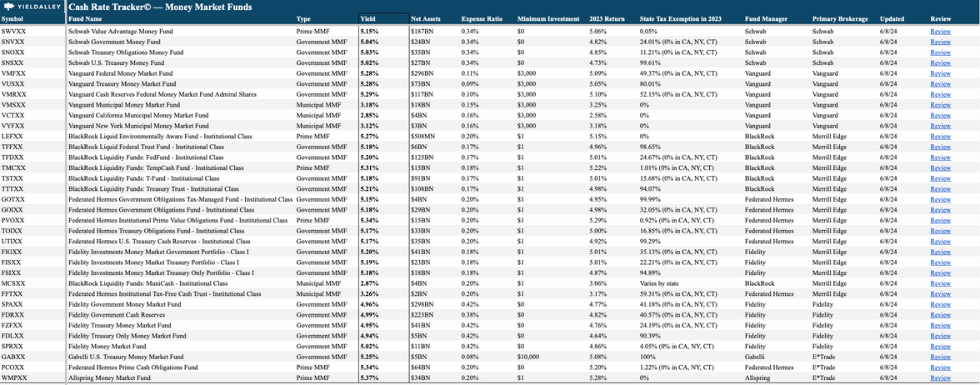

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 5.03%

SPAXX (Fidelity Government Money Market Fund): 4.97%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 5.18%

VMFXX (Federal Money Market Fund): 5.28%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 5.22%

E*Trade: 5.25%

Fidelity: 5.15%

Merrill Edge and Merrill Lynch: 5.25%

Vanguard: 5.25%

ETFs

SGOV (iShares 0-3 Month Treasury Bond ETF): 5.26%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 5.21%

USFR (WisdomTree Floating Rate Treasury Fund): 5.34%

TFLO (iShares Treasury Floating Rate Bond ETF): 5.32%

Want To Track the Highest Cash Yields?

Refer just one person to the YieldAlley newsletter for instant access to the YieldAlley Cash Rate Tracker©.

This simple spreadsheet lets you easily compare and track the best cash rates and investments.

Get all the details on the best money market funds and ETFs in a single spreadsheet.

BONUSES

Brokerage, Bank and Credit Card Bonuses

Brokerage Bonuses

E*Trade (still active): Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Bank Bonuses

Chartway Federal Credit Union (active) — $200 cash back when you open a new checking account using promo code 200CASH. Offer here.

Availability: Nationwide

Soft credit inquiry.

Axos Bank (active) — $500 when you open a new rewards checking account with promo code RC500 and certain requirements. Offer here.

Availability: Nationwide

Soft credit inquiry.

Discover Savings Account (active) — With your first Discover Savings account, earn a $150 bonus with a $15,000 deposit, or a $200 bonus with a $25,000 deposit. Use offer code GOBP623. Offer here.

Availability: Nationwide

Soft credit inquiry.

USC Credit Union (active) — $250 bonus when you open a new checking account and set up direct deposit with a $1,000 minimum direct deposit every 30 days for the first 90 days of checking account AND make a minimum of ten (10) debit transactions every 30 days for the first 90 days of checking account opening. Use promo code SPRING24. Offer here.

Availability: CA.

Soft credit inquiry.

Credit Card Bonuses

Citi Strata Premier (active) — 75,000 points after $4,000 in spend within the first three months. Offer here.

Bank of America Sonesta (active) — 120,000 points after $2,000 in spend on the first 90 days of account opening. Offer here.

American Express Hilton Surpass Card (active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

Picture of the Week