Hello, YieldAlley readers! In this issue:

The Best Age to Start Dividend Investing Isn't What You Think

Markets Rally on Domestic Strength While Global Growth Diverges

Buffett’s $325 Billion Cash Hoard Is an Early Warning Signal

And more!

NEWS

Standout Stories

₿ Companies are getting FOMO over strategic bitcoin reserves (Sherwood)

🎶 TikTok is one step closer to being banned in the US (CNN)

📈 What Higher Bond Yields Mean for Markets in 2025 (Morningstar)

📚 The Best Books and Podcasts in 2024 About Aging and Retirement (WSJ)

🛍️ Black Friday sales accelerate with online a bright spot (Fortune)

MARKET THOUGHTS

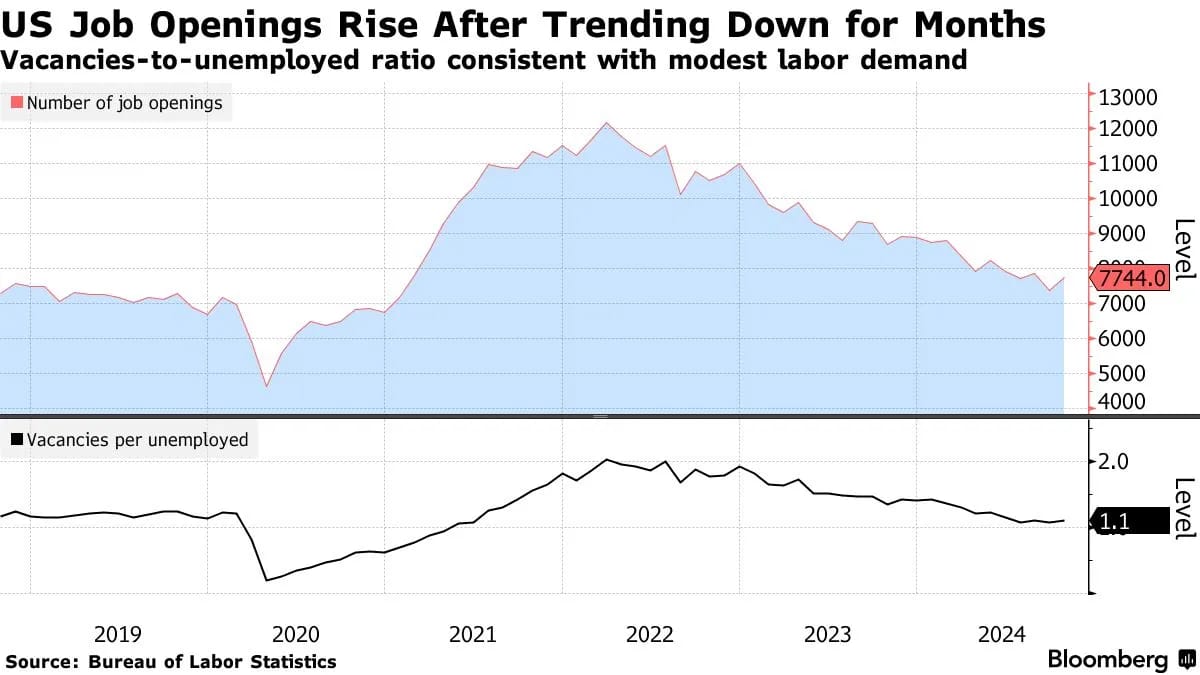

U.S. Markets Hit Records as Jobs Data Supports Fed Rate Cut Path

U.S. stocks reach new milestones:

S&P 500 and Nasdaq hit fresh record highs

Small-caps and tech sectors show strong performance

Energy sector lags despite OPEC production cuts

Bond yields fall to 6-week lows

November employment report exceeds expectations:

Economy added 227,000 jobs, above 200,000 forecast

Three-month average payrolls rose to 173,000

Unemployment rate increased to 4.2%

Labor force participation dropped to 62.5%

Rate cut expectations strengthen:

December rate cut probability rises to 85%

2-year Treasury yields decline more than 10-year

Fed views job market as less inflationary

Gradual pace of cuts expected through 2025

Inflation outlook and expectations:

Headline CPI forecast to rise to 2.7% from 2.6%

Core CPI expected to hold at 3.3%

Housing costs showing signs of moderation

2025 inflation target range of 2-3% anticipated

Energy market developments:

OPEC delays production increases to April 2026

U.S. producers gaining market share

Chinese demand remains weak

Supply-demand dynamics stay challenging

Looking ahead:

Key inflation data due before Fed's December 18 meeting

Gradual disinflation trend expected to continue

Housing and wage costs likely to ease further

Fed maintaining cautious approach to policy changes

INCOME BUILDING

The Best Age to Start Dividend Investing Isn’t What You Think

Should you start investing in dividend stocks if you don’t need the dividends? This is a common debate, with some younger investors wondering why they should buy dividend stocks if the total return is lower and they’re getting taxed each year. This is an interesting debate worthy of discussion, and we believe it reflects a common tension between optimal returns and practical investing psychology.

The Case Against Early Dividend Investing

The mathematical argument against early dividend investing shows that historical returns show that $10,000 invested in VOO (S&P 500 ETF) 13 years ago would grow to $45,000 today. The same amount in SCHD, despite its impressive 12% dividend compound annual growth rate and reinvested dividends, would reach only $37,000. That $8,000 difference represents a significant lost opportunity for young investors.

Tax efficiency amplifies this gap. Growth stocks defer taxes until sale, while dividends create annual tax events - even with qualified dividends’ preferential treatment. This means less money compounding over time. Even major tech companies recognize this - Nvidia, despite being one of the market’s strongest performers, pays a minimal 0.03% dividend yield, keeping most capital invested in growth.

Looking at traditional dividend stalwarts: Coca-Cola’s 5.4% dividend increase in the last 12 months to $1.92 per share and ExxonMobil’s 4.2% increase to $3.96 might seem attractive, but their total returns have significantly lagged the S&P 500 over the past decade. Even financial giants like JPMorgan Chase, despite an impressive 19% dividend increase to $5.00 per share, have struggled to match broad market returns.

The Case For Early Dividend Investing

However, focusing purely on returns misses crucial behavioral benefits. One retail investor shared that "Every $4,000 invested in dividend stocks replaces an hour of work at my monthly income.” This reframing transforms abstract investments into tangible steps toward financial independence.

Long-term investors point to the power of rising income streams. A portfolio manager highlighted positions in JPM, XOM, KR, MRK, and KO held for over 15 years: "I’ve built a solid portfolio without chasing trends. Making investing automatic with quality companies creates sustainable wealth." This approach has particular merit during market turbulence - when MMM and JNJ shareholders continued receiving dividends despite price volatility.

The psychological impact proves significant. Consider an investor holding BlackRock ($20.40 per share dividend) or Amgen ($9.00 per share)—watching quarterly payments grow turns abstract market movements into concrete progress. Many track their dividend income to cover increasingly larger expenses, from utility bills to mortgage payments, creating a tangible path to financial independence.

Understanding Total Return

Total return combines price appreciation and dividend income, and it's crucial for evaluating investment performance. Take Verizon (≈6.8% yield) versus Apple (<1% yield). While Verizon's dividend appears more attractive, Apple's price appreciation has driven superior total returns. However, this oversimplifies the dynamic nature of returns.

Consider "yield on cost" - if you bought Verizon at $32 eighteen months ago, your yield based on your purchase price would be 8.49%, with the stock now at $41. This demonstrates how early dividend investment can create attractive income streams even if initial yields seem modest.

A Balanced Approach: The Transition Strategy

Many successful dividend investors advocate for a measured transition toward dividend stocks. One popular strategy suggests adjusting 25% of your portfolio from growth to dividends every five years as retirement approaches. For someone starting at 30, this might mean:

Age 30-35: 90% growth/10% dividends

Age 35-40: 75% growth/25% dividends

Age 40-45: 60% growth/40% dividends

Age 45-50: 45% growth/55% dividends

Age 50+: 30% growth/70% dividends

Implementation might include:

Starting with dividend growth stocks (like Microsoft or Apple) that offer both appreciation potential and rising dividends

Gradually adding traditional dividend payers (like Coca-Cola or Johnson & Johnson)

Including dividend ETFs (SCHD, VIG) for diversification

Finally, incorporating high-yield options (REITs, MLPs) as income becomes a priority

Bottom Line: The Psychology of Long-Term Success

While mathematics favors growth investing for young investors, the psychological and practical benefits of dividend investing merit consideration. During the “Lost Decade” of 2000-2010, when the S&P 500 delivered essentially zero price return, dividend-focused investors still earned income and saw their payments grow. This regular income helped many stay invested when others panicked and sold.

One veteran investor noted, “Growth stocks build wealth, dividend stocks maintain it, but the best strategy is the one you’ll stick with through market cycles.” Consider starting with a small dividend component that can grow with your investment journey rather than waiting until retirement to learn dividend investing principles.

INCOME BUILDING

Cash Rates

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 4.34%

SPAXX (Fidelity Government Money Market Fund): 4.26%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 4.46%

VMFXX (Federal Money Market Fund): 4.56%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 4.45%

E*Trade: 4.45%

Fidelity: 4.35%

Merrill Edge and Merrill Lynch: —

Vanguard: 4.45%

ETFs (30-Day Yields)

SGOV (iShares 0-3 Month Treasury Bond ETF): 4.54%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 4.44%

USFR (WisdomTree Floating Rate Treasury Fund): 4.54%

TFLO (iShares Treasury Floating Rate Bond ETF): 4.56%

BONUSES

Brokerage, Bank and Credit Card Bonuses

Brokerage Bonuses

E*Trade (still active): Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Bank Bonuses

BMO Harris (active) — Earn up to a $560 bonus when you open a new Smart Advantage or BMO Harris Premier checking account. Offer here.

Availability: Nationwide

Soft credit inquiry

Credit Card Bonuses

Chase Ink Preferred (active) — Get 120,000 Ultimate Rewards bonus points when you spend $8,000 in the first three months after account opening. Offer here.

American Express Hilton Surpass Card (active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

Picture of the Week