Hello, YieldAlley readers! In this issue:

Stocks Stabilize After Volatile Week.

Practical DDRM Case Studies (Part 5 of DDRM Fundamentals).

Warren Buffett’s Apple stock dump was so big.

The best way to track and monitor the highest cash rates.

And more!

NEWS

Standout Stories

🏃♂️ How Olympic athletes make money (CNBC)

📉 How to Avoid Another Recession (NYT)

🍎 Warren Buffett’s Apple stock dump was so big (Fortune)

🏠 What Should You Do With Your 401(k) When You Retire? (WSJ)

📊 Market Turmoil Revives Age-Old Question: Should You Buy the Dip? (WSJ)

MARKET THOUGHTS

Stocks Stabilize After Volatile Week, Investors Eye Inflation Data and Fed Rate Cut Prospects

U.S. stocks ended a volatile week with slight gains, but market sentiment remains fragile.

The S&P 500 experienced its largest single-day drop since September 2022 on Monday.

This was followed by the best session since November 2022 on Thursday as recession fears eased.

Overall, markets narrowed their losses for the week to end mostly unchanged.

Investors are focused on upcoming economic data to reassess growth and inflation outlook.

Retail sales are expected to increase 0.5% monthly for the headline figure.

July CPI data is anticipated to show core inflation ticking down to 3.2% from 3.3% in June.

The decline in jobless claims has helped ease some recession concerns.

The Federal Reserve's monetary policy stance is evolving.

Markets are pricing in a more aggressive Fed easing cycle.

The 10-year Treasury yield fell below 4%.

Analysts now expect the Fed to cut rates two or possibly three times this year, up from the single cut projected in June.

Corporate earnings will provide insights into consumer health.

Several retailers, including Walmart, are scheduled to report earnings next week.

These reports will offer a glimpse into the state of consumer spending.

Despite recent market volatility, the fundamental economic backdrop remains favorable.

Inflation is moving closer to the Fed's target.

The economy continues to expand, albeit at a slowing pace.

Productivity is on the upswing, and corporate earnings are rising.

Analysts recommend using market pullbacks as opportunities to rebalance and diversify portfolios.

INCOME BUILDING

Practical DDRM Case Studies (Part 5 of DDRM Fundamentals)

Welcome to the fifth and final installment of our Dividend Drill Return Model (DDRM) Fundamentals series. In this article, we'll apply the DDRM to analyze four real-world dividend stocks from different sectors and dividend growth categories. These case studies will demonstrate how to use the DDRM in your dividend investment process.

Case Study 1: Johnson & Johnson (JNJ) - Healthcare, Dividend Aristocrat

Johnson & Johnson is a diversified healthcare company with a strong history of dividend growth. As a Dividend Aristocrat, it has increased its dividend for 61 consecutive years as of 2023.

DDRM Inputs (as of December 29, 2023):

Stock Price: $156.74

Dividend Rate: $4.76 annually

EPS (TTM): $6.65

Core Growth Rate: 6%

ROE: 25.5%

DDRM Outputs:

Cost of Growth/Share = (6% / 25.5%) * $6.65 = $1.57

Funding Gap = $6.65 - $4.76 - $1.57 = $0.32

Share Change = $0.32 / $156.74 = 0.2%

Dividend Growth = 6% + 0.2% = 6.2%

Total Return Estimate = (4.76 / 156.74) + 6.2% = 9.2%

The 6.2% projected dividend growth aligns with JNJ's 6% historical 5-year growth rate. The 9.2% total return estimate seems reasonable for a stable healthcare leader.

Case Study 2: Realty Income (O) - REIT, Monthly Dividend Company

Realty Income is a retail REIT known for its monthly dividend payments. Its REIT structure provides a strong incentive for consistent dividend growth.

DDRM Inputs (as of December 29, 2023):

Stock Price: $62.09

Dividend Rate: $3.06 annually

AFFO/Share: $3.95

Core Growth Rate: 4%

ROE: 5.5%

DDRM Outputs:

Cost of Growth/Share = (4% / 5.5%) * $3.95 = $2.87

Funding Gap = $3.95 - $3.06 - $2.87 = -$1.98

Share Change = -$1.98 / $62.09 = -3.2%

Dividend Growth = 4% - 3.2% = 0.8%

Total Return Estimate = (3.06 / 62.09) + 0.8% = 5.7%

The negative funding gap and share change reflect Realty Income's high payout ratio and capital-intensive business model. However, its REIT structure still supports modest 0.8% projected dividend growth. The 5.7% total return estimate is primarily from the 4.9% starting yield.

Case Study 3: Texas Instruments (TXN) - Technology, Dividend Grower

Texas Instruments is a semiconductor company that has consistently grown its dividend, though it lacks the lengthy growth streak of a Dividend Aristocrat.

DDRM Inputs (as of December 29, 2023):

Stock Price: $176.41

Dividend Rate: $5.12 annually

EPS (TTM): $8.74

Core Growth Rate: 8%

ROE: 57.8%

DDRM Outputs:

Cost of Growth/Share = (8% / 57.8%) * $8.74 = $1.21

Funding Gap = $8.74 - $5.12 - $1.21 = $2.41

Share Change = $2.41 / $176.41 = 1.4%

Dividend Growth = 8% + 1.4% = 9.4%

Total Return Estimate = (5.12 / 176.41) + 9.4% = 12.3%

TXN's high ROE allows it to fund brisk growth while still having excess earnings to buy back shares. This supports strong 9.4% projected dividend growth. The 12.3% total return estimate reflects TXN's combination of a decent 2.9% starting yield and attractive dividend growth prospects.

Case Study 4: AT&T (T) - Telecommunications, Turnaround Situation

AT&T is a telecommunications giant that has faced challenges in recent years. It cut its dividend in 2022 following the spin-off of Warner Media.

DDRM Inputs (as of December 29, 2023):

Stock Price: $16.50

Dividend Rate: $1.11 annually

EPS (TTM, adjusted): $2.57

Core Growth Rate: 1%

ROE: 10.3%

DDRM Outputs:

Cost of Growth/Share = (1% / 10.3%) * $2.57 = $0.25

Funding Gap = $2.57 - $1.11 - $0.25 = $1.21

Share Change = $1.21 / $16.50 = 7.3% (assuming buybacks, but more likely used for deleveraging)

Dividend Growth = 1% + 0% (assuming no buybacks) = 1%

Total Return Estimate = (1.11 / 16.50) + 1% = 7.7%

AT&T's low core growth estimate and ROE reflect its mature, capital-intensive business. The 1% dividend growth projection assumes the funding gap is used for debt reduction rather than buybacks. The 7.7% total return estimate is mostly from the high 6.7% starting yield, as dividend growth is expected to just keep pace with inflation. This example shows how the DDRM can flag potential dividend growth challenges.

Key Takeaways

The DDRM provides a structured framework to analyze a stock's dividend growth potential and estimate total returns. However, it's important to interpret the results in the context of the company's business model, industry dynamics, and dividend policy.

Stocks with long dividend growth streaks (like JNJ) tend to have more reliable dividend growth projections, as management is incentivized to maintain the streak.

REITs and other pass-through entities (like O) often have high yields but lower growth prospects due to their mandatory high payout ratios and capital-intensive businesses.

Companies with high ROEs (like TXN) can often support strong dividend growth while still reinvesting for growth and repurchasing shares.

The DDRM can also identify potential dividend growth challenges, such as AT&T's high payout ratio, low growth prospects, and competing capital allocation priorities.

Always consider multiple scenarios with conservative and optimistic inputs to stress-test your dividend growth projections.

We hope this DDRM Fundamentals series has equipped you with a powerful tool to analyze dividend stocks and make more informed investment decisions. Keep an eye out for future dividend investing content!

INCOME BUILDING

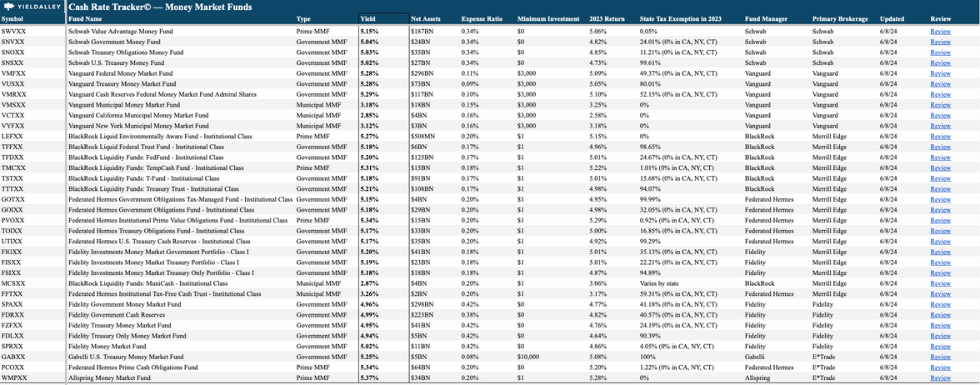

Cash Rates

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 5.02%

SPAXX (Fidelity Government Money Market Fund): 4.98%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 5.19%

VMFXX (Federal Money Market Fund): 5.26%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 4.70%

E*Trade: —

Fidelity: 4.65%

Merrill Edge and Merrill Lynch: —

Vanguard: 4.80%

ETFs

SGOV (iShares 0-3 Month Treasury Bond ETF): 5.25%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 5.19%

USFR (WisdomTree Floating Rate Treasury Fund): 5.32%

TFLO (iShares Treasury Floating Rate Bond ETF): 5.32%

Want To Track the Highest Cash Yields?

Refer just one person to the YieldAlley newsletter for instant access to the YieldAlley Cash Rate Tracker©.

This simple spreadsheet lets you easily compare and track the best cash rates and investments.

Get all the details on the best money market funds and ETFs in a single spreadsheet.

BONUSES

Brokerage, Bank and Credit Card Bonuses

Brokerage Bonuses

E*Trade (still active): Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Bank Bonuses

U.S. Bank (active) — Earn up to a $450 bonus when you open a new Smartly checking account when you use promo code 2024JUL. Offer here.

Availability: Nationwide

Soft credit inquiry.

Axos Bank (active) — $500 when you open a new rewards checking account with promo code RC500 and certain requirements. Offer here.

Availability: Nationwide

Soft credit inquiry.

Credit Card Bonuses

Barclays jetBlue Plus Card (new) — Get 80,000 JetBlue points after $1,000 in spend within the first 90 days of account opening. Offer here.

Chase Ink Preferred (active) — Get 120,000 Ultimate Rewards bonus points when you spend $8,000 in the first three months after account opening. Offer here.

Capital One Venture (active) — Enjoy $250 on Capital One Travel in your first year and earn 75,000 bonus miles after spending $4,000 in the first 3 months. Offer here.

American Express Hilton Surpass Card (active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

Picture of the Week