Hello, YieldAlley readers! In this issue:

June Jobs Report Shows Mixed Signals.

Use This Framework to Understand Dividend Growth Potential.

How to track and monitor the highest cash rates.

And more!

NEWS

Standout Stories

👗 LVMH's Arnault on How He Built an Empire of Opulence (Bloomberg)

🏧 JPMorgan Warns Customers: Prepare to Pay for Checking Accounts (WSJ)

🏖️ Social Security Cost-of-Living Adjustment May Be Lower In 2025. These Charts Help Show Why (CNBC)

📞 Vanguard Will Now Close Your Account If You Call Them Too Much (MyMoneyBlog)

✈️ Passenger Complaints About Airline Travel Surged In 2023 (CBS)

MARKET THOUGHTS

June Jobs Report Shows Mixed Signals, Boosting Odds of September Fed Rate Cut

The U.S. economy added 206,000 jobs in June, exceeding expectations but falling short of May's revised figure of 218,000.

The unemployment rate increased to 4.1%, up from 3.6% a year ago. This rise suggests more people are entering the job market or facing challenges finding employment.

The three-month average job growth dipped below 200,000, returning to levels similar to those seen before the pandemic. This indicates a potential normalization of the job market after a period of rapid post-pandemic recovery.

These figures collectively point to a possible slowdown in the labor market, which could influence future economic policies and Federal Reserve decisions.

Treasury yields experienced a decline, with short-term notes falling more significantly than long-term securities.

The yield on the 10-year Treasury note decreased by 6 basis points to 4.28%.

In contrast, the 2-year Treasury note yield fell by 14 basis points to 4.61%, reaching its lowest point since March 27.

The falling rates provided support for yield-sensitive sectors such as utilities and consumer staples, as these sectors often become more attractive to investors in a lower-yield environment.

The upcoming Consumer Price Index (CPI) report will be crucial for shaping expectations about potential Federal Reserve rate cuts.

Analysts anticipate a 0.1% month-over-month increase in headline CPI and a 3.1% year-over-year rise.

Core CPI, which excludes volatile food and energy prices, is expected to increase by 0.2% month-over-month and remain at 3.4% year-over-year.

If prices don't go up much, the Federal Reserve might lower interest rates sooner.

If prices go up more than people expect, interest rates might stay high for longer.

INCOME BUILDING

Use This Framework to Understand Dividend Growth Potential

For income-focused investors and dividend stock investors, you're not just looking for a company that can pay you now. You want a company that can keep paying you more and more over time. This is called dividend growth. It's really important for people who want to make money from their investments for many years.

If you plant a tree, you don't just want it to stay the same size forever. You want it to grow taller and stronger each year. The same is true for dividends. A growing dividend can help your money grow faster and protect you against rising prices of things you buy.

Let's look at the main factors that can help us figure out if a company's dividend is likely to grow. Assessing a company's dividend growth potential is crucial for long-term success. While a high current yield might seem attractive, sustainable dividend growth often leads to superior total returns over time.

Key Factors for Evaluating Dividend Growth

Dividend Record: A company's dividend history provides valuable context.

Consistency: Look for a track record of steady increases without cuts.

Meaningful payments: Ensure the yield has been consistently attractive.

Substantial increases: Evaluate the magnitude of past dividend hikes.

Earnings Per Share: The foundation for sustainable dividend increases.

Current earnings: Assess the company's present profitability.

Growth potential: Consider both organic growth and acquisition prospects.

Payout Ratio: A lower ratio provides more room for future growth.

Industry context: Appropriate payout ratios vary by sector.

Trend analysis: Look at how the payout ratio has changed over time.

Return on Equity (ROE): Higher ROEs can support faster dividend growth.

Economic moat: Companies with strong competitive advantages often maintain higher ROEs.

Capital efficiency: How effectively the company uses shareholders' equity to generate profits.

Core Growth Rate: How fast can the business increase its annual profits?

Market dynamics: Consider industry trends and the company's market position.

Historical performance: Use past growth as a starting point, but focus on future potential.

Beyond the Numbers: Management's Dividend Philosophy

While quantitative factors are important, it's crucial also to consider qualitative aspects. We can categorize dividend growth potential into three areas:

Trend: Companies with long histories of consistent increases often strive to maintain their track record.

Incentive: Some businesses have structural reasons for dividend growth, such as REITs or certain Master Limited Partnerships (MLPs).

Hope: In some cases, there may be no clear trend or incentive for dividend growth, requiring more careful analysis.

Case Study: Procter & Gamble (PG) - A Dividend Growth Powerhouse

Let's apply these factors to a real-world example: Procter & Gamble (PG), a consumer goods giant with a strong history of dividend growth.

Dividend Record:

Consistency: PG has increased its dividend for 67 consecutive years as of 2024.

Meaningful payments: The yield has consistently ranged between 2-3.5% over the past decade.

Substantial increases: 5-year average dividend growth rate of 6.2% (2019-2024).

Earnings Per Share:

Current earnings: $6.13 per share (fiscal year 2023)

Growth potential: 5-7% annual EPS growth projected for the next 3-5 years

Payout Ratio:

Current payout ratio: 61% (2024)

Industry context: In line with consumer staples sector average

Trend: Stable over the past 5 years, indicating sustainable dividend growth

Return on Equity (ROE):

Current ROE: 30.2% (2024)

Economic moat: Strong brand portfolio and global distribution network

Core Growth Rate:

Historical 5-year revenue CAGR: 5.2% (2019-2024)

Market dynamics: Stable demand for household and personal care products

Management's Dividend Philosophy: PG falls firmly in the "Trend" category, with management consistently prioritizing dividend growth as part of their capital allocation strategy. In their 2023 annual report, PG reaffirmed their commitment to returning value to shareholders through dividends.

Our conclusion is that Procter & Gamble demonstrates strong dividend growth potential based on our key factors:

Its exceptional dividend growth streak showcases a long-term commitment to shareholders.

The current payout ratio, while not low, is sustainable given the company's stable earnings and industry position.

A high ROE indicates efficient use of capital, supporting future growth and dividend increases.

Projected earnings growth aligns well with recent dividend growth rates, suggesting the potential for continued increases.

Building a Sustainable Framework to Forecast Dividend Growth

To help investors systematically evaluate a company's dividend growth potential, we will be introducing the Dividend Drill Return Model (DDRM) created by Morningstar’s Josh Peters. This comprehensive framework incorporates the key factors discussed above in a systematic way to forecast dividend growth and total return prospects.

We're excited to announce a 5-part series that will dive deep into the DDRM and its applications:

DDRM Fundamentals: Introduction to the model and its core concepts.

DDRM Inputs: Detailed explanation of the five key inputs and how to determine them.

DDRM Calculations: Step-by-step guide on using the model to estimate dividend growth.

Interpreting DDRM Results: How to analyze and apply the model's outputs to your investment decisions.

DDRM in Action: Real-world case studies demonstrating the model's practical application.

We want to equip you with this powerful tool for assessing dividend growth prospects and potential total returns. Whether you're a seasoned income investor or just starting to build your dividend portfolio, the DDRM series will provide valuable insights to enhance your dividend investing playbook.

Stay tuned for our first installment next week, where we'll introduce the foundational concepts of the Dividend Drill Return Model and how it can evolve your approach to dividend investing.

INCOME BUILDING

Cash Rates

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 5.03%

SPAXX (Fidelity Government Money Market Fund): 4.97%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 5.17%

VMFXX (Federal Money Market Fund): 5.27%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 5.32%

E*Trade: 5.30%

Fidelity: 5.25%

Merrill Edge and Merrill Lynch: —

Vanguard: 5.25%

ETFs

SGOV (iShares 0-3 Month Treasury Bond ETF): 5.28%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 5.23%

USFR (WisdomTree Floating Rate Treasury Fund): 5.34%

TFLO (iShares Treasury Floating Rate Bond ETF): 5.33%

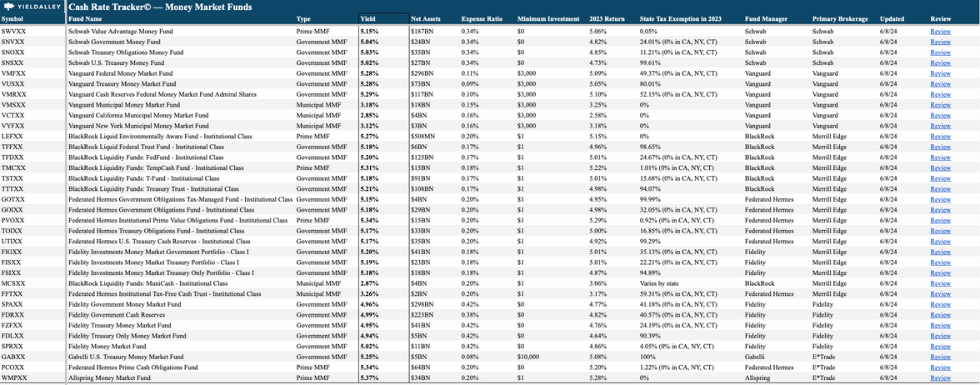

Want To Get the Highest Cash Yields?

Refer just one person to the YieldAlley newsletter for instant access to the YieldAlley Cash Rate Tracker©.

This simple spreadsheet lets you easily compare and track the best cash rates and investments.

Get all the details on the best money market funds and ETFs in a single spreadsheet.

BONUSES

Brokerage, Bank and Credit Card Bonuses

Brokerage Bonuses

E*Trade (still active): Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Bank Bonuses

Chartway Federal Credit Union (active) — $200 cash back when you open a new checking account using promo code 200CASH. Offer here.

Availability: Nationwide

Soft credit inquiry.

Axos Bank (active) — $500 when you open a new rewards checking account with promo code RC500 and certain requirements. Offer here.

Availability: Nationwide

Soft credit inquiry.

Discover Savings Account (active) — With your first Discover Savings account, earn a $150 bonus with a $15,000 deposit, or a $200 bonus with a $25,000 deposit. Use offer code GOBP623. Offer here.

Availability: Nationwide

Soft credit inquiry.

USC Credit Union (active) — $250 bonus when you open a new checking account and set up direct deposit with a $1,000 minimum direct deposit every 30 days for the first 90 days of checking account AND make a minimum of ten (10) debit transactions every 30 days for the first 90 days of checking account opening. Use promo code SPRING24. Offer here.

Availability: CA.

Soft credit inquiry.

Credit Card Bonuses

Citi Strata Premier (active) — 75,000 points after $4,000 in spend within the first three months. Offer here.

Bank of America Sonesta (active) — 120,000 points after $2,000 in spend on the first 90 days of account opening. Offer here.

American Express Hilton Surpass Card (active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

Picture of the Week