Hello, YieldAlley readers! In this issue:

Stocks Rally on Soft Landing Hopes

When Your Financial Advisor Pushes Your Risk Tolerance Beyond Comfort

The Dramatic Turnaround in Millennials’ Finances

The best way to track and monitor the highest cash rates.

And more!

NEWS

Standout Stories

☕️ Why Wall Street thinks Brian Niccol is the person to revive Starbucks — and end the Howard Schultz era (CNBC)

🛜 Google has an illegal monopoly on search (Reuters)

📈 The Dramatic Turnaround in Millennials’ Finances (WSJ)

🛢️ Semiconductors are ‘the new oil.’ (Fortune)

🏡 Real Estate Agent Commissions Are Changing. Here’s How It’ll Work (Bloomberg)

MARKET THOUGHTS

Stocks Rally on Soft Landing Hopes, Markets Await Fed's Jackson Hole Symposium

U.S. stocks finished the week with modest gains, reflecting growing confidence in a "soft landing" scenario.

The S&P 500 extended its winning streak to seven days, nearly erasing the previous week's sell-off.

U.S. markets are now roughly 2% from their all-time high.

Sector performance was mixed, with leadership from financials, communication services, and utilities.

Economic data released this week eased recession fears and bolstered market sentiment.

Softer inflation readings in both PPI and CPI provided relief on the interest rate outlook.

Strong retail sales figures and a drop in weekly jobless claims soothed concerns about consumer spending.

Walmart's positive quarterly results further supported the consumer outlook.

The Federal Reserve's upcoming Jackson Hole symposium is in focus for investors.

Markets expect the Fed to cut rates at its September meeting.

There's an increased expectation for a 50-basis-point (0.50%) initial rate cut.

Investors will seek signals on the Fed's plans for future rate cuts.

Interest rates moved lower, with the 10-year Treasury yield falling below 3.9%.

Bond markets continue to digest incoming economic data.

The interest rate outlook remains a key factor in market performance.

INCOME BUILDING

What To Do When Your Financial Advisor Pushes Your Risk Tolerance Beyond Comfort

After five weeks of deep-diving into the Dividend Drill Return Model (DDRM) Fundamentals series, we're shifting gears to address a crucial aspect of retirement planning: the role of bonds. Today, we'll explore how bonds can provide stability and income, complementing the dividend growth stocks we've been analyzing with the DDRM.

This transition comes at an opportune time, as one of our readers recently shared an eye-opening experience with a financial advisor that highlights the ongoing debate between growth and safety in retirement portfolios.

Meet "Prudent Patricia" and her husband, both in their 60s. They sought advice on Roth conversions from a fee-only financial advisor, only to be surprised by a recommendation for a riskier asset allocation than they were comfortable with. This scenario raises important questions about the balance between equities and fixed income investments in retirement strategies.

Let's examine the advisor's perspective and delve into the often-underestimated role of bonds in creating a well-rounded retirement portfolio.

The Advisor's Perspective:

Recommended increasing equity allocation from 60% to 65%

Suggested maintaining this allocation until their 80s

Questioned the value of Treasuries and bond ladders

Posed the question: "How much safety do you really need?"

This perspective clearly made Patricia and her husband uneasy. In response, they expressed discomfort with the proposed higher-risk allocation. They preferred their current strategy, which included Treasuries and bond ladders. Moreover, they feared being advised to sell their existing bonds. This conflict between the advisor's recommendations and the couple's comfort level highlights the importance of personalized financial planning.

Considerations for Retirees:

When facing similar situations, retirees should first assess their risk tolerance. Your comfort level with market fluctuations should guide your asset allocation. Don't let external pressure push you beyond your risk tolerance. It's crucial to evaluate your financial security. If stress tests show you're financially secure with your current allocation, there may be no need to increase risk.

Weighing peace of mind against potential gains is another key consideration. Consider whether the potential for higher returns is worth the added stress and risk, whereas low-risk bonds can offer stability and consistent income. Understanding your options is also vital. You can seek a second opinion from another advisor, implement only the parts of the advice you're comfortable with, or focus the advisor on your original questions, such as Roth conversions in Patricia's case.

It's important to remember that it's your money and your decision. Don't feel pressured to follow advice that doesn't align with your financial goals and comfort level. Consider the value of bonds and fixed income. Treasuries and bond ladders can provide stability and reliable income, which may be more valuable to you than potential higher returns from a riskier portfolio.

When making these decisions, account for other income sources. Factor in pensions, Social Security, and other stable income when determining your need for portfolio income and growth. This comprehensive view can help you make more informed decisions about your asset allocation.

Additional Perspectives:

Financial Security: With substantial assets, some retirees may have already "won the game" financially. There may not be a need to take on additional risk if the current strategy meets your needs.

Age Considerations: It's important to consider age when determining asset allocation, with many experts suggesting a more conservative approach for those in their 70s and 80s.

Fixed Income Strategies: In the current high-interest rate environment, maintaining or even increasing allocation to fixed income investments like Treasuries, CDs, and bond ladders may be beneficial for some.

Gradual Changes: If changes to your portfolio are desired, consider making adjustments gradually rather than sudden shifts.

Advisor Necessity: Depending on your asset level and financial knowledge, you may want to reassess the need for an advisor, especially one pushing for increased risk beyond your comfort level.

Tax Strategy Focus: For specific questions like Roth conversions, a tax advisor or CPA might be more appropriate than a financial advisor focused on asset allocation.

Personal Comfort: Many retirees find that reducing equity exposure leads to better peace of mind, which can be invaluable during retirement years.

In conclusion, while financial advice can be valuable, it's crucial to ensure that any recommended strategy aligns with your personal financial goals, risk tolerance, and peace of mind. Your retirement years should be enjoyed with confidence in your financial decisions, not spent worrying about unnecessary market risks. By carefully considering your unique situation, risk tolerance, and long-term objectives, you can create a retirement strategy that provides both security and potential for growth, tailored to your individual needs and preferences.

What's Your Take?

We'd love to hear your thoughts! Have you dealt with similar advice from a financial advisor? What's your approach to balancing safety and growth in retirement? Reply to this email to share your experience or insights. Your perspective could be really helpful for others in our community who are facing similar decisions. Don't be shy – whether it's a quick tip or a full story, we're all ears!

INCOME BUILDING

Cash Rates

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 5.01%

SPAXX (Fidelity Government Money Market Fund): 4.98%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 5.17%

VMFXX (Federal Money Market Fund): 5.27%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 4.66%

E*Trade: 4.60%

Fidelity: 4.65%

Merrill Edge and Merrill Lynch: —

Vanguard: 4.95%

ETFs

SGOV (iShares 0-3 Month Treasury Bond ETF): 5.24%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 5.18%

USFR (WisdomTree Floating Rate Treasury Fund): 5.29%

TFLO (iShares Treasury Floating Rate Bond ETF): 5.31%

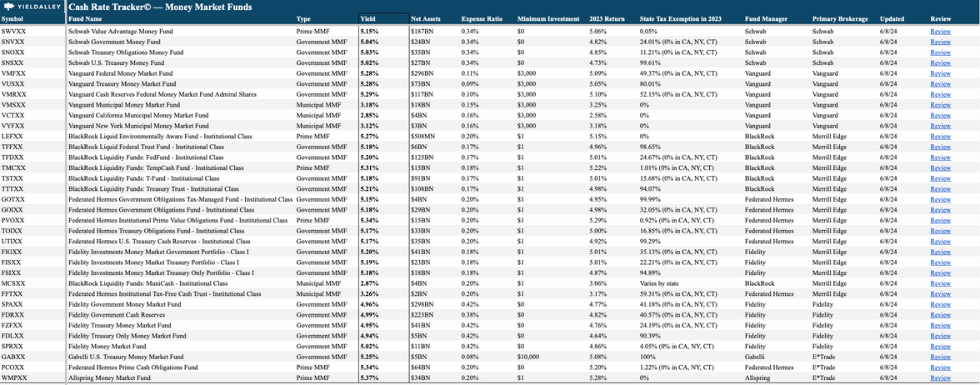

Want To Track the Highest Cash Yields?

Refer just one person to the YieldAlley newsletter for instant access to the YieldAlley Cash Rate Tracker©.

This simple spreadsheet lets you easily compare and track the best cash rates and investments.

Get all the details on the best money market funds and ETFs in a single spreadsheet.

BONUSES

Brokerage, Bank and Credit Card Bonuses

Brokerage Bonuses

E*Trade (still active): Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Bank Bonuses

U.S. Bank (active) — Earn up to a $450 bonus when you open a new Smartly checking account when you use promo code 2024JUL. Offer here.

Availability: Nationwide

Soft credit inquiry.

Axos Bank (active) — $500 when you open a new rewards checking account with promo code RC500 and certain requirements. Offer here.

Availability: Nationwide

Soft credit inquiry.

Credit Card Bonuses

Barclays jetBlue Plus Card (active) — Get 80,000 JetBlue points after $1,000 in spend within the first 90 days of account opening. Offer here.

Chase Ink Preferred (active) — Get 120,000 Ultimate Rewards bonus points when you spend $8,000 in the first three months after account opening. Offer here.

Capital One Venture (active) — Enjoy $250 on Capital One Travel in your first year and earn 75,000 bonus miles after spending $4,000 in the first 3 months. Offer here.

American Express Hilton Surpass Card (active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

Picture of the Week