Hello, YieldAlley readers! In this issue:

Will Lower Interest Rates Affect Your Retirement Portfolio?

Stocks End Higher as Inflation Holds Steady.

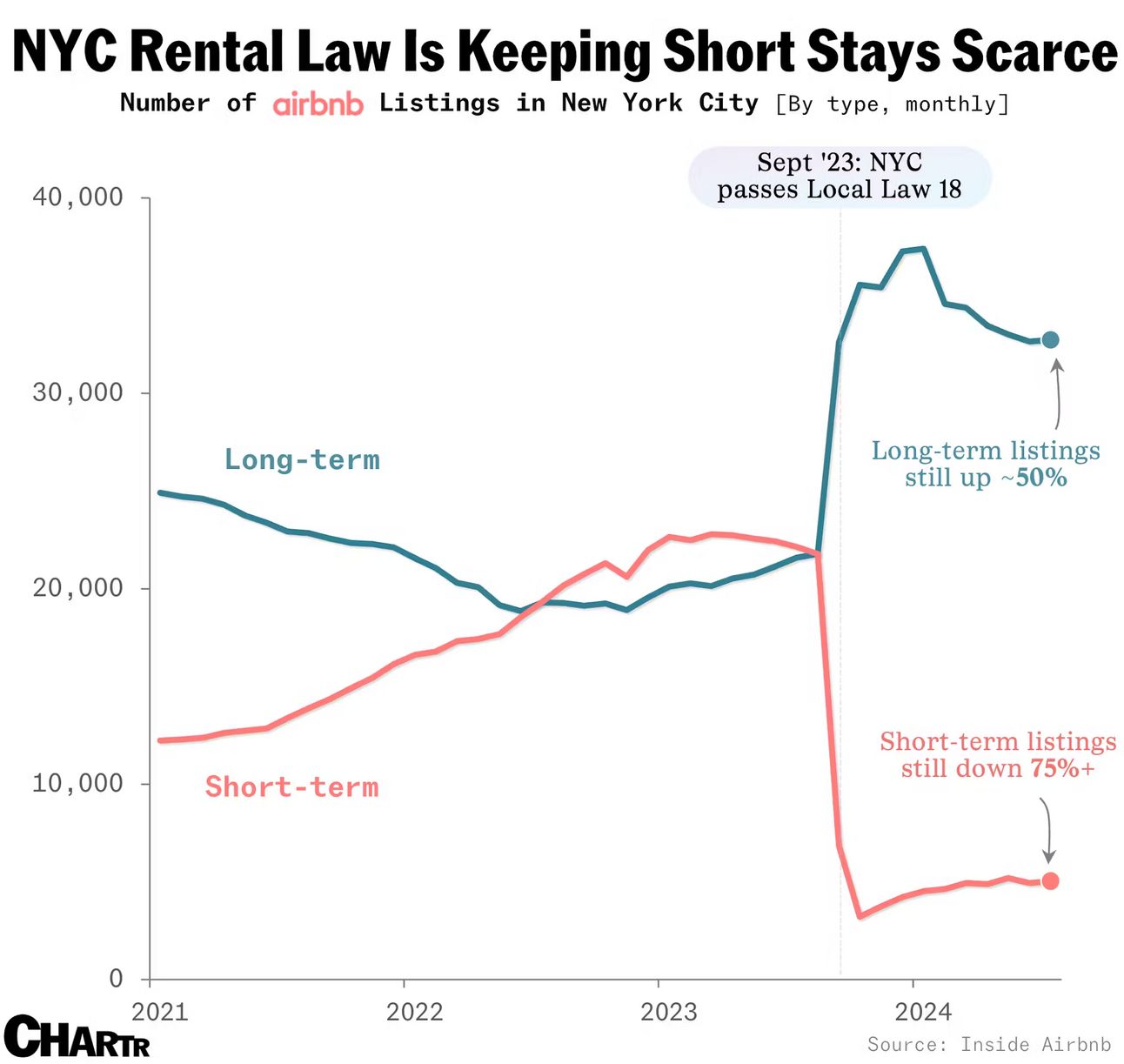

75%+ of short-term Airbnb rentals have disappeared in NYC.

The best way to track and monitor the highest cash rates.

And more!

NEWS

Standout Stories

🤖 The AI Chip That Made Nvidia One of the World's Most Valuable Companies (Bloomberg)

💸 OpenAI in talks to raise funding that would value it at more than $100 billion (CNBC)

⚾️ Private Equity Is Coming for Youth Sports (Bloomberg)

📲 The Olympian to influencer pipeline (NPR)

🐶 Inflation is causing pet parents to pull back on treats (Fortune)

MARKET THOUGHTS

Stocks End Higher as Inflation Holds Steady, Fed Rate Cut Expectations Firm

Financial Times

U.S. stocks closed higher on Friday, with large-cap stocks outperforming small- and mid-caps.

Consumer discretionary and industrial sectors led the gains.

The 10-year Treasury yield edged up to about 3.91%.

Global markets were mixed, with Asian markets up and European markets mixed.

Key inflation measures remained stable, supporting the Fed's rate cut plans.

Core PCE price index rose 2.6% annualized through July, below the 2.7% estimate.

Headline PCE held steady at 2.5% year-over-year, below expectations of 2.6%.

Month-over-month core PCE changes have been below 0.2% for three consecutive months.

Consumer spending showed resilience, exceeding expectations.

Consumption expenditures increased 0.5% in July, above the expected 0.3%.

Personal income grew 0.3%, also surpassing expectations.

The Federal Reserve is expected to begin its rate-cutting cycle in September.

Bond markets are pricing in 2.0% of Fed interest-rate cuts over the next 12 months.

The Fed's dual mandate of maximum employment and stable prices is coming into better balance.

Analysts anticipate a gradual moderation in consumer spending in the coming months.

This moderation is expected to support continued economic growth, albeit at a slower pace.

In other markets:

The U.S. dollar advanced against major currencies.

WTI oil and gold prices traded lower.

INCOME BUILDING

Will Lower Interest Rates Affect Your Retirement Portfolio?

As we expect potential interest rates to come in September, it’s a good time to evaluate how lower rates might affect your portfolio. We’ll explore the implications using a three-tier approach to retirement planning.

Tier 1: Short-Term Liquidity Reserve

The first tier, typically holding one to two years' worth of portfolio withdrawals, is most directly impacted by interest rate changes. Here's what you need to know:

Immediate yield reduction: When interest rates fall, yields on savings instruments like high-yield savings accounts and money market funds tend to decrease quickly.

Don't overallocate: Given the ephemeral nature of high yields, avoid overloading this tier.

Consider CDs: To lock in current yields, certificates of deposit (CDs) with maturities up to five years could be an option. However, balance this with your liquidity needs. We recommend brokered CDs instead of the more common bank CDs, due to generally higher rates and better liquidity.

Tier 2: Intermediate-Term Stability Zone

This tier, often containing five to eight years' worth of portfolio withdrawals, faces a mixed impact:

Lower long-term returns: Declining yields reduce the overall return potential for this portion of your portfolio.

Short-term price boost: Falling interest rates can push up bond prices, providing a temporary benefit.

Bonds vs. Bond Funds: While individual bonds offer predictable returns if held to maturity, bond funds provide simplicity and built-in diversification. The key is matching the fund's duration to your expected holding period.

Tier 3: Long-Term Growth Engine

Primarily consisting of equities, this tier's reaction to interest rate cuts is less straightforward:

Potential economic stimulus: Lower rates can boost borrowing and spending, potentially benefiting the broader economy and stocks.

Economic uncertainty: If rate cuts are a response to weakening economic conditions, it could negatively impact stocks.

Diversification is key: Spread your investments across different types of stocks, geographies, and sectors to mitigate risk.

Key Takeaways for Retirement Investors

Stay flexible with cash holdings: Be prepared for potentially lower yields on savings instruments.

Consider locking in current yields: Brokered CDs or bond ladders might help secure today's rates for the near future.

Match bond fund duration to your time horizon: This helps manage interest rate risk in your fixed-income holdings.

Maintain a diversified equity portfolio: Don't concentrate too heavily in any one area of the stock market.

Keep perspective: Remember that interest rate changes are just one factor in a complex economic landscape.

What's Your Take?

We'd love to hear from our readers about their strategies for managing retirement portfolios in a changing interest rate environment. How are you adjusting your allocations across these tiers? What tools or products are you finding most useful? Share your insights and experiences by replying to this email – your perspective could be invaluable to fellow retirees and soon-to-be retirees navigating these financial waters!

INCOME BUILDING

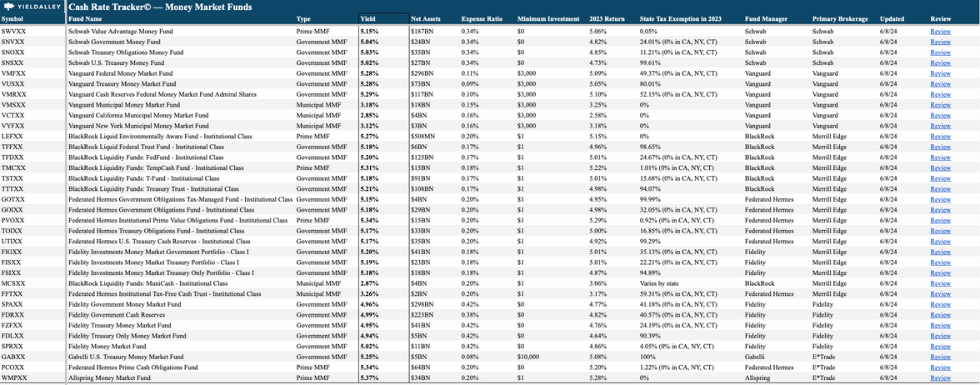

Cash Rates

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 5.00%

SPAXX (Fidelity Government Money Market Fund): 4.98%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 5.13%

VMFXX (Federal Money Market Fund): 5.25%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 4.71%

E*Trade: 4.65%

Fidelity: 4.45%

Merrill Edge and Merrill Lynch: —

Vanguard: 4.75%

ETFs

SGOV (iShares 0-3 Month Treasury Bond ETF): 5.21%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 5.15%

USFR (WisdomTree Floating Rate Treasury Fund): 5.25%

TFLO (iShares Treasury Floating Rate Bond ETF): 5.26%

Want To Track the Highest Cash Yields?

Refer just one person to the YieldAlley newsletter for instant access to the YieldAlley Cash Rate Tracker©.

This simple spreadsheet lets you easily compare and track the best cash rates and investments.

Get all the details on the best money market funds and ETFs in a single spreadsheet.

BONUSES

Brokerage, Bank and Credit Card Bonuses

Brokerage Bonuses

E*Trade (still active): Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Bank Bonuses

BMO Harris (active) — Earn up to a $560 bonus when you open a new Smart Advantage or BMO Harris Premier checking account. Offer here.

Availability: Nationwide

Soft credit inquiry

U.S. Bank (active) — Earn up to a $450 bonus when you open a new Smartly checking account when you use promo code 2024JUL. Offer here.

Availability: Nationwide

Soft credit inquiry.

Axos Bank (active) — $500 when you open a new rewards checking account with promo code RC500 and certain requirements. Offer here.

Availability: Nationwide

Soft credit inquiry.

Credit Card Bonuses

American Express Marriott Bonvoy Brilliant Card — Get 185,000 Marriott Bonvoy points after $6,000 in spend within the first six months of account opening. Offer here through October 2, 2024.

American Express Marriott Bonvoy Bevy Card — Get 155,000 Marriott Bonvoy points after $5,000 in spend within the first six months of account opening. Offer here through October 2, 2024.

Barclays jetBlue Plus Card (active) — Get 80,000 JetBlue points after $1,000 in spend within the first 90 days of account opening. Offer here.

Chase Ink Preferred (active) — Get 120,000 Ultimate Rewards bonus points when you spend $8,000 in the first three months after account opening. Offer here.

Capital One Venture (active) — Enjoy $250 on Capital One Travel in your first year and earn 75,000 bonus miles after spending $4,000 in the first 3 months. Offer here.

American Express Hilton Surpass Card (active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

Picture of the Week