Hello, YieldAlley readers! In this issue:

The 90/10 Portfolio Myth: Is Your Retirement Strategy Too Aggressive?

U.S. Markets Surge Friday On Cooling PCE Data While Weekend Funding Bill Ends Shutdown Risk

What You Can Learn From Young Warren Buffett

And more!

NEWS

Standout Stories

🚁 Are Amazon’s Drones Finally Ready for Prime Time? (NYT)

📈 Investing in Stocks at All-Time Highs (A Wealth of Common Sense)

😬 A guide to investing in the age of anxiety (Wellington)

🧐 What You Can Learn From Young Warren Buffett (WSJ)

🏖️ What’s Changing for Retirement in 2025? (Morningstar)

MARKET THOUGHTS

U.S. Markets Surge Friday On Cooling PCE Data While Weekend Funding Bill Ends Shutdown Risk

U.S. stock market shows powerful bullish sentiment driven by inflation data:

S&P 500 and Dow's strong advance of 1.1% and 1.2% reflects market confidence

Treasury yields retreat to 4.53%, signaling dovish rate expectations

Market strength demonstrates resilience through political uncertainty

Strong domestic performance contrasts with weakening global markets

November inflation data reveals crucial economic progress:

Core PCE's 0.1% monthly gain marks lowest since May, showing disinflation momentum

Services inflation moderates to 0.2%, indicating pressure point relief

Flat goods prices and supply chain normalization reinforce trend

Annual PCE's decline to 2.4% supports Fed pivot potential

Global markets highlight U.S. economic leadership:

Asian markets face renewed growth headwinds

European markets weaken on disappointing UK retail data

German higher-than-expected producer prices signal regional challenges

U.S. maintains position as global market leader despite international weakness

Weekend political resolution removes uncertainty:

Bipartisan agreement secures funding through March 14

$100 billion disaster aid package demonstrates fiscal response

$10 billion agricultural assistance targets sector support

Political compromise reduces near-term market risk

Investment outlook suggests positive momentum:

Strong inflation improvement supports Fed easing path

Market resilience shows robust fundamental backdrop

Economic data consistently exceeds expectations

Year-end positioning reflects constructive outlook

INCOME BUILDING

The 90/10 Portfolio Myth: Is Your Retirement Strategy Too Aggressive?

For decades, the conventional wisdom in retirement planning has been clear: the younger you are, the more your portfolio should be invested in stocks. This approach, championed by many financial advisors and target-date funds, typically starts with a portfolio heavily weighted toward equities — often 90% or more — gradually shifting toward bonds as retirement approaches. The logic seems sound: stocks have historically delivered superior returns over the long term, and younger investors have time to weather market volatility.

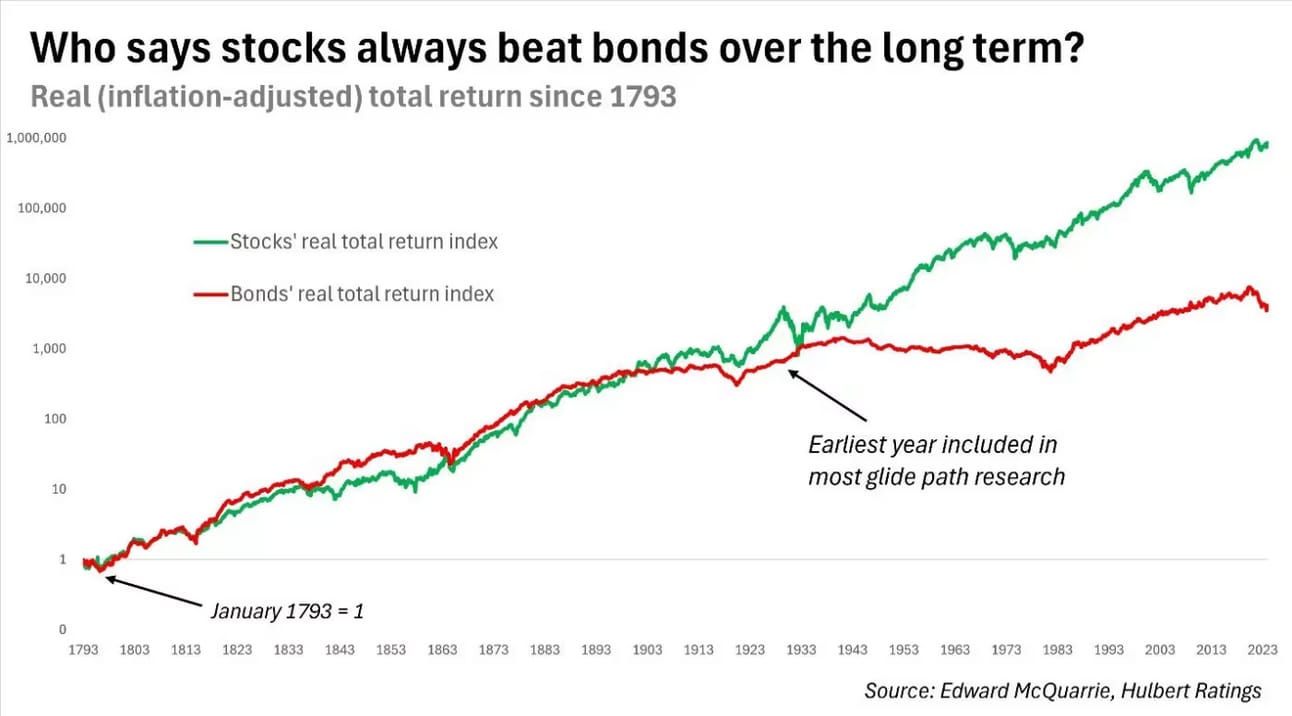

But what if this widely accepted strategy isn’t as foolproof as we’ve been led to believe? Recent research by Professor Edward McQuarrie, analyzing over two centuries of market data, reveals a more nuanced reality that challenges this fundamental assumption and makes a compelling case for a more balanced approach to retirement investing.

Historical data paints a fascinating picture: from 1793 to 1903, stocks and bonds delivered remarkably similar returns. In fact, during this extensive period, bonds frequently matched or outperformed stocks. This revelation carries profound implications for modern investors, particularly those approaching or in retirement, who must carefully balance growth potential with capital preservation.

The story of the S&P 500 and the Vanguard Total Bond Market Index (VBMFX) following the 1999 market peak serves as a sobering reminder of why bonds deserve a prominent place in retirement portfolios. It took approximately 18 years - until 2017 - for the S&P 500 to recover and finally surpass the Total Bond Index in total returns.

VFINX vs. VBMFX from the end of 1999 to present

How painful it must have been to experience this painful drawdown for 18 years, especially the emotional and financial toll on retirees who need regular income from their investments. This extended period of underperformance, triggered by the extremely elevated stock valuations during the dot-com bubble, illustrates why retirees cannot afford to ignore bonds as a crucial portfolio component. A portfolio heavily tilted toward stocks might offer higher potential returns in the long run, but the path to those returns can also be treacherous. When withdrawing funds for living expenses, significant market downturns can force you to sell assets at depressed prices, permanently impairing your portfolio’s long-term value. This is where bonds prove their worth, providing stability and reliable income during stock market turbulence.

The popular “glide path” strategy, which starts with 90% or more in stocks and gradually shifts toward bonds as retirement approaches, often falls short of a simple, constant 60/40 allocation. However, historical data analysis shows that investors would have fared as well or better with a steady 60/40 portfolio in about two-thirds of cases while taking on significantly less risk. This finding challenges the conventional approach of many target-date funds in retirement plans.

The success of a 60/40 portfolio isn’t merely about returns — it's about risk-adjusted performance. On this crucial metric, the balanced portfolio proves superior to the glide path approach 98% of the time. This remarkable consistency stems from the portfolio’s ability to weather various market environments while providing growth potential and downside protection.

Modern markets present their own challenges. Current stock valuations echo the lofty levels seen during the dot-com era, suggesting potential headwinds for equity returns. Meanwhile, political polarization and economic uncertainties add layers of risk that prudent investors cannot ignore. In this environment, the stabilizing effect of bonds becomes even more valuable.

The 60/40 portfolio’s enduring relevance speaks to a fundamental truth about investing: success isn’t just about maximizing returns but finding a sustainable balance that allows investors to stay the course through market cycles. While younger investors might be tempted to dismiss bonds in favor of aggressive stock allocations, the historical record suggests that patience and balance often triumph over aggressive growth strategies.

For those approaching retirement, the message is clear: don’t underestimate the role of bonds in your portfolio. They serve not just as a shock absorber during market turbulence but as a crucial source of reliable income when you need it most. The 18-year recovery period following the dot-com bubble is a stark reminder that stock market rebounds can take far longer than many investors can comfortably wait.

Ultimately, the case for a 60/40 portfolio rests not on maximizing returns in the best of times, but on delivering reliable performance across all market conditions. In a world where financial markets can shift dramatically and unexpectedly, this time-tested approach continues to offer a compelling balance of growth potential and stability for long-term investors.

INCOME BUILDING

Cash Rates

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 4.21%

SPAXX (Fidelity Government Money Market Fund): 4.20%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 4.37%

VMFXX (Federal Money Market Fund): 4.45%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 4.30%

E*Trade: 4.15%

Fidelity: 4.15%

Merrill Edge and Merrill Lynch: —

Vanguard: 4.20%

ETFs (30-Day Yields)

SGOV (iShares 0-3 Month Treasury Bond ETF): 4.48%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 4.43%

USFR (WisdomTree Floating Rate Treasury Fund): 4.51%

TFLO (iShares Treasury Floating Rate Bond ETF): 4.49%

BONUSES

Brokerage, Bank and Credit Card Bonuses

Brokerage Bonuses

E*Trade (still active): Up to $6,000 in bonuses for deposits made within 60 days of enrollment. Offer here.

Use promo code OFFER24.

$1,000+ will receive $50

$5,000-$19,999 will receive $150

$20,000-$49,999 will receive $200

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Bank Bonuses

Capital One (new) — Earn a $300 bonus when you open a new checking account and use promo code OFFER300 and set up and receive at least 2 direct deposits, each of $500 or more, within 75 days of account opening. Offer here.

Availability: Nationwide

Soft credit inquiry

Credit Card Bonuses

Chase Ink Preferred (active) — Get 120,000 Ultimate Rewards bonus points when you spend $8,000 in the first three months after account opening. Offer here.

American Express Hilton Surpass Card (active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

Picture of the Week