Hello, YieldAlley readers! In this issue:

A recap on April inflation figures.

Locking in 5% rates for retirees.

Dividends from big tech firms.

Warren Buffet’s 70% Coca-Cola dividend yield.

And more!

Cash Income

April’s Inflation Report Softer Than Expected

Morningstar

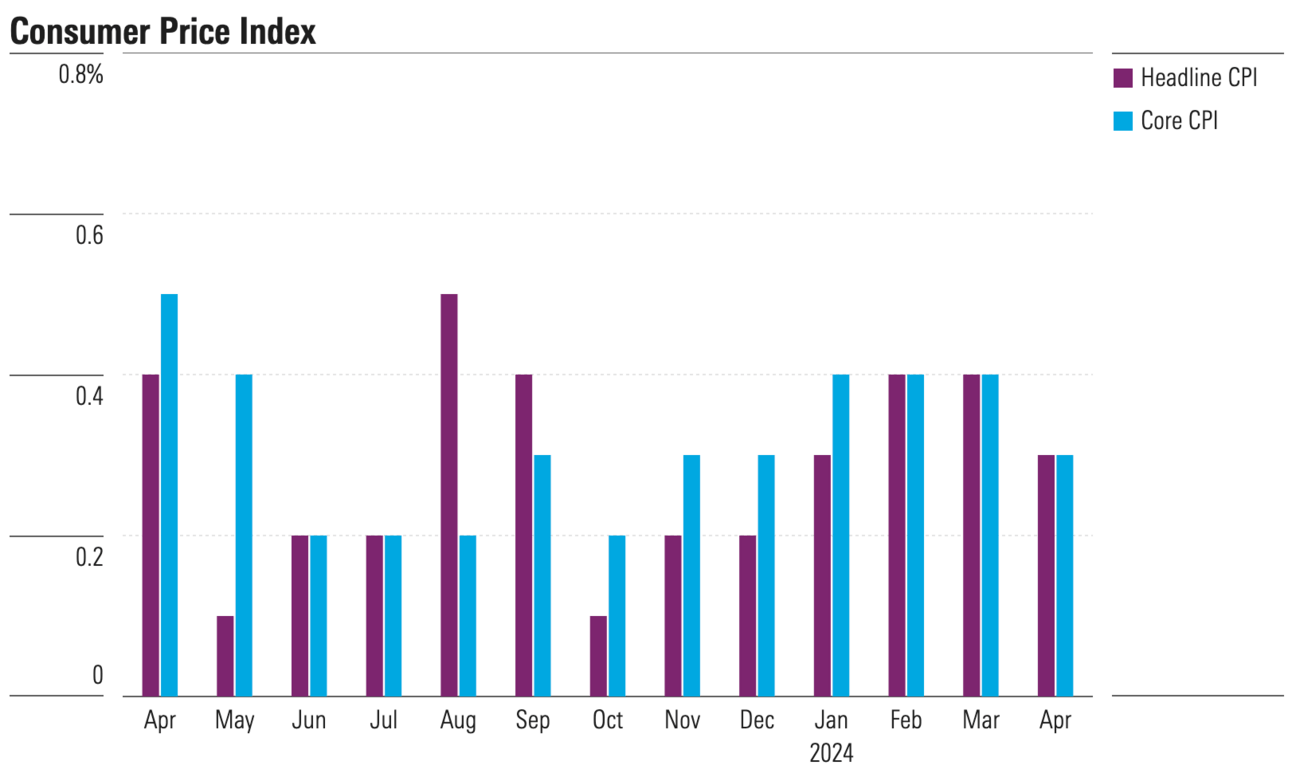

The April US CPI report shows inflation up 0.3% from the previous month. This is softer than expected, with many expecting inflation to have risen 0.4%. The softer-than-expected inflation print now has investors accelerating their expectations of an interest rate cut from the Federal Reserve. This in turn helped boost the Dow Jones to an all-time high this week. In March, both CPI and Core CPI (which excludes volatile food and energy costs), increased 0.4%. Inflation has now settled from the 9.1% annual increase seen back in June 2022. In April, prices rose 3.4% from a year earlier, compared to the Federal Reserve's annual inflation target rate of 2%. Inflation impacts retirees the most, as many have taken out more money from savings and investments to keep up with rising prices.

📈 Should I lock in 5%+ rates now, as a new retiree? We see this question often, especially with retirees who no longer have regular income and are drawing down on investments to meet their needs. Income production and capital preservation are the two most critical factors for most retiree’s portfolios, thus making fixed-income investments and bonds appealing investments. While we are in a bullish environment, partially driven by expectations of another interest rate cut, there will inevitably be another down market for equities, and you may want to focus on capital preservation by locking in risk-free, 5% yields now. Of course, no one can predict the future, so this is highly dependent on your particular life situation.

🏦 Vanguard’s new CEO is a former BlackRock executive. Salim Ramji is the first outsider to take charge of the storied asset manager. Ramji previously led BlackRock’s iShares ETF and index investing business. While we are cautiously optimistic, it is a bit of an interesting appointment. Ramji has indicated he is seeking to expand Vanguard’s advisory offering (we are generally not huge fans of this), and he also launched BlackRock’s Bitcoin ETF, which Vanguard has famously said they are against (Ramji has confirmed there will be no Vanguard Bitcoin ETF). Last week, we mentioned that Vanguard is introducing a new $100 account closure fee, a surprising move from the brokerage known for low costs and fees.

All brokerage cash guides and playbooks can be found on YieldAlley.com.

Keep up with AI

How do you keep up with the insane pace of AI? Join The Rundown — the world’s largest AI newsletter that keeps you up-to-date with everything happening in AI with just a 5-minute read per day.

Dividend Income

Big Tech Flexes its Financial Muscle With Dividend Payouts

Bloomberg

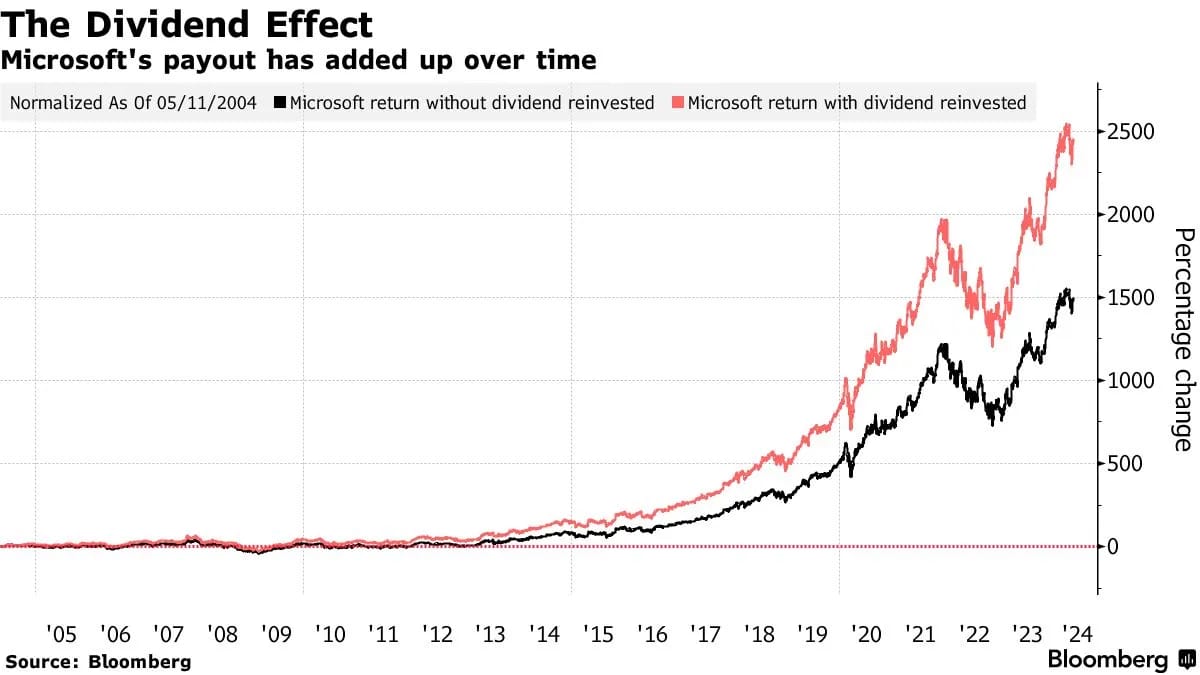

Tech companies are known for growth, not dividends. Now though, tech firms are shifting to a regular dividend payout, as they sit on more cash than they know what to do with. Some investors believe that the trend of major technology companies starting to pay dividends will continue, while those who do not introduce might be considered more volatile. Still, buybacks (repurchasing stock) are the preferred way for these companies to return money to shareholders. In 2024 alone, $58.5 billion has been spent by the Magnificent Seven on buybacks, compared to $11 billion on dividends. While dividend yields for tech firms remain low, they add up. Microsoft’s dividend yield is currently around 0.7%. Over the past 20 years, Microsoft shares have risen 1,500%, but including dividends, that return is over 2,400%!

🥤 Coca-Cola pays Warren Buffett $736 million every year. Buffett first invested in Coca-Cola in 1988 with a $1.3 billion investment. He bought over 400 million shares, or 6.2% of the company, at a share price of $2.73. Based on today’s share price of $63.03, Coca-Cola pays a 3.08% annual dividend yield, or $1.94 a share. But Buffett bought the stock for much cheaper, so his dividend yield is closer to 70%! Buffett is making over 100% of his original investment every two years just from the dividends alone, without including Coca-Cola's share price appreciation.

✂️ 3M cuts dividend by 54% after its spinoff. The company announced its dividend has been more than half on Tuesday, May 14. The new dividend will equal $2.80 a share per year, or an annual yield of 2.66% based on the Friday closing price of $105.26. Earlier in April, 3M completed the spinoff of Solventum, its healthcare business. 3M shareholders as of March 18, 2024 received one share of Solventum common stock for every four shares of 3M stock they held.

Opportunities

Brokerage Bonuses

Brokerages can offer very generous bonuses for deposits. We recommend taking advantage of these bonuses, which can help you earn up to 7% APY on your cash. Brokerages are the best way for most people to purchase the investments we discuss. As always, we highly recommend reading the fine print with these offers. We earn no money from these offers.

E*Trade: Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade: Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood: Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Opportunities

Bank Bonuses

While we recommend passive savers and investors consider brokered CDs, money market funds, or floating rate ETFs instead, some people may want to take advantage of bank bonuses and promotional rates. As always, we highly recommend reading the fine print with these offers. We earn no money from these offers.

Bank Bonuses

Laurel Road — Bonus of $300 + $20 monthly for the first year, after making deposits totaling at least $2,500 within 60 days of the account opening. Offer here.

Availability: Nationwide to both nurses and non-nurses.

Soft credit inquiry.

Opportunities

Credit Card Bonuses and Offers

Credit card signup bonuses are one of the easiest ways to earn extra income, as long as you are vigilant in managing payments, your credit score, and claiming bonuses. We know some of our readers are interested in the latest credit deals. As always, we highly recommend reading the fine print with these offers. We earn no money from these offers. The offers below show the best current offer at this time.

Citi / AAdvantage Platinum Select World Elite MasterCard — 75,000 American Airline miles after $3,500 in spend within the first four months. Offer here.

Citi / AAdvantage Executive World Elite Mastercard — 100,000 Mile offer after spending $10,000 within the first three months. Offer here.

Citi / AAdvantage Business Select World Elite MasterCard — 75,000 American Airline miles after $5,000 in spend within the first five months. Offer here.

Chase Sapphire Reserve — 75,000 points with referral link after $4,000 in spend within the first three months.

Chase Sapphire Preferred offer here (please message us if you need a referral link).

Chase Sapphire Reserve offer here (please message us if you need a referral link).

Chase British Airways — 85,000 points after spending $5,000 within 3 months on Chase British Airways, Iberia, and Aer Lingus cards.

Picture of the Week

What We’re Reading

The bull is ready to roar. (Spilled Coffee)

The rise of the forever renter class. (Of Dollars and Data)

Translating Wall Street jargon. (A Wealth of Common Sense)

Five common mistakes investors mark. (Real Vision)

A safer Treasury bond. (UCLA)