Hello, YieldAlley readers! In this issue:

Recent inflation reports in May show that it’s cooling.

U.S. money market assets hit an all-time high.

Academics say dividends are irrelevant — and why they’re wrong.

The easiest way to compare money market fund rates.

And more!

Fixed Income and Cash Income

It’s Been a Good Week For Inflation Data

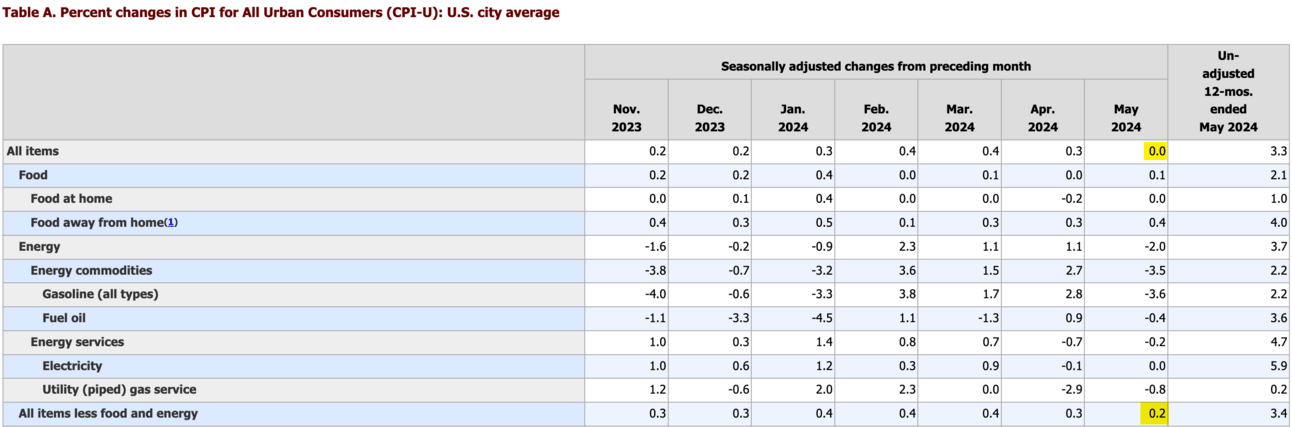

Softer inflation numbers came in this week. On Wednesday, May CPI data showed that consumer prices were unchanged, which is the first time the CPI has remained flat since July 2022. Core CPI, which excludes food and energy increased by 0.2%, which is lower than it had been in the previous months. On Thursday, PPI data was released. PPI measures the prices paid by businesses, and it declined by 0.2% in May, the largest decline since October 2023. Finally, on Friday, import data was released, which was also lower than expected. All of these measures point to fading U.S. inflation. Increasingly, investors expect PCE, the Fed’s preferred measure of inflation, to come in at 2.6%, compared to 2.7% last month. The market now expects at least two interest rates, with the first one in September. On Wednesday, using the dot plot, the Fed had guided toward one interest rate cut this year.

💰 U.S. money market fund assets hit an all-time high. Total assets rose $28 billion to hit $6.12 trillion from $6.09 trillion a week prior. Some believe that money market funds have the potential to go to $7 trillion. The Fed has penciled in one interest rate cut this year (the market expects two), compared to three when projections were announced last March. With cash still paying over 5%, one of the highest risk-free rates in a generation, many retail investors continue to pour money into Treasury bills and money market funds instead of riskier assets. Last week, we mentioned that Berkshire Hathway owns 3% of the entire Treasury bill market, showing that even the best investors in the world view cash right now as one of the best investment opportunities currently.

All brokerage cash guides and playbooks can be found on YieldAlley.com.

Dividend Income

Academics Say Dividends Are Irrelevant — And Why They’re Wrong

Academics have been arguing against dividends for decades, but why do companies keep paying them?

Back in 1961, two economists, Franco Modigliani and Merton Miller (let's call them M&M), dropped a bombshell in the Journal of Business. They claimed that a company's dividend policy shouldn't matter to its share price. Their logic? If a company pays out more in dividends, they'll just have to raise more capital elsewhere to keep growing. Sounds reasonable, right?

When M&M cooked up this theory, the business world looked very different:

From 1962 to 1966, the top 500 U.S. companies were cash-hungry beasts:

They were spending 9-12% of their sales on new equipment and facilities

They were paying out 67-74% of their profits as dividends

After all that, they were actually running out of cash!

Fast forward to today, and things have changed:

Looking at 2015-2019 (and 2022), those same top 500 companies:

Are spending only about 6% of sales on new stuff

Are paying out a more modest 40-46% of profits as dividends

And get this - they're swimming in extra cash!

This means that M&M's original assumptions now only apply to about 10% of the S&P 500 Index. Here's why:

M&M's original theory was based on companies needing to raise external capital to fund growth and pay dividends. In the 1960s, this applied to most large companies. However, the economic landscape has dramatically shifted since then.

Today, only a small subset of the market still operates under these conditions:

Utilities: These companies represent just 3.18% of the S&P 500 Index (as of 12/31/22). They often run free cash flow negative and need to raise external capital to modernize infrastructure, like power grids.

Real Estate Investment Trusts (REITs): These account for another 2.71% of the S&P 500 Index. Many REITs also frequently need to raise capital for property acquisitions and developments.

Other capital-intensive industries: There may be a few other companies that regularly pay dividends in excess of their free cash flow, requiring them to raise capital. However, these are now the exception rather than the rule.

For the vast majority of companies, their dividend policies are now, in M&M's words, "indistinguishable from investment policy." This means that for most companies, paying dividends is a choice about how to allocate their excess cash, not a decision that requires raising new capital.

This shift is crucial because it fundamentally changes the context in which dividend policies operate. For most of today's companies, dividends aren't creating the dilution effect that M&M's theory was concerned about. Instead, they represent a direct way for companies to share profits with shareholders without needing to issue new shares or take on debt.

Now, you might be thinking, "Why should I care about this academic debate?" Well, here's the real-world impact: how you view dividends could seriously affect your investment strategy.

The number crunchers see dividends and capital gains as basically the same thing. But for many investors, there's a big difference between getting a regular cash payment and hoping your stocks go up in value.

While academic finance treats dividends and capital gains as mathematically equivalent, from a business ownership perspective, they are not the same. Dividends represent a natural mechanism for sharing in the success of an enterprise, especially for minority shareholders of large publicly traded companies. This real-world perspective often gets overlooked in pursuit of purely theoretical models.

As of 2023, a whopping 75% of the top 500 companies are still paying dividends, and there’s a reason why both companies and shareholders continue to enjoy the practice of dividends.

Opportunities

Brokerage Bonuses

Brokerages can offer very generous bonuses for deposits. We recommend taking advantage of these bonuses, which can help you earn up to 7% APY on your cash. Brokerages are the best way for most people to purchase the investments we discuss. As always, we highly recommend reading the fine print with these offers. We earn no money from these offers.

E*Trade (still active): Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Opportunities

Bank Bonuses

While we recommend passive savers and investors consider brokered CDs, money market funds, or floating rate ETFs instead, some people may want to take advantage of bank bonuses and promotional rates. As always, we highly recommend reading the fine print with these offers. We earn no money from these offers.

Bank Bonuses

Eastern Bank (still active) — $350 when you open a new checking account with a direct deposit of $4,000 or more. Offer here.

Availability: MA, NH, ME, or RI

Soft credit inquiry.

Discover Savings Account (still active) — With your first Discover Savings account, earn a $150 bonus with a $15,000 deposit, or a $200 bonus with a $25,000 deposit. Use offer code GOBP623. Offer here.

Availability: Nationwide

Soft credit inquiry.

USC Credit Union (still active) — $250 bonus when you open a new checking account and set up direct deposit with a $1,000 minimum direct deposit every 30 days for the first 90 days of checking account AND make a minimum of ten (10) debit transactions every 30 days for the first 90 days of checking account opening. Use promo code SPRING24. Offer here.

Availability: CA.

Soft credit inquiry.

Opportunities

Credit Card Bonuses and Offers

Credit card signup bonuses are one of the easiest ways to earn extra income, as long as you are vigilant in managing payments, your credit score, and claiming bonuses. We know some of our readers are interested in the latest credit deals. As always, we highly recommend reading the fine print with these offers. We earn no money from these offers. The offers below show the best current offer at this time.

American Express Hilton Surpass Card (still active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

Picture of the Week

U.S. GDP Growth vs. the Rest of G7

What We’re Reading

Cash is hot and what it means for stocks. (Barron’s)

Dreaming of retiring abroad? (FT)

Are you Rich? The net worth thresholds. (Yahoo Finance)

Why Japan's Shrinking Economy Is Stuck in the ‘90s (WSJ)

A conversation with NVIDIA’s Jensen Huang. (Stripe)

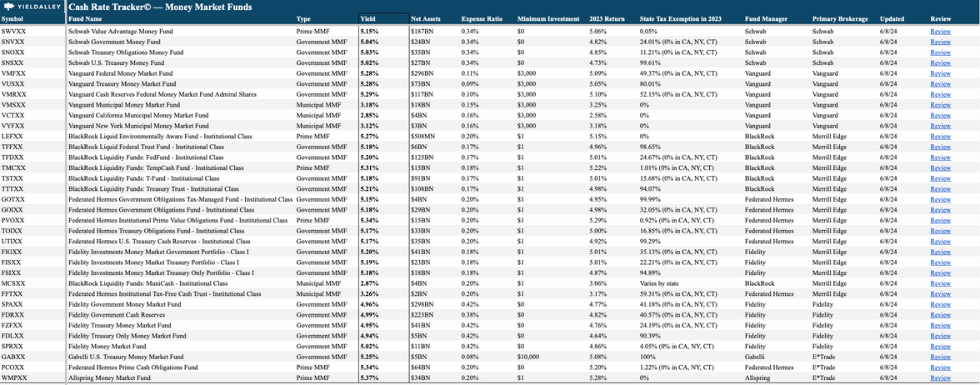

Get Access to the Free Cash Rate Tracker!

With the YieldAlley Cash Rate Tracker©, you can now easily compare and track the latest money market fund and cash rates across brokerages. Get instant access to the spreadsheet by forwarding the YieldAlley newsletter to one person!