Hello, YieldAlley readers! In this issue:

Three Pillars of Sustainable Dividends and Reliable Income Stocks

U.S. Markets Rally With Strong GDP Growth As Wage Gains Drive 2025 Outlook

Can Money Buy Happiness for Millionaires?

And more!

NEWS

Standout Stories

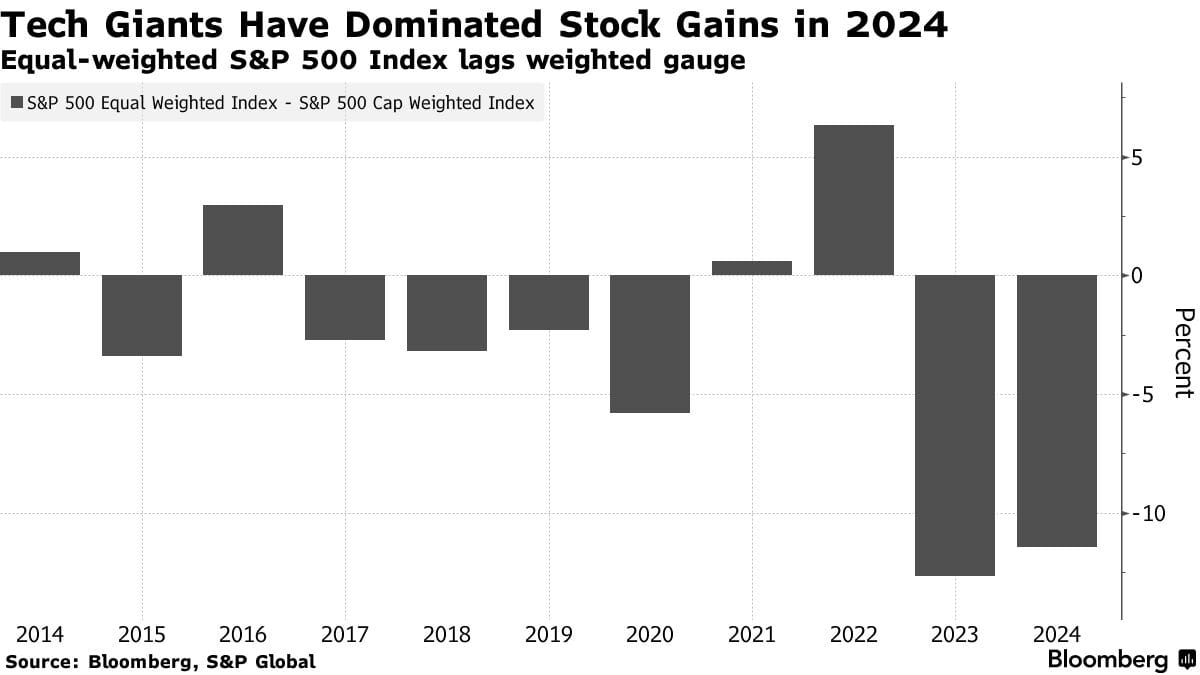

🦸♂️ Long live the BATMMAAN stocks (Sherwood)

😁 Can Money Buy Happiness for Millionaires? (University of Pennsylvania Wharton)

📈 Trust the Process (Italian Leather Sofa)

💸 Vanguard to Establish New Advice & Wealth Management Division (Vanguard)

💰 Dividend Stocks Are Primed for a Comeback in 2025 (WSJ)

MARKET THOUGHTS

U.S. Markets Rally With Strong GDP Growth As Wage Gains Drive 2025 Outlook

U.S. stock performance demonstrates broad-based strength:

S&P 500's 27% year-to-date gain indicates robust market breadth beyond just mega-cap tech

Nasdaq's 33% surge in 2024 reflects continued tech sector innovation and AI advancement

Dow Jones's more modest 16% YTD gain shows traditional industries are also participating

Treasury yields at 4.40% suggest markets are pricing in continued economic strength while anticipating potential rate cuts

Economic indicators reveal underlying momentum:

2.5% average quarterly GDP growth significantly exceeds pre-pandemic trends, indicating structural economic improvements

Q4's projected 3.3% growth demonstrates economy's resilience against higher rates

Consumer spending strength, particularly notable given higher borrowing costs, indicates healthy household balance sheets

Service sector dominance signals a full post-pandemic recovery and shift in consumer behavior patterns

Consumer and wage trends show important structural improvements:

Real wage growth outpacing inflation since 2023 means consumers are gaining purchasing power

Strong service sector spending indicates consumers are confident about job security and future income

Persistent consumer confidence despite higher rates suggests household adaptability to new rate environment

2-3% inflation target range for 2025 aligns with Fed goals while being manageable for businesses

Forward outlook identifies key market drivers:

White House policy shifts could affect corporate margins through trade and labor cost changes

Trade tension risks warrant sector diversification as global supply chains may shift

Overweight U.S. equities recommendation based on domestic market's innovation and adaptability

Large-cap and mid-cap focus provides balance between stability and growth potential

Shift from cash to short-duration bonds takes advantage of higher yields while maintaining flexibility

INCOME BUILDING

Three Pillars of Sustainable Dividends and Reliable Income Stocks

Not all dividends are created equal. While high yields might catch your eye, the real challenge lies in identifying dividends that aren't just attractive today but sustainable for years to come. Three fundamental pillars can help investors distinguish between reliable dividend payers and potential dividend traps.

Pillar 1: Economic Moat - The Competitive Advantage

The first and perhaps most crucial pillar of dividend sustainability is a company’s economic moat - its ability to maintain competitive advantages over time. When a company can consistently fend off competition and maintain pricing power, it’s more likely to generate stable earnings that support dividend payments. During the 2020 market turbulence, Morningstar's research revealed that companies with wide economic moats were significantly less likely to cut their dividends compared to those without competitive advantages. Think of companies like Johnson & Johnson or Microsoft - their strong market positions and diverse revenue streams buffer against economic headwinds, making their dividends more resilient during downturns.

Pillar 2: Financial Health - The Foundation

A strong economic moat means little without robust financial health to back it up. This second pillar encompasses several key elements: a manageable debt load, strong interest coverage ratios, and, most importantly, a track record of maintaining dividends through different market cycles. Companies with clean balance sheets have more flexibility to maintain their dividend commitments during economic downturns. Equally important is management’s commitment to the dividend - some teams view dividends as a sacred commitment to shareholders, while others see them as a lower priority compared to share buybacks or reinvestment. The best dividend payers typically demonstrate both the financial capacity and the management's will to sustain shareholder payments during challenging times.

Pillar 3: Sustainable Payout Ratio - The Safety Margin

The third pillar is a sustainable payout ratio - the percentage of earnings paid out as dividends. While lower payout ratios generally suggest more room for dividend growth and better sustainability, the "right" ratio varies significantly by industry. Utility companies often maintain higher payout ratios due to their stable earnings, while technology companies might keep ratios lower to retain flexibility for growth investments. The key is comparing payout ratios within industry groups and considering the stability of underlying earnings. For some sectors, like Real Estate Investment Trusts (REITs), alternative metrics like Adjusted Funds from Operations provide better insight into dividend sustainability than traditional payout ratios.

The Bottom Line

Chasing high yields without considering these three pillars often leads to disappointment. A stock yielding 8% or 9% might seem attractive, but unusually high yields often signal market skepticism about dividend sustainability. The most reliable dividend stocks combine competitive advantages, strong financial health, and appropriate payout ratios. Rather than pursuing the highest current yield, focus on companies that demonstrate strength in all three pillars - they’re more likely to provide not just current income, but growing streams of dividends for years to come. Remember: in dividend investing, stability and growth potential often matter more than current yield.

INCOME BUILDING

Cash Rates

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 4.32%

SPAXX (Fidelity Government Money Market Fund): 4.25%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 4.42%

VMFXX (Federal Money Market Fund): 4.54%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 4.30%

E*Trade: 4.40%

Fidelity: 4.30%

Merrill Edge and Merrill Lynch: —

Vanguard: 4.40%

ETFs (30-Day Yields)

SGOV (iShares 0-3 Month Treasury Bond ETF): 4.50%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 4.42%

USFR (WisdomTree Floating Rate Treasury Fund): 4.52%

TFLO (iShares Treasury Floating Rate Bond ETF): 4.52%

BONUSES

Brokerage, Bank and Credit Card Bonuses

Brokerage Bonuses

E*Trade (still active): Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Bank Bonuses

Capital One (new) — Earn a $300 bonus when you open a new checking account and use promo code OFFER300 and set up and receive at least 2 direct deposits, each of $500 or more, within 75 days of account opening. Offer here.

Availability: Nationwide

Soft credit inquiry

BMO Harris (active) — Earn up to a $560 bonus when you open a new Smart Advantage or BMO Harris Premier checking account. Offer here.

Availability: Nationwide

Soft credit inquiry

Credit Card Bonuses

Chase Ink Preferred (active) — Get 120,000 Ultimate Rewards bonus points when you spend $8,000 in the first three months after account opening. Offer here.

American Express Hilton Surpass Card (active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

Picture of the Week