Hello, YieldAlley readers! In this week’s newsletter:

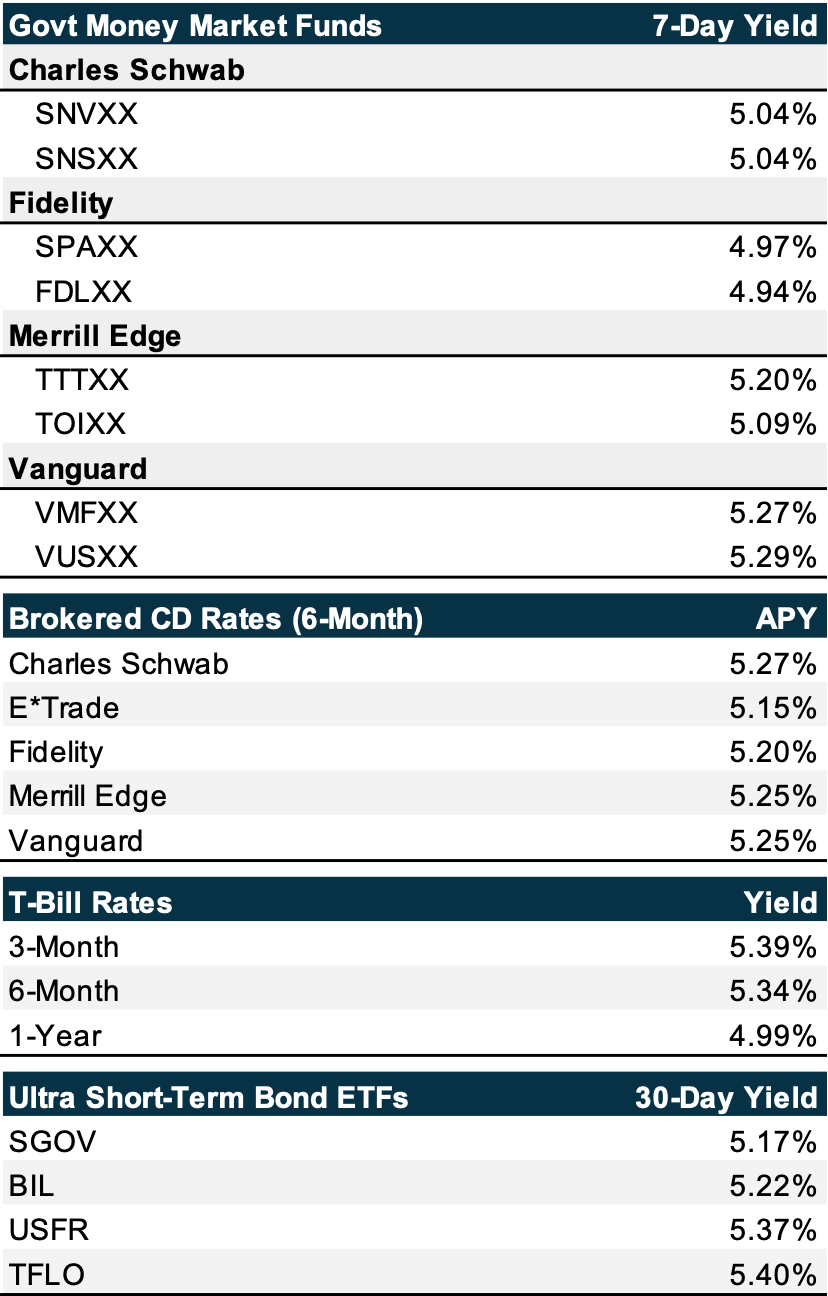

Rates Roundup for money market funds, brokered CDs, Treasury bills, and ultra short-term bond ETFs.

Read of the Week: Structural Alpha: How “The Bond King” Outperformed the Market for 20 Years

Elsewhere: Wealth managers are worried about cash investing, The cost of owning a car in the U.S. continues to rise

As of February 16, 2024

January 2024 CPI (Consumer Price Index) data was released this past Tuesday. U.S. inflation slowed to 3.1%, which is lower than December's 3.4% but still a smaller decline in inflation than experts had expected. As a result, expectations around an early interest rate cut are dropping, and the stock market reacted negatively to the news. Bond yields continue to climb as inflation seems to stick around.

Read our cash guides on Charles Schwab, Fidelity, Merrill Edge, Robinhood, and Vanguard to compare rates across money market funds and CDs to earn the highest cash rates.

Structural Alpha: How “The Bond King” Maintained Consistent Outperformance

Bill Gross is widely known as “The Bond King”. Gross is the founder of PIMCO, Pacific Investment Management Company, one of the world’s largest investment firms, which has a special focus on active fixed-income management.

While at PIMCO, Gross managed PIMCO's Total Return fund, which was once the world's largest bond fund with almost $293 billion in assets (today, it’s roughly $140 billion). Gross’s Total Return fund beat the market for much of his career, which was boosted by what Gross called “structural alpha”.

Alpha, in the context of the market, means outperformance, which is the performance beyond the market’s return. Structural means repeatable and persistent returns. Gross’s structural alpha trades contributed to around 0.5 to 1 percent of his fund’s performance every single year. PIMCO then used more advanced strategies, primarily leverage, to magnify its cash returns.

What was one of these structural trades that Gross loved? Beginning in the early 1990s, PIMCO would take whatever cash it had left over and invest it in anything that generated a return more than zero. At the time, this was a huge innovation. Many of PIMCO’s competitors sat around not doing any of these things, finding it too troublesome to invest in opportunities that would generate pennies on the dollar.

Sound familiar? We all know friends and family members who shy away from higher yields due to inertia and friction, or a lack of knowledge. We suspect many investment professionals and wealth managers today don’t have a sophisticated cash strategy or are not incentivized to recommend one (read on below for interesting survey results).

Actionable tip: A solid income investing portfolio requires a cash strategy, income investments, and a total return approach. The cash strategy is our own “structural alpha” approach to consistently gain returns in any market environment. Meanwhile, selecting the right income investments (bond ETFs, mutual funds, stocks) and a total return strategy (bond prices, dividend stocks) will result in less stable returns. Therefore, nailing our cash strategy is the first step to income success.

Wealth managers are worried about cash investing

A recent survey of investment professionals shows that many wealth managers are "working hard to persuade clients to put money in markets, not in cash”. The idea is that investing in cash for its yield of 5% or more is unlikely to deliver the same return as other assets.

Funny, isn’t it? Wealth managers have a strong incentive to pitch higher-margin investment products to their clients. While we believe a cash investing strategy is just a small component of an investment portfolio and you need other investments for a “total return strategy”, the general wariness to encourage cash investing amongst professional fund managers points to a lack of incentive alignment.

Warren Buffett himself has a huge cash pile (roughly $150 billion) that he uses to buy truckloads of Treasury bills.

If you work with a financial advisor, be vigilant about the products and investments they recommend. Make sure you understand the fees, commissions, and incentive model for your wealth advisor, and don’t be afraid of risk-free returns when you can’t find other better deals in the market!

The cost of owning a car in the U.S. continues to rise

Gas prices have stayed consistent in recent months, but everything else related to owning a car continues to go up, even surpassing the inflation rate. Car insurance premiums increased an eye-boggling 21% from last January. The higher premiums are partially driven by higher car prices.

Including gas and insurance, the average annual cost of owning a new car increase to $12,182 in 2023, up from $10,728 in 2022, according to the latest estimates from AAA. Of course, the largest contributor to rising car ownership costs has been the increase in borrowing rates.

Thank you for reading! We’d love to hear from you. If you have any feedback or thoughts, please feel free to directly respond to this email with your message. Our ChatGPT bot is also available for your questions, as is our Facebook group.

If you enjoyed this newsletter, please subscribe here. Investing and saving is more fun with friends and family. You can forward this newsletter to anyone who might find the advice in this email useful!