Hello, YieldAlley readers! In this issue:

Buffett Loves Dividends — But He Doesn't Pay One. How Come?

Semiconductor Weakness Sparks Worst Week Since March 2023.

Why 401(k) investors ignore 'keep cool' advice when markets tank.

The best way to track and monitor the highest cash rates.

And more!

NEWS

Standout Stories

🏈 Why the Chiefs Are Worth Less Than Teams Missing the Playoffs Despite Their Dynasty (CNBC)

💸 Top 10 people most likely to reach trillionaire status (CNBC)

📉 Why 401(k) investors ignore 'keep cool' advice when markets tank (Yahoo Finance)

🎸 U.K. is investigating Ticketmaster after Oasis tour prices surprised fans (NPR)

🛻 Stellantis recalls more than 1.2 million Ram vehicles (CNN)

MARKET THOUGHTS

Stocks Tumble on Mixed Jobs Report, Semiconductor Weakness Sparks Worst Week Since March 2023

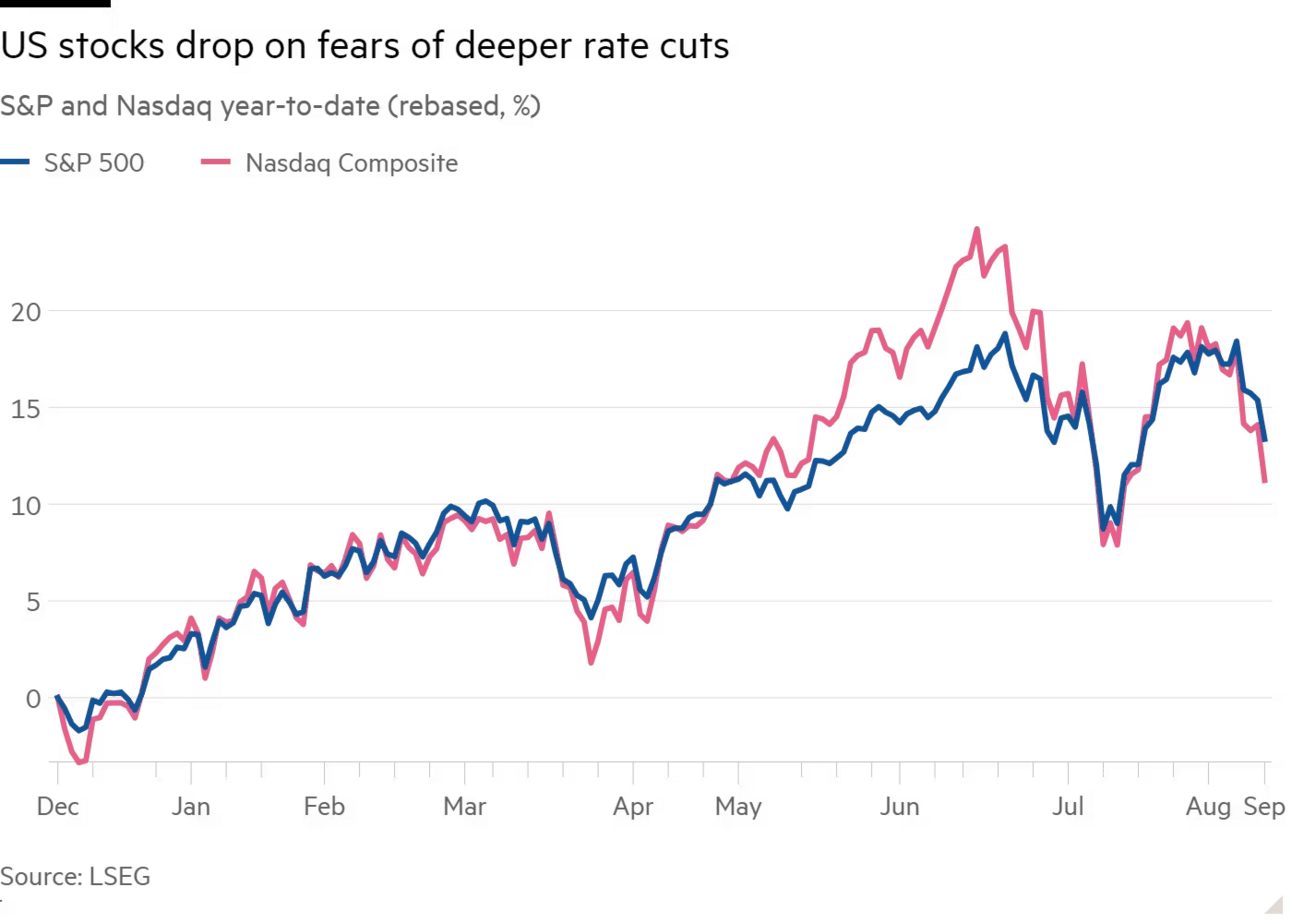

U.S. stocks suffered their worst week in 18 months, with major indexes posting steep losses.

The S&P 500 dropped 4.3% for the week.

The Nasdaq Composite declined 5.8% weekly, re-entering correction territory.

The Dow Jones Industrial Average fell 2.9% for the week.

August's nonfarm payrolls report showed mixed results, falling short of expectations.

Job growth rebounded to 142,000, below the 160,000 consensus.

June and July job gains were revised down by 86,000.

The unemployment rate ticked down to 4.2%.

Hourly earnings rose 3.8% annualized, above the expected 3.7%.

The semiconductor sector faced significant pressure, weighing heavily on the market.

The PHLX Semiconductor Index (SOX) suffered nearly 12% weekly losses.

Broadcom's earnings and outlook disappointed investors.

Bond yields declined, with the yield curve returning to positive territory.

The 10-year Treasury yield fell to 3.71%, down 20 basis points for the week.

The 2-year Treasury yield dropped 28 basis points weekly.

Analysts note that while the job market is softening, it's not collapsing.

The Federal Reserve is still expected to cut rates by 25 basis points at its September meeting.

Bond markets are pricing in 2.5% of Fed rate cuts over the next 12 months.

INCOME BUILDING

Warren Buffett Loves Dividends — But He Doesn't Pay One. How Come?

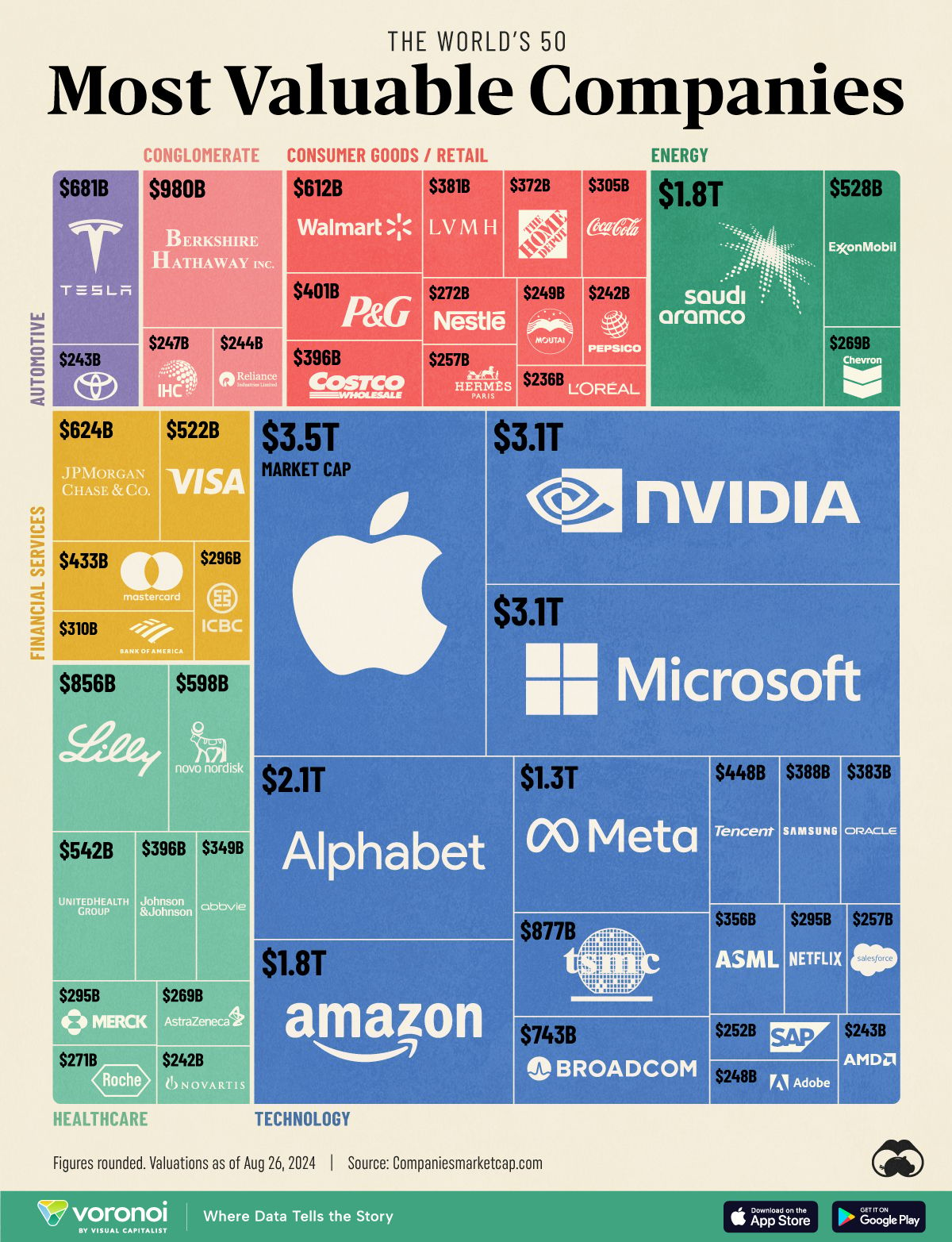

Warren Buffett, one of the world's most successful investors, is known for his fondness for dividend-paying stocks. However, his conglomerate Berkshire Hathaway notably does not offer a dividend to its shareholders, despite sitting on hundreds of billions in cash. Let's dive into why Buffett has decided Berkshire doesn’t pay dividends.

The Power of Reinvestment

The primary reason Berkshire Hathaway doesn't pay a dividend is Buffett's confidence in his ability to deploy capital more profitably within the company. By retaining earnings instead of distributing them as dividends, Berkshire can reinvest in its own operations or acquire other businesses, potentially generating higher returns for shareholders in the long run.

Buffett has consistently demonstrated his skill in capital allocation, turning Berkshire Hathaway from a failing textile manufacturer into one of the world's largest and most successful conglomerates. This track record lends credibility to his approach of prioritizing reinvestment over dividend payments.

Flexibility in Capital Allocation

Another key factor is the flexibility that comes with not paying regular dividends. Buffett views dividends as an implied promise to shareholders - one that companies are often reluctant to break by reducing or eliminating the payout. By avoiding this commitment, Berkshire maintains the freedom to adjust its capital allocation strategy as opportunities arise.

This flexibility has allowed Berkshire to make significant acquisitions and investments over the years.

Buybacks: The Preferred Alternative

When Berkshire does decide to return capital to shareholders, it prefers share repurchases over dividends. Buffett believes that buybacks can be more beneficial for shareholders, particularly when the company's stock is undervalued.

In a 2018 interview with CNBC, Buffett stated, "We would probably lean toward repurchase" if faced with the choice between dividends and buybacks. This preference was evident in 2021 when Berkshire spent a record $27 billion on share repurchases amid a competitive deal-making environment.

History Was Different Once

Interestingly, Berkshire Hathaway did pay a dividend once in its history under Buffett's leadership. In 1967, just two years after Buffett took control, the company issued a 10-cent per share dividend. Buffett later described this as "a terrible mistake" during the 2023 annual meeting, highlighting his long-standing aversion to dividends for Berkshire.

Shareholder Supports The Lack of Dividends

Despite the lack of dividends, Berkshire's shareholders have largely supported this approach. In 2014, when a proposal for Berkshire to pay a "meaningful annual dividend" was put to a vote, it was overwhelmingly rejected by both Class A and Class B shareholders.

Buffett interprets this support as shareholder trust in management's ability to allocate capital effectively. "I think they expect us to do whatever we think makes sense for all shareholders," he said at the 2023 annual meeting.

Implications for Investors

While Berkshire Hathaway doesn't pay dividends, many of its top holdings do. Apple, Bank of America, Coca-Cola, and Chevron - all significant positions in Berkshire's portfolio - offer dividend yields ranging from 0.6% to 3.9%. This suggests that while Buffett values dividends as an investor, he sees greater value in retaining earnings at the corporate level for Berkshire.

For individual investors, especially those in or nearing retirement, Berkshire's approach underscores the importance of looking beyond dividend yield when evaluating investments. Total return, which includes both capital appreciation and income, may be a more meaningful measure of investment performance.

Moreover, Berkshire's strategy highlights the value of flexible capital allocation and the potential benefits of reinvesting earnings for long-term growth. Investors might consider applying similar principles to their own portfolios, balancing the need for current income with opportunities for future growth.

What's Your Take?

We'd love to hear your thoughts on Berkshire Hathaway's no-dividend policy. Do you agree with Warren Buffett's approach to capital allocation, or do you prefer companies that pay regular dividends? How do you balance the need for current income with potential long-term growth in your investment strategy?

INCOME BUILDING

Cash Rates

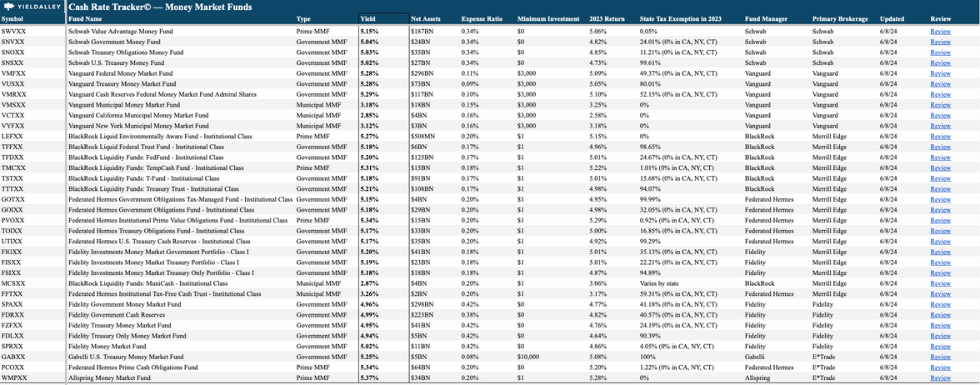

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 4.99%

SPAXX (Fidelity Government Money Market Fund): 4.96%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 5.10%

VMFXX (Federal Money Market Fund): 5.22%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 4.71%

E*Trade: 4.70%

Fidelity: 4.65%

Merrill Edge and Merrill Lynch: —

Vanguard: 4.75%

ETFs

SGOV (iShares 0-3 Month Treasury Bond ETF): 5.23%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 5.14%

USFR (WisdomTree Floating Rate Treasury Fund): 5.22%

TFLO (iShares Treasury Floating Rate Bond ETF): 5.25%

Want To Track the Highest Cash Yields?

Refer just one person to the YieldAlley newsletter for instant access to the YieldAlley Cash Rate Tracker©.

This simple spreadsheet lets you easily compare and track the best cash rates and investments.

Get all the details on the best money market funds and ETFs in a single spreadsheet.

BONUSES

Brokerage, Bank and Credit Card Bonuses

Brokerage Bonuses

E*Trade (still active): Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Bank Bonuses

BMO Harris (active) — Earn up to a $560 bonus when you open a new Smart Advantage or BMO Harris Premier checking account. Offer here.

Availability: Nationwide

Soft credit inquiry

U.S. Bank (active) — Earn up to a $450 bonus when you open a new Smartly checking account when you use promo code 2024JUL. Offer here.

Availability: Nationwide

Soft credit inquiry.

Axos Bank (active) — $500 when you open a new rewards checking account with promo code RC500 and certain requirements. Offer here.

Availability: Nationwide

Soft credit inquiry.

Credit Card Bonuses

American Express Marriott Bonvoy Brilliant Card — Get 185,000 Marriott Bonvoy points after $6,000 in spend within the first six months of account opening. Offer here through October 2, 2024.

American Express Marriott Bonvoy Bevy Card — Get 155,000 Marriott Bonvoy points after $5,000 in spend within the first six months of account opening. Offer here through October 2, 2024.

Barclays jetBlue Plus Card (active) — Get 80,000 JetBlue points after $1,000 in spend within the first 90 days of account opening. Offer here.

Chase Ink Preferred (active) — Get 120,000 Ultimate Rewards bonus points when you spend $8,000 in the first three months after account opening. Offer here.

Capital One Venture (active) — Enjoy $250 on Capital One Travel in your first year and earn 75,000 bonus miles after spending $4,000 in the first 3 months. Offer here.

American Express Hilton Surpass Card (active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

Picture of the Week