Hello, YieldAlley readers! In this issue:

The Fed’s Preferred Inflation Gauge Slows.

How To Evaluate Dividend Safety.

How to track and monitor the highest cash rates.

And more!

NEWS

Standout Stories

📈 Peak ‘Roaring Kitty’? Dog-Tweet Rally Shows His Power and Limits (Bloomberg)

🧑🎓 Here’s What $200 Billion in Covid Money Did for Students (WSJ)

🏖️ 55-Year-Old Americans Are ‘Critically Underprepared’ for Retirement (CNBC)

💸 Americans’ Pandemic Savings Are Gone — And the Economy Is Bracing for Impact (Bloomberg)

👻 That Job You Applied for Might Not Exist. Here's What's Behind a Boom in "Ghost Jobs." (CBS)

MARKET THOUGHTS

Fed’s Preferred Inflation Gauge Slows to 3-Year Low, Increasing Chances of September Rate Cut

An inflation measure closely tracked by the Federal Reserve slowed to its smallest annual increase in three years.

The personal consumption expenditures index (PCE) rose 2.6% in May year-over-year.

Lowest increase since March 2021.

Indicates cooler consumer spending momentum and easing inflation.

The Federal Reserve scaled back its forecast to one rate cut in 2024 from three.

Friday's PCE numbers could increase the likelihood of a rate cut at the Fed's September meeting.

Odds for a rate cut at the September 18th meeting are approximately 75%.

Prices for physical goods fell 0.4% from April to May.

Gasoline prices dropped 3.4%, furniture prices 1%, and recreational goods and vehicles prices 1.6%.

Prices for services, including restaurant meals and airline fares, ticked up 0.2%.

Inflation has cooled substantially from its 2022 peak.

Treasury yields fell after the report, as investors priced in a greater chance of rate cuts.

The saving rate rose to 3.9%, the highest level since the start of the year.

Consumer sentiment edged lower in June, while inflation expectations moderated.

INCOME BUILDING

How To Evaluate Dividend Safety: A Critical Consideration for Income Investors

For retirees and income-focused investors in 2024, dividend safety should be a top priority when evaluating stocks. While high yields can be tempting, double-digit yields often signal trouble ahead, as demonstrated by numerous dividend cuts during the 2008 financial crisis and the 2020 pandemic. Several key factors are crucial to assess dividend safety. Here are our top 5 factors:

Payout Ratio: This measures the percentage of earnings paid out as dividends. A payout ratio below 100% is essential for long-term sustainability. However, the appropriate level varies by industry and company. As of 2024, utilities may have sustainable 60-80% payout ratios, while cyclical industries require much lower ratios.

Earnings Stability: Short-term earnings fluctuations arise from revenue variability, operating leverage (fixed vs. variable costs), and financial leverage (debt levels). Companies with more stable earnings can generally support higher payout ratios, a principle that has held true for decades.

Earnings Durability: This refers to a company's long-term ability to generate sufficient earnings to cover dividends. Key factors include:

Economic moat: Sustainable competitive advantages protect profits

Long-term demand trends: Avoid declining industries

Liquidity: Cash reserves and credit access provide flexibility

Management's Willingness to Pay: Dividends represent a commitment to shareholders. A history of consistent dividend increases signals management's dedication to maintaining payouts. For example, companies in the S&P 500 Dividend Aristocrats index have increased their dividends for at least 25 consecutive years.

Warning Signs:

Unsustainable earnings sources (e.g., asset sales)

Excessive debt or pension obligations

Legal/regulatory issues

Industry-wide dividend cuts

Let’s dive into two case studies to understand how to apply these key factors.

Case Study 1: Suburban Propane Partners (SPH) - 2005-2007

In August 2005, Suburban Propane Partners faced a challenging situation. The propane distributor was grappling with warm weather and high propane prices, which reduced consumer demand. More critically, its smaller fuel oil delivery business was in trouble due to per-gallon price caps offered for the 2004-2005 heating season. When crude oil prices surged, these caps became a significant liability.

The impact was severe. Cash flow was hit hard, the trailing payout ratio soared to 139%, the stock price dropped from $35 to $25, and the yield rose to nearly 10%. At first glance, this appeared to be a classic dividend trap. However, a deeper analysis revealed potential.

Management quantified the one-time impact of fuel oil caps at $21.5 million. Removing this expense brought the payout ratio to a more manageable 100%. The company also announced it was eliminating fuel oil price caps permanently. The stock was $25.20 in January 2006.

What followed was a remarkable turnaround. Cash flow improved dramatically as the fuel oil cap impact disappeared. Management implemented significant cost-cutting measures. Within 8 months, Suburban began raising its cash distribution. By mid-2007, the distribution rate increased to $2.80 per unit (up 14% in less than two years) and the stock price nearly doubled to $48, ending up with a dividend yield of around 6%.

Case Study 2: Tuesday Morning (TUES) - 2006-2007

In May 2006, specialty retailer Tuesday Morning appeared to offer an attractive dividend opportunity. It boasted a 5% yield, well above the industry average, with a newly instituted generous dividend policy. The payout ratio was slightly above 50%, and the stock was priced at just under $16. The company's business model focused on selling closeout name-brand merchandise at 50-80% discounts. Initial analysis suggested the dividend was well-covered and had room to grow.

However, several warning signs were overlooked. Same-store sales had been negative for seven consecutive quarters. The business model was becoming less relevant as major department stores increased their discounting. Cost-cutting opportunities were largely exhausted.

As the situation unfolded, the payout ratio rapidly increased from 50% to 60%, then 70%, and finally 90%. Negative same-store sales trends accelerated. By late 2006, dividend sustainability was in question, despite no long-term debt. In March 2007, the $0.80 annual dividend was barely covered by earnings.

What was the key difference between these cases? It was the presence (or lack) of an economic moat. Suburban Propane had a defensible business model with high switching costs for customers. Tuesday Morning's perceived competitive advantages proved illusory in the face of changing retail dynamics.

To recap:

Be skeptical of unusually high yields

Analyze payout ratios in the context of earnings stability and business quality

Look for durable competitive advantages (economic moats)

Consider management's commitment to dividends

Be alert to industry-wide dividend trends

Recent dividend increases are often the best sign of safety

Dividend safety is often found by critically evaluating the key factors we’ve laid above, which can also represent a business’s durability and stability. While a high dividend yield is often attractive, be wary of “too good to be true” opportunities could backfire on you.

INCOME BUILDING

Cash Rates

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 5.03%

SPAXX (Fidelity Government Money Market Fund): 4.97%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 5.19%

VMFXX (Federal Money Market Fund): 5.29%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 5.37%

E*Trade: 5.35%

Fidelity: 5.20%

Merrill Edge and Merrill Lynch: —

Vanguard: 5.30%

ETFs

SGOV (iShares 0-3 Month Treasury Bond ETF): 5.27%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 5.21%

USFR (WisdomTree Floating Rate Treasury Fund): 5.35%

TFLO (iShares Treasury Floating Rate Bond ETF): 5.32%

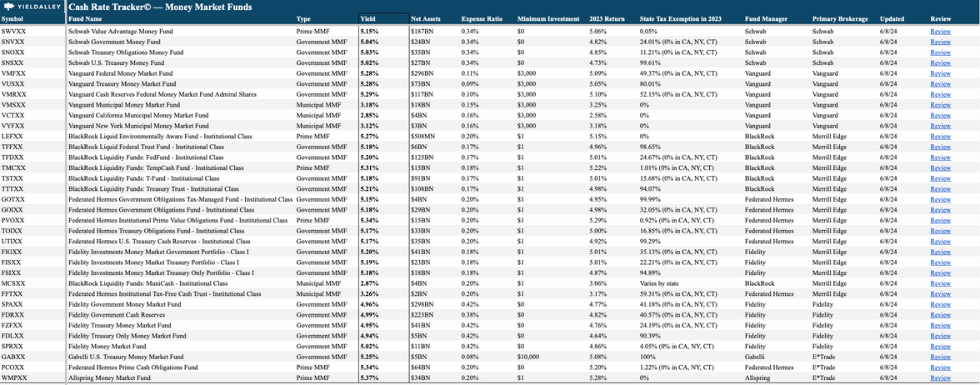

Want To Get the Highest Cash Yields?

With the YieldAlley Cash Rate Tracker©, you can now easily compare and track the latest money market fund and cash rates by brokerage. Get all the details you need including fund type, yields, expense ratios, and tax benefits in a single spreadsheet.

Refer one person to this newsletter for instant access.

BONUSES

Brokerage, Bank and Credit Card Bonuses

Brokerage Bonuses

E*Trade (still active): Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Bank Bonuses

Chartway Federal Credit Union (active) — $200 cash back when you open a new checking account using promo code 200CASH. Offer here.

Availability: Nationwide

Soft credit inquiry.

Axos Bank (active) — $500 when you open a new rewards checking account with promo code RC500 and certain requirements. Offer here.

Availability: Nationwide

Soft credit inquiry.

Discover Savings Account (active) — With your first Discover Savings account, earn a $150 bonus with a $15,000 deposit, or a $200 bonus with a $25,000 deposit. Use offer code GOBP623. Offer here.

Availability: Nationwide

Soft credit inquiry.

USC Credit Union (active) — $250 bonus when you open a new checking account and set up direct deposit with a $1,000 minimum direct deposit every 30 days for the first 90 days of checking account AND make a minimum of ten (10) debit transactions every 30 days for the first 90 days of checking account opening. Use promo code SPRING24. Offer here.

Availability: CA.

Soft credit inquiry.

Credit Card Bonuses

Citi Strata Premier (active) — 75,000 points after $4,000 in spend within the first three months. Offer here.

Bank of America Sonesta (active) — 120,000 points after $2,000 in spend on the first 90 days of account opening. Offer here.

American Express Hilton Surpass Card (active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

Picture of the Week