Hello, YieldAlley readers! In this issue, we cover new updates on Vanguard and Fidelity’s platforms, and look at the top 10 dividend-paying tech companies. We’ve also added a new brokerage bonuses section due to reader requests. With brokerage bonuses, you can boost your annual cash returns by 1-3%, so it’s worth investigating and taking advantage of.

Let’s review the latest income opportunities.

Cash Income

Many Fed officials have recently commented on interest rates. The takeaway? “Higher for longer”.

Cash News and Opportunities

Vanguard recently announced a new $100 account closure and outgoing transfer fee. It’s effective July 1, 2024. Here is the full commission and fee schedule. The fine print: “Vanguard may charge a $100 processing fee for account closure or the transfer of account assets to another firm.” If you have a dormant Vanguard account or are planning to close your account, we strongly suggest moving your assets before July 1. We are generally disappointed with Vanguard’s decision. Fidelity does not charge for any outgoing transfers, and Schwab and Merrill Edge charge nothing for a partial transfer (both charge $50 for a full outgoing transfer).

The Treasury plans on introducing a 6-week Treasury Bill, as noted in the Treasury’s recent quarterly refunding statement. The Treasury notes that it “intends to change the regular 6-week CMB into a benchmark bill”, and that it will take a few quarters to implement.

Fidelity plans on introducing SPAXX as a core position (default sweep fund) for its Cash Management Account (CMA) users on June 15, 2024. This is a huge boost, as one of the main drawbacks of the Fidelity CMA was that it only offered a 2.72% APY sweep. We previously wrote about how to use Fidelity as a bank, with the workaround of using the Fidelity brokerage account as overdraft protection for the CMA account. Now, CMA customers can directly benefit from the SPAXX APY without this workaround.

As always, CD rates for all brokerages can be found here. Floating rate note ETFs are still paying over 5.3% and will settle in one business day instead of two, starting on May 28.

All brokerage cash guides and playbooks can be found on YieldAlley.com.

Dividend Income

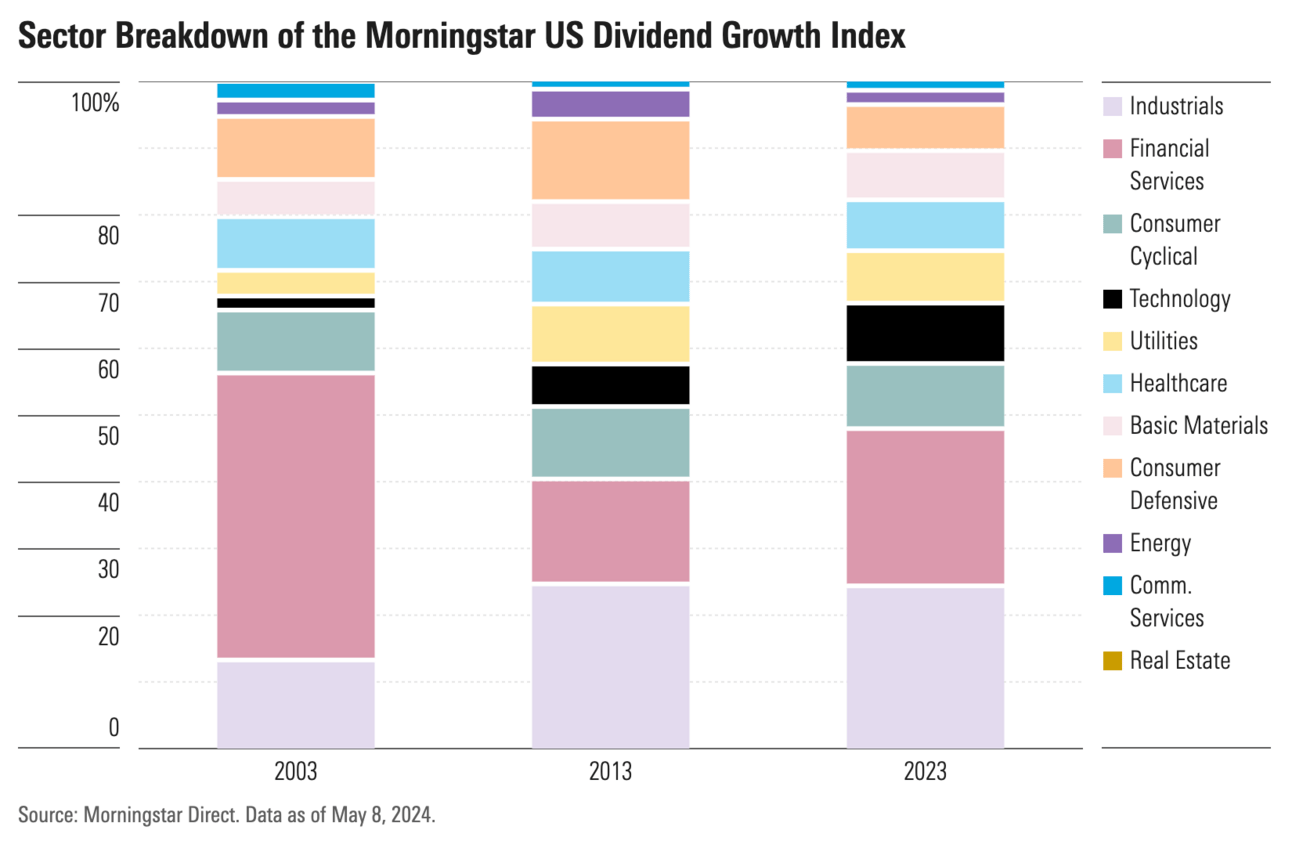

More opportunities for dividend growth investors to buy technology stocks.

Dividend Stocks News and Opportunities

Remarkably, both 3M (MMM) and Leggett & Platt (LEG) recently announced dividend cuts. LEG cut dividends by 89% to $0.05 a share, after previously increased dividends for 52 consecutive years. 3M has not yet announced its new dividend, but the spin-off of its subsidiary Solventum (SOLV) means that 3M holders will receive a lower dividend. (Company)

Morningstar wrote an article about the major technology companies that are now paying a dividend. The top 10 dividend-paying tech stocks now include:

Microsoft (forward dividend yield of 0.73% | annual dividend of $3.00 per share)

Apple (0.55% | $1.00)

Nvidia (0.02% | $0.16)

Alphabet (0.47% | $0.80)

Meta Platforms (0.42% | $2.00)

Broadcom (1.58% | $21.00)

Salesforce (0.57% | $1.60)

Cisco (3.33% | $1.60)

Accenture (1.65% | %5.16)

Qualcomm (1.88% | $3.40)

Brokerage Bonuses

Brokerages offer very generous bonuses for deposits. We highly recommend taking advantage of these, as they are free money, and also the best way for most people to purchase the investments we discuss.

We wrote a thread on why taking advantage of these brokerage bonuses could mean earning up to 7% APYs on your cash.

As always, we highly recommend reading the fine print with these offers. We earn no money from these offers. Please check past emails for older deals.

E*Trade: Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50.

Use promo code PROMO24.

$50+ will receive $100;

$1,000-$24,999 will receive $150;

$25,000-$49,999 will receive $150;

and more…

tastytrade: Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return).

Robinhood: Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening.

Bank Bonuses, Best CD and HYSA Rates

Certain people want to take advantage of bank bonuses, and promotional CD and high-yield saving account rates. Banks often tie these promotional rates with specific terms or fees and may change rates at any time. While we recommend passive investors who want to earn a yield to hold brokered CDs, money market funds, or floating rate ETFs, we list some of the best offers we discover here.

As always, we highly recommend reading the fine print with these offers. We earn no money from these offers. Please check past emails for older deals.

Bank Bonuses

Capital One — Bonus of up to $1,500 depending on deposit amount. A $20,000 deposit gets a $300 bonus.

Promotional Bank CD and HYSA Rates

FlagStar — 5.55% savings rate with a minimum $25,000 balance. Guaranteed for 5 months. Offer here.

Note on CD and HYSA rates: brokered CDs offer more flexibility than traditional CDs. If the brokered CDs are call-protected, they’ll pay a guaranteed rate compared to HYSA rates, which may change at any time.

Credit Card Bonuses and Offers

Credit card signup bonuses are one of the easiest ways to earn extra income, as long as you are vigilant in managing payments, your credit score, and claiming bonuses. We know some of our readers are interested in the latest credit deals.

As always, we highly recommend reading the fine print with these offers. We earn no money from these offers. Please check past emails for older deals.

Chase Sapphire Reserve — 75,000 points with referral link after $4,000 in spend within the first three months.

Chase Sapphire Preferred offer here (please message us if you need a referral link).

Chase Sapphire Reserve offer here (please message us if you need a referral link).

Chase British Airways — 85,000 points after spending $5,000 within 3 months on Chase British Airways, Iberia, and Aer Lingus cards.

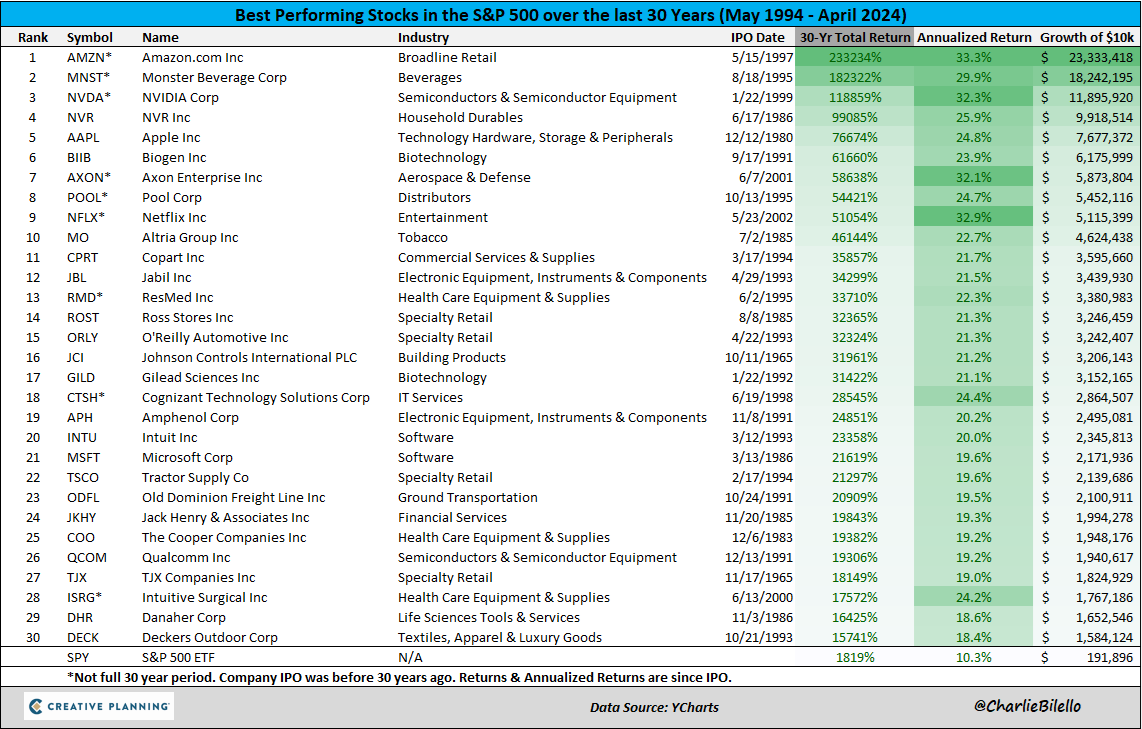

Picture of the Week

Best-performing stocks in the S&P 500 over the last 30 years.

What We’re Reading

Jim Simons, pioneer of quantitative trading and founder of quant fund Renaissance Technology, dies at 86. (WSJ)

How to find a partner like Charlie Munger. (Neckar)

Can you afford to retire early? (FT)

How I Think About Debt by Morgan Housel (Collab Fund)

The $8 million dollar dividend man (WSJ)

We’d love to hear from you. If you have any feedback or thoughts, please respond directly to this email with your message. Our ChatGPT bot is also available for your questions, as is our Facebook group.

If you enjoyed this newsletter, please subscribe or forward this email!