Hello, YieldAlley readers! In this issue:

SCHD Deep Dive: The Dividend ETF That's Capturing Investors' Hearts

Stocks Pause After Fed-Induced Rally; Yield Curve Returns to Normal

The End of Fabulous Money Market Rates Is Near.

And more!

NEWS

Standout Stories

🍗 Raising Cane’s founder makes hundreds of millions in dividends (Sherwood)

⛳️ Callaway’s Topgolf acquisition has been a masterclass in value destruction (Sherwood)

👟 Nike CEO calls it quits as sportswear giant’s sales sink (NY Post)

🤑 The End of Fabulous Money Market Rates Is Near (New York Times)

☢️ Three Mile Island nuclear reactor to restart under Microsoft deal (Yahoo Finance)

MARKET THOUGHTS

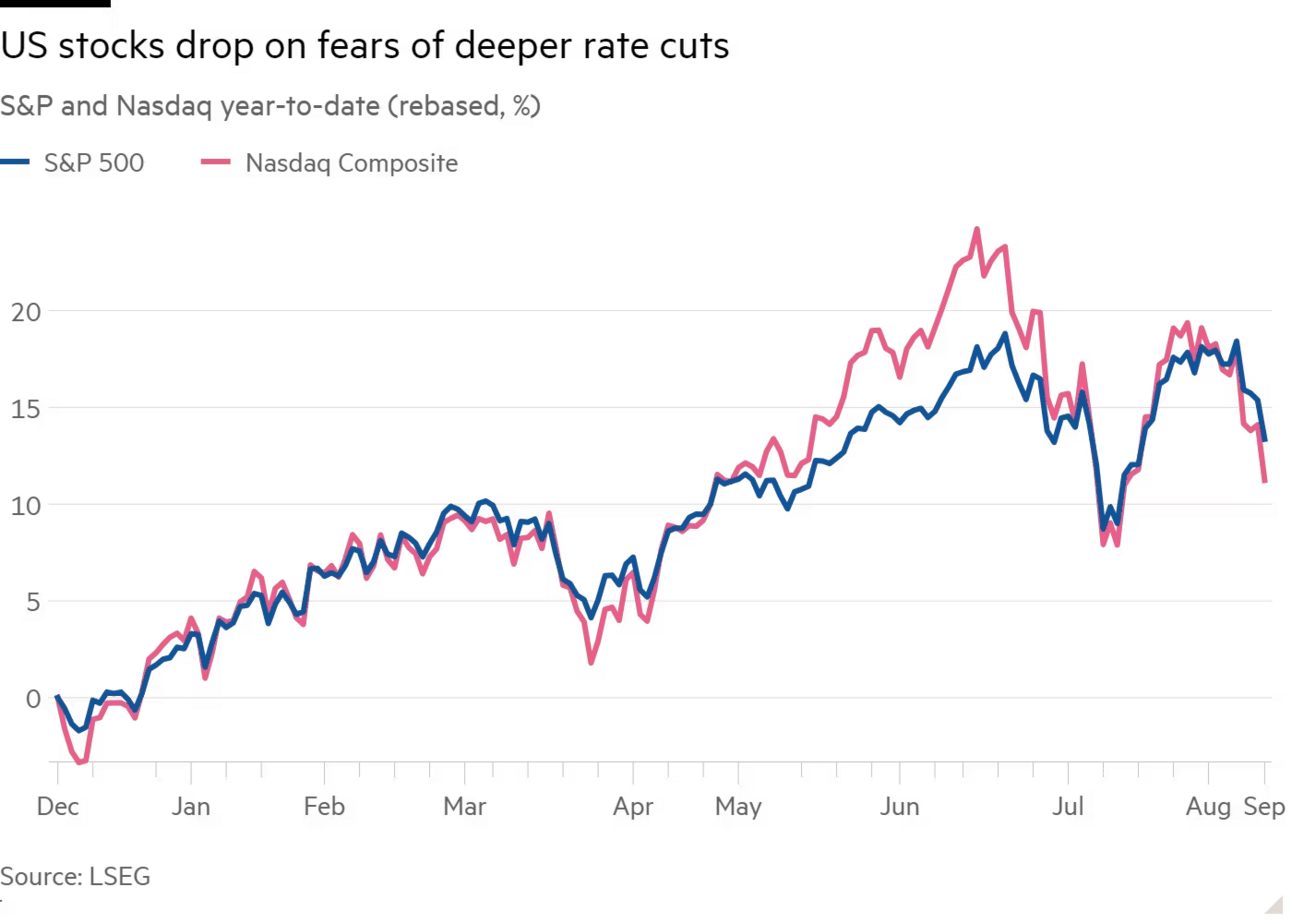

Stocks Pause After Fed-Induced Rally; Yield Curve Returns to Normal

U.S. stocks took a breather on Friday after a strong post-Fed rally.

The S&P 500 touched a new all-time high of 5,700 on Thursday.

Markets have rallied 5.7% in the last nine trading days.

Cyclicals and small-caps outperformed this week, boosted by the Fed's rate cut.

The Federal Reserve initiated its rate-cutting cycle with a significant move.

The FOMC announced a 50 basis point (0.50%) reduction in the federal funds rate.

The new target range is now 4.75%-5.00%.

This larger-than-usual cut signals the Fed's intention to front-load policy easing.

The yield curve has normalized for the first time in over two years.

10-year Treasury yields are now higher than 2-year yields.

2-year Treasury yields have fallen 100 basis points since July.

The upward-sloping yield curve is seen as a positive economic signal.

Economic indicators showed mixed but generally positive trends.

Retail sales increased 0.1% in August, better than expected.

Single-family housing starts jumped 15.8% to a 992,000-unit annual pace.

Existing home sales declined 2.5% to a 3.86 million-unit annual pace.

Looking ahead:

Markets will focus on incoming economic data to assess the probability of a "soft landing".

Upcoming reports include manufacturing and services activity, housing market data, consumer confidence, and household income and spending.

Analysts expect these reports to reflect a moderating but expanding economy.

The Fed's future moves:

Expectations are for 25 basis point cuts at the two remaining meetings this year.

The Fed aims to recalibrate its policy stance given current economic conditions.

INCOME BUILDING

SCHD Deep Dive: The Dividend ETF That's Capturing Investors' Hearts

In the world of dividend investing, the Schwab U.S. Dividend Equity ETF (SCHD) has become a standout player. But what exactly is SCHD, and why has it captured the attention of so many investors?

SCHD is an exchange-traded fund (ETF) that tracks the performance of the Dow Jones U.S. Dividend 100 Index. Launched in October 2011, this fund focuses on high-quality, dividend-paying U.S. stocks. Its primary goal is to provide investors with a relatively high yield while offering the potential for dividend growth and capital appreciation.

The fund has earned Morningstar's coveted Gold Medalist Rating and over the past three years, SCHD has attracted a staggering $27 billion in net inflows - nearly triple the amount of its nearest rival, the Vanguard High Dividend Yield ETF (VYM). But what's driving this remarkable surge in popularity, and more importantly, are there hidden risks investors should be aware of?

SCHD's allure stems from its multifaceted approach to dividend investing. Rather than zeroing in on a single metric, SCHD employs a strategy that balances high yields with dividend growth potential and quality fundamentals. The Dow Jones U.S. Dividend 100 Index, which SCHD tracks, selects 100 stocks that have paid dividends for at least 10 consecutive years and demonstrate the financial health to maintain that streak.

This methodology has enabled SCHD to outpace the Russell 1000 Value Index by about 1.6 percentage points annually from its inception through February 2024. SCHD's risk-adjusted performance (as measured by its Sharpe ratio) ranked within the top decile of large-value peers over the same period.

One of SCHD's key strengths is its focus on quality. As of March 2024, nearly 65% of the portfolio consisted of stocks with wide Morningstar Economic Moat Ratings, surpassing 96% of its Morningstar Category peers. This emphasis on quality has historically been tied to market-beating returns, with SCHD consistently outperforming the Russell 1000 Value Index in profitability metrics like return on invested capital.

Another distinguishing feature is SCHD's defensive stance. The fund has demonstrated remarkable resilience during market downturns, capturing just 87% of the Russell 1000 Value's downside since inception, with lower overall volatility. This was evident in 2022, when holdings like Merck (MRK) and Amgen (AMGN) helped the fund outperform its category index by about 4 percentage points.

However, this defensive posture can be a double-edged sword. While SCHD has captured 90% of its category index's upside over its lifetime, it can lag during strong bull markets, especially those driven by growth stocks. This was painfully apparent in 2023 when SCHD trailed the Russell 1000 Value Index by about 7 percentage points, underperforming nearly 90% of its peers. The fund missed out on the stellar performance of companies like Meta Platforms (META), Salesforce (CRM), and Advanced Micro Devices (AMD).

SCHD's methodology does have potential drawbacks. The requirement for a 10-year dividend history may limit exposure to younger, potentially faster-growing companies. Additionally, while the market-cap weighting approach is efficient, it may not be ideal for a dividend-focused fund as it rewards the biggest companies regardless of their dividend metrics.

The fund's concentration in 100 stocks also presents risks, although SCHD mitigates this by limiting each stock's weighting to 4% and each sector to 25% of the portfolio. This helps maintain diversification, but investors should know that the fund's composition can differ significantly from broader market indices. SCHD has just an 8% overlap with the S&P 500, which can lead to periods of significant underperformance during tech-led rallies.

Despite these potential drawbacks, SCHD's long-term track record remains impressive. From inception through February 2024, its risk-adjusted and absolute returns remained within the top 10% of the large-value cohort. The fund's rock-bottom fee also makes it a very cost-effective offering.

What's Your Take?

We're eager to hear your thoughts on SCHD. Does its quality-focused, defensive approach align with your investment strategy?

Share your insights - we're curious to learn how you're navigating the dividend landscape and what role SCHD plays in your portfolio strategy, if any!

INCOME BUILDING

Cash Rates

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 4.94%

SPAXX (Fidelity Government Money Market Fund): 4.96%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 5.01%

VMFXX (Federal Money Market Fund): 5.16%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 4.60%

E*Trade: 4.70%

Fidelity: 4.55%

Merrill Edge and Merrill Lynch: —

Vanguard: 4.55%

ETFs

SGOV (iShares 0-3 Month Treasury Bond ETF): 5.15%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 5.08%

USFR (WisdomTree Floating Rate Treasury Fund): 5.14%

TFLO (iShares Treasury Floating Rate Bond ETF): 5.16%

BONUSES

Brokerage, Bank and Credit Card Bonuses

Brokerage Bonuses

E*Trade (still active): Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Bank Bonuses

BMO Harris (active) — Earn up to a $560 bonus when you open a new Smart Advantage or BMO Harris Premier checking account. Offer here.

Availability: Nationwide

Soft credit inquiry

U.S. Bank (active) — Earn up to a $450 bonus when you open a new Smartly checking account when you use promo code 2024JUL. Offer here.

Availability: Nationwide

Soft credit inquiry.

Credit Card Bonuses

American Express Marriott Bonvoy Brilliant Card — Get 185,000 Marriott Bonvoy points after $6,000 in spend within the first six months of account opening. Offer here through October 2, 2024.

American Express Marriott Bonvoy Bevy Card — Get 155,000 Marriott Bonvoy points after $5,000 in spend within the first six months of account opening. Offer here through October 2, 2024.

Barclays jetBlue Plus Card (active) — Get 80,000 JetBlue points after $1,000 in spend within the first 90 days of account opening. Offer here.

Chase Ink Preferred (active) — Get 120,000 Ultimate Rewards bonus points when you spend $8,000 in the first three months after account opening. Offer here.

Capital One Venture (active) — Enjoy $250 on Capital One Travel in your first year and earn 75,000 bonus miles after spending $4,000 in the first 3 months. Offer here.

American Express Hilton Surpass Card (active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

Picture of the Week