Hello YieldAlley readers! Inflation data came out this week for December, coming in higher than expected. Investors still expect an interest rate cut from the Fed, but some are now pushing their timeline for when they think it’ll happen. However, our cash strategy remains unchanged and focused on ultra low-risk cash investments that are still yielding over 5%.

In this week’s newsletter:

Rates Roundup for money market funds, brokered CDs, Treasury bills, and ultra short-term bond ETFs.

State-Tax Exemptions Can be a Hidden Boost to Your Cash Returns

Elsewhere: Wall Street Quants Are Losing to Cash, 2023 Was a Record Year for Dividends

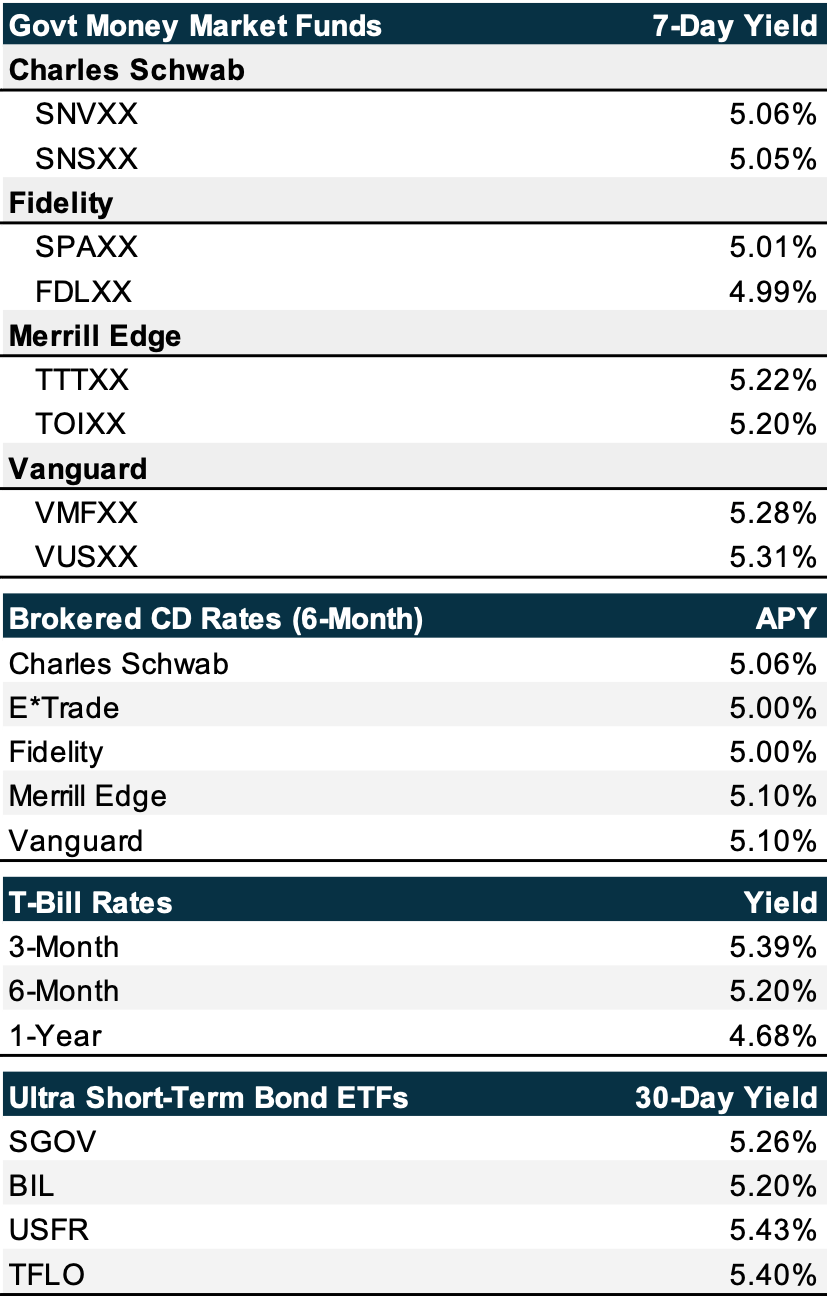

As of January 12, 2024

Inflation data came out on Thursday, showing that US inflation accelerated at the end of 2023. The cost of living in December was up 3.4% versus a year ago, which was a larger increase than the 3.1% increase seen in November but well below the January 2023 peak of 6.4%.

Investors still expect interest rate cuts, and U.S. Treasury yields declined slightly after the news in expectation of future cuts. Many of the money market fund and CD rates have responded accordingly, also dropping a few basis points (1 basis point is 0.01%). Regardless, we continue to recommend holding the cash equivalents in the above table instead of cash.

To understand the highest cash rates on each brokerage, read our cash guides on Charles Schwab, Fidelity, Merrill Edge, and Vanguard.

State-Tax Exemptions Can be a Hidden Boost to Your Cash Returns

Any interest income earned from U.S. Treasuries in a taxable account is exempt from state and local taxes. If you live in a high-tax state such as California, New York, or Connecticut, that means saving 10% or more on your yield. 10% savings on your yield is significant and is the difference between earning 5% and 5.5%!

What many people are unaware of is that you benefit from these state-tax exemptions when you hold money market funds and Treasury ETFs. These funds hold a large amount of U.S. Treasuries. If you hold these funds or ETFs in a taxable brokerage account, the portion of income that is generated from Treasuries is exempt from state income, which is great news for us!

Let’s walk through some examples by using some investments on Fidelity’s platform:

SPAXX is Fidelity’s most popular money market fund. It invests in U.S. Treasuries, which are state tax exempt. But most of its holdings are Treasury repos and U.S. agency bonds, which are not state tax exempt. As a result, SPAXX’s state-tax exemption in 2022 was 31%. Note: this exemption is 0% for residents in CA, CT, and NY. Fidelity offers municipal funds with tax exemptions for these state residents.

In contrast, FDLXX, the Fidelity Treasury Only Money Market Fund, which only holds Treasuries, had a tax exemption of 94% in 2022, and this applies to all holders.

We want to highlight ultra short-term Treasury ETFs. In 2022, SGOV was 93% state tax exempt, USFR was 99.7%, and TFLO was 98%. These ETFs also charge a lower fee and pay higher yields than most money market funds or CDs!

Let's compare the impact of investing $10,000 in SPAXX which yields 5.01% with a state tax exemption of 31% versus TFLO which yields 5.43% and a state tax exemption of 98%.

Assuming a state tax rate of 10%: the SPAXX holder would earn $466 after one year, whereas the TFLO holder would earn $542. The TFLO holder is earning 16% more! Even if TFLO were paying the same yield as SPAXX, the TFLO holder would still come out ahead by 7%.

You benefit from this state tax exemption by directly holding Treasury bills. However, you do not get this benefit with brokered CDs, bank CDs, or high-yield savings accounts.

The tax savings for buying U.S. Treasuries, or the funds and ETFs that hold them, are significant. On our brokerage cash guides, we publish the state tax exemption rates for all ETFs and each brokerage’s money market funds.

Elsewhere

Wall Street Quants Are Losing to Cash

You too can beat the professional Wall Street investor. According to a Goldman Sachs analysis, the vast majority of the factors used in quantitative investing models could not outperform the cash rate of 5%, as seen in our Rates Roundup table above. Bloomberg ($) reports that investor expectations have risen as cash rates went up. Investors in hedge funds and quantitative funds are asking whether these funds can justify the high fees they’re paying if they can’t even earn the cash rate. As YieldAlley readers know, we strongly advocate earning this risk-free yield with your cash wherever you can.

2023 Was a Record Year for Dividends

In 2023, a record amount of dividends was paid. CNBC ($) reported that companies in the S&P 500 paid out $588 billion in dividends in 2023, a new record. In 2022, it was $564 billion. These dividends were paid by 80% of the companies in the S&P 500, which is still a lower percentage than what it was five years ago.

Of those, just six companies paid out 15% of all dividends. Those were Microsoft ($22.3 billion & 0.8% dividend yield), ExxonMobil ($15.2 billion & 3.7% yield), Apple ($14.0 billion & 0.5% yield), JPMorgan ($12.1 billion & 2.4% yield), Johnson & Johnson ($11.5 billion & 3.0% yield), and Verizon ($11.2 billion & 6.8% yield).

While YieldAlley is currently focused on sharing the best strategies around cash and fixed income to develop a solid income-generating portfolio, feel free to reply to this email to let us know if you’re interested in an analysis of dividend-paying stocks as well.

If you enjoyed this newsletter, please subscribe here. Investing and saving is more fun with friends and family. You can easily forward this newsletter to anyone who might find the advice in this email useful!