Hello, YieldAlley readers! In this issue:

Vanguard Announces Largest Fee Cut in History and What It Means for Income Investors

U.S. Markets Decline as Trade Tensions Rise and Labor Market Shows Mixed Signals

Free DoorDash Credits for Chase Cardholders

And more!

NEWS

Standout Stories

📌 Pinterest projects revenue above estimates as AI tools boost ad spend (Reuters)

📱 Elon Musk said he’s not interested in acquiring TikTok (TechCrunch)

📰 The New York Times didn’t get as much of a “Trump bump” as investors wanted (Sherwood)

💰 How To Be Less Anxious And Awkward About Money (Happier)

🥳 Is Wall Street ready to stay up all night? (Financial Times)

MARKET THOUGHTS

U.S. Markets Decline as Trade Tensions Rise and Labor Market Shows Mixed Signals

ECONOMY

The U.S. labor market showed signs of gradual cooling in January, with nonfarm payrolls increasing by 143,000, falling short of the expected 170,000 and down significantly from December's upwardly revised 307,000. Despite the slower job growth, the unemployment rate unexpectedly improved to 4.0% from 4.1%. Job openings declined to a three-month low of 7.6 million in December, while weekly jobless claims rose to 219,000, with continuing claims increasing to 1.89 million. In a positive development, the manufacturing sector expanded in January for the first time in 27 months, though ISM officials warned that potential tariffs pose a "huge threat" to sustained recovery.

STOCKS

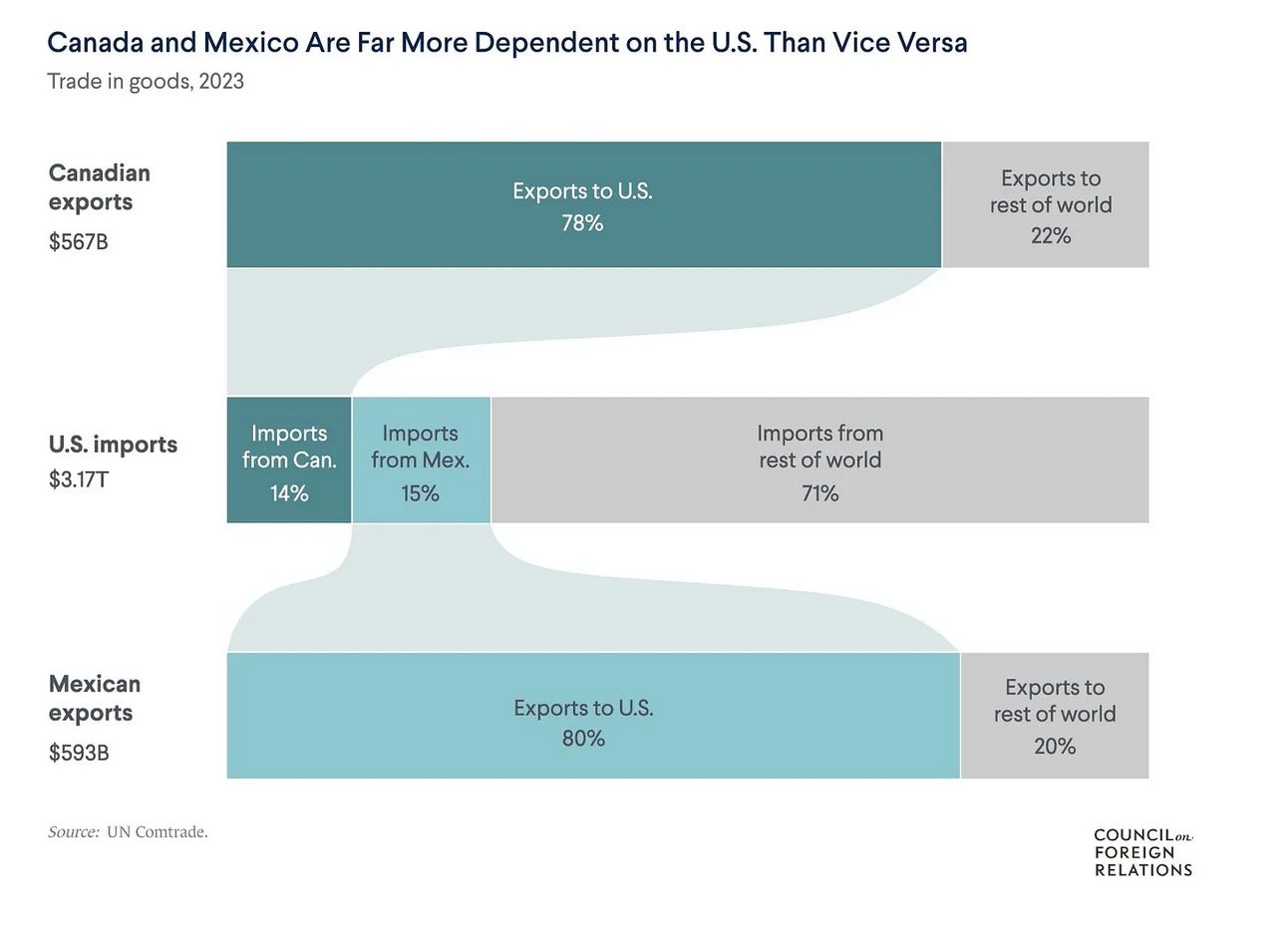

Markets ended the week lower amid uncertainty surrounding trade policy, with the S&P 500 declining 0.24%. Stocks faced sharp early-week pressure following President Trump's announcement of planned 25% tariffs on Mexican and Canadian imports, along with 10% levies on Chinese goods. However, markets partially recovered after a 30-day postponement was granted for Mexico and Canada. Corporate earnings provided some support, with 77% of reporting S&P 500 companies beating consensus expectations and showing average growth of 16.4%, significantly above the estimated 11.9%. The Dow Jones Industrial Average fell 241.26 points to 44,303.40, while the Nasdaq Composite dropped 104.04 points to 19,523.40.

FIXED INCOME

Treasury yields decreased across most maturities as softer employment data and concerns about tariffs' impact on global growth drove investors toward safer assets. Municipal bonds performed well alongside Treasuries. The investment-grade corporate bond market saw higher-than-expected issuance, with nearly half of the deals oversubscribed. High-yield market volumes exceeded average levels, maintaining steady new issuance despite initial weakness following the tariff announcements. Market participants began pricing in potential disinflationary pressures from trade tensions, while continuing to monitor economic indicators for signs of further cooling in the labor market.

INCOME BUILDING

Vanguard Announces Largest Fee Cut in History and What It Means for Income Investors

In a move that will significantly benefit yield-seeking investors, Vanguard announced its largest fee reduction in the company's 50-year history on February 3rd, 2025. The asset management giant is slashing fees across 168 share classes spanning 87 funds, with the cuts expected to save investors more than $350 million in 2025 alone.

Major Impact on Fixed Income and Money Market Funds

For income investors, the fee reductions are particularly noteworthy in the fixed-income space. After these cuts, Vanguard's actively managed bond funds will have an average expense ratio of just 0.10%, while their index bond funds will charge an average of 0.05% - significantly below the industry averages of 0.44% and 0.08% respectively.

Some notable reductions in popular income-focused funds include:

The Total Bond Market Index Fund (VBTLX) seeing its expense ratio drop from 0.05% to 0.04%

The Treasury Money Market Fund (VUSXX) decreasing from 0.09% to 0.07%

The Intermediate-term Corporate Bond ETF (VCIT) receiving a fee cut

The fee reductions further cement Vanguard's position as a leader in the money market fund space. VUSXX, their Treasury Money Market Fund, now sports an expense ratio of just 0.07%, making it even more competitive against offerings from rivals like Fidelity, whose comparable funds often carry significantly higher expense ratios.

What This Means for Income Investors

For income-focused investors, these fee cuts offer several benefits:

Higher Net Yields: Lower expense ratios mean more of the funds' earned income flows through to investors

Enhanced Competitive Position: Vanguard's already competitive money market and bond funds become even more attractive compared to alternatives

Compounding Advantages: The savings from lower fees compound over time, particularly beneficial for long-term income investors

Broader Selection: With fees reduced across 87 funds, income investors have more low-cost options for building diversified fixed-income portfolios

Looking Ahead

The timing of these fee reductions, coinciding with Vanguard's upcoming 50th anniversary in May 2025, reflects the company's continued commitment to reducing investment costs. For income investors, this means the ability to retain more of their investment yields while maintaining access to some of the industry's most reliable and well-managed fixed-income products.

As interest rates remain elevated and income investors seek optimal yields, these fee reductions make Vanguard's offerings even more compelling for those looking to maximize their investment income while minimizing costs.

INCOME BUILDING

Cash Rates

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 4.10%

SPAXX (Fidelity Government Money Market Fund): 4.02%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 4.19%

VMFXX (Federal Money Market Fund): 4.27%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 4.30%

E*Trade: 4.25%

Fidelity: 4.25%

Merrill Edge and Merrill Lynch: —

Vanguard: 4.30%

ETFs (30-Day Yields)

SGOV (iShares 0-3 Month Treasury Bond ETF): 4.27%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 4.18%

USFR (WisdomTree Floating Rate Treasury Fund): 4.24%

TFLO (iShares Treasury Floating Rate Bond ETF): 4.23%

BONUSES

Brokerage, Bank and Credit Card Bonuses

DashPass for Chase Card Members

Chase has updated their DoorDash benefits starting February 1, 2025, offering free DashPass memberships and credits across most of their credit card lineup. The Chase Sapphire Reserve and JP Morgan Reserve cards receive a $5 monthly credit for restaurant orders, which can be stacked with one other promotion like $10 off or 25% off coupons. The credit is valid for most Chase co-branded cards including Southwest, Marriott, United, Disney, IHG, British Airways, Aer Lingus, Iberia, and World of Hyatt cards - though notably excluding the Amazon Rewards Visa, Instacart Mastercard, and DoorDash Rewards Mastercard. To receive the credit, cardholders must use their eligible Chase card as the payment method.

The majority of credits offered are for "non-restaurant" purchases, specifically at grocery, convenience, or retail stores available through DoorDash. While these credits can provide value, they come with significant limitations - cardholders need local stores that offer pickup to avoid delivery fees and driver tips, and DoorDash's pricing often includes markups compared to in-store prices. When accounting for these additional costs like price markups, delivery fees (typically $3-7), and driver tips (15-20% expected), the actual savings from these credits can be minimal unless you have access to pickup options in your area.

Picture of the Week