Hello, YieldAlley readers! In this issue:

Post-Election Dividend Income Strategies In a Shifting Market

U.S. Stocks Post Best Weekly Gain in a Year as Markets Rally on Election Results and Fed Rate Cut

What Trump 2.0 means for the Magnificent 7

And more!

NEWS

Standout Stories

🧠 Meet the Bogleheads (Elm Wealth)

🎰 Was the Polymarket Trump whale smart or lucky? (FT)

🏇 What Trump 2.0 means for the Magnificent 7 (Sherwood)

🧾 Vanguard to pay $40 million to mutual fund investors stuck with big tax bills (Reuters)

🏖️ 401(k) limit increases to $23,500 for 2025, IRA limit remains $7,000 (IRS)

MARKET THOUGHTS

U.S. Stocks Post Best Weekly Gain in a Year as Markets Rally on Election Results and Fed Rate Cut

U.S. stocks finished with strong weekly gains and near milestone levels:

S&P 500 approached 6,000, rising 4.66% for the week.

Nasdaq posted strongest gains, up 5.74% for the week, reflecting tech sector strength.

All 11 S&P sectors recorded weekly gains, signaling broad-based market confidence.

Consumer discretionary and energy sectors led advances, boosted by expectations of economic growth under new Republican leadership.

Federal Reserve delivered anticipated rate cut with clear forward guidance:

Cut rates by 0.25% to 4.5%-4.75% range, marking second cut of the cycle.

Indicated more cuts ahead but at measured pace, balancing growth with inflation concerns.

Long-term rate expected in 3.5% to 4.0% range, suggesting significant easing still ahead.

Fed's positive economic outlook boosted market confidence.

Bond market movements showed mixed signals about economic outlook:

2-year Treasury yield rose to 4.25%, reflecting near-term Fed expectations.

10-year Treasury yield fell to 4.31%, suggesting longer-term growth moderation.

Short-term yields gained against long-term ones, indicating market focus on Fed's next moves.

Market sentiment improved significantly as uncertainties cleared:

Consumer sentiment reached seven-month high, supporting retail sector outlook.

Election uncertainty dissipated, allowing investors to focus on fundamentals.

Key upcoming events could influence Fed's December decision:

October CPI expected at 0.2% monthly growth, crucial for rate cut path.

Core CPI forecast at 0.3% monthly, still above Fed's target.

Retail sales data due next Friday will show consumer strength heading into holidays.

Markets open Monday despite Veterans Day, allowing continuous trading momentum.

Global developments add complexity to market outlook:

China's budget meeting ended without major stimulus announcements, disappointing investors.

Chinese markets closed lower Friday but up for the week, showing mixed reaction to policy decisions.

INCOME BUILDING

Post-Election Dividend Income Strategies In a Shifting Market

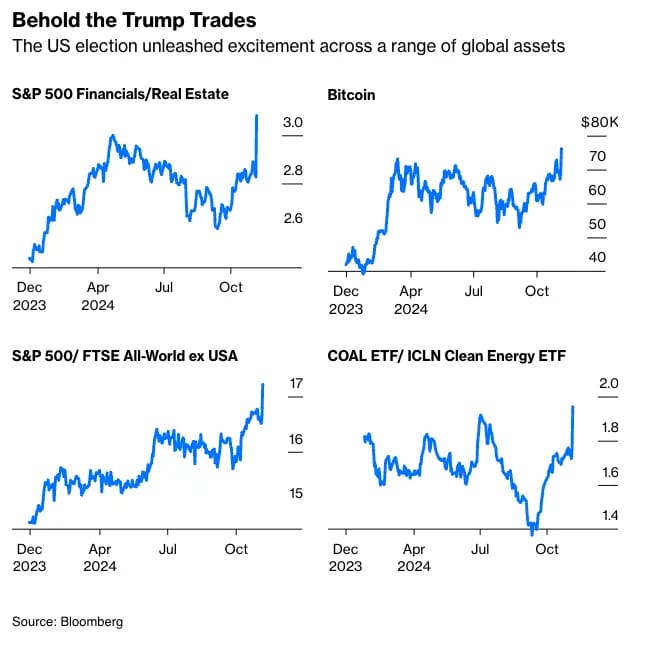

The 2024 post-election market response has created distinct winners and losers across sectors, reminiscent of the 2016 election aftermath. According to Bloomberg's John Authers, the market response translated into one of the strongest post-election trading days in history, with transportation and energy stocks emerging as primary beneficiaries, posting gains between 3.1% and 11.2% in the day following the election.

The transportation sector, particularly companies like Old Dominion Freight Line, Union Pacific, and Norfolk Southern, rallied on expectations of strengthened domestic industrial activity. Cross-border operators face increased scrutiny, with Canadian Pacific Kansas City's 20% revenue exposure to Mexico-related shipments making it particularly sensitive to trade policy developments. The company's unique position operating more than 30 ports and over 200 transload facilities across North America illustrates the complex interplay between infrastructure assets and political risk.

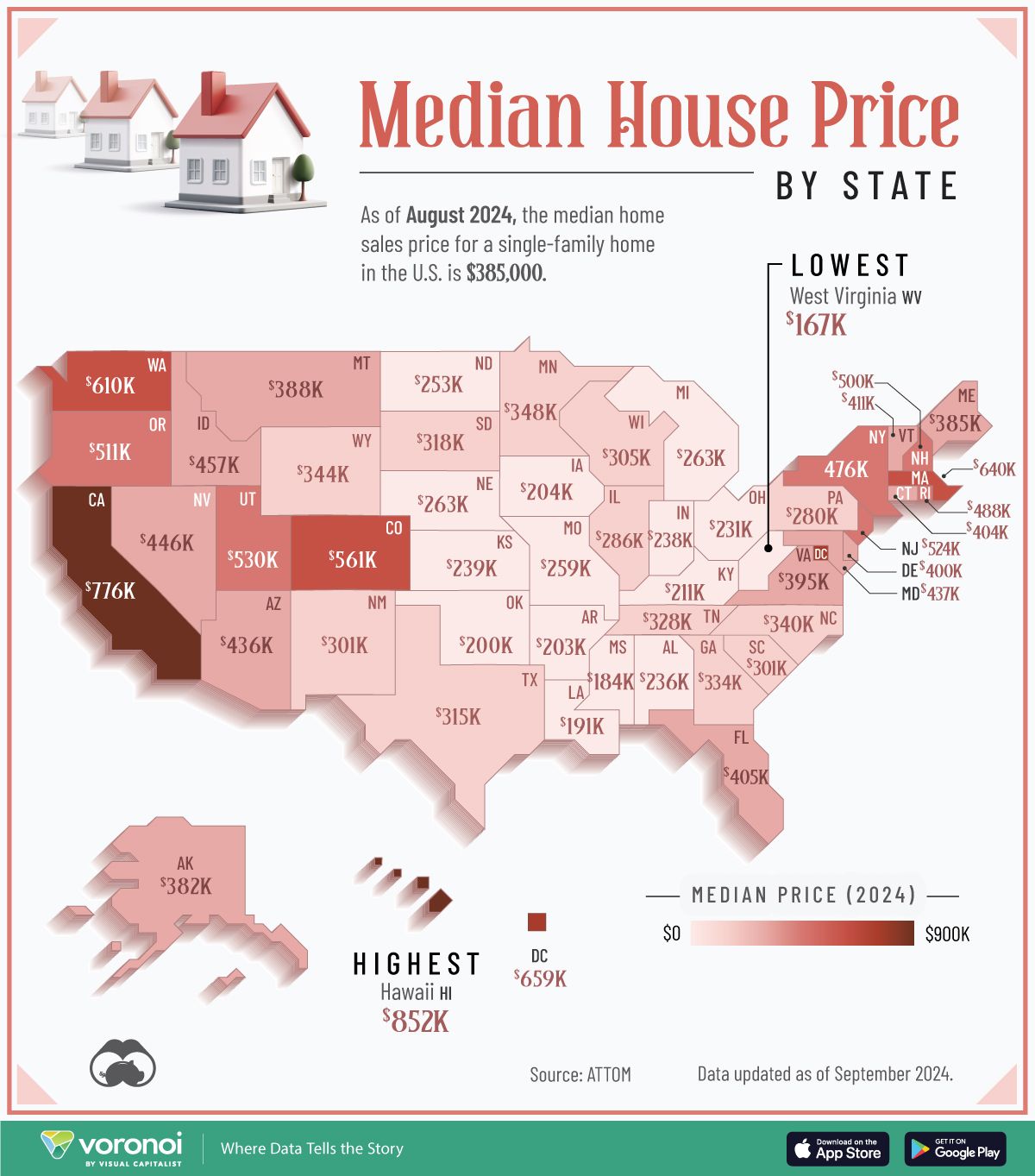

Real Estate Investment Trusts faced immediate pressure as investors priced in expectations of sustained higher interest rates and potential inflation from anticipated deficit spending. Despite these pressures, some REITs now offer compelling yields above 5.5%. Stock exchange operators present another interesting dynamic, with CME Group projecting a 4.5% annualized dividend yield including special dividends, while both Intercontinental Exchange and Cboe Global Markets have shown resilience despite market volatility.

Perhaps most significantly, 2024 has witnessed a transformation in the dividend landscape beyond traditional sector movements. Tech giants Meta and Alphabet initiated their first-ever dividends, with Meta announcing a quarterly dividend of $0.50 on February 1, and Alphabet following suit on April 25. These moves coincide with dramatic monetary policy shifts, as the Federal Reserve implemented its first rate cut in four years with a 50-basis-point reduction in September, while inflation declined from over 9% in 2022 to 2.4% in October 2024.

The market has responded to this evolving environment with new risk management tools. The S&P 500 Annual Dividend Index futures options, launched January 29, 2024, saw trading volume surge to a record 12,000 contracts on April 18, reflecting heightened institutional focus on dividend risk management.

For income-focused investors, these developments suggest several strategic considerations. The expansion of dividend-paying companies beyond traditional sectors creates new diversification opportunities, while rate-sensitive sectors may present value opportunities despite near-term pressures. Companies with significant cross-border operations require particular scrutiny given potential trade policy shifts. The market's message is clear: successful dividend investing in this environment requires looking beyond traditional high-yield sectors toward companies with strong balance sheets and sustainable payout ratios.

As both Meta and Alphabet have demonstrated, the dividend landscape continues to evolve. Lower borrowing costs typically support dividend sustainability, particularly for small-cap companies reliant on bank financing, but may also signal economic weakness that could pressure corporate revenues. In this environment, investors must balance the appeal of higher yields against fundamental business quality and capital allocation priorities, as companies increasingly weigh dividends against stock buybacks and other uses of capital.

INCOME BUILDING

Cash Rates

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 4.54%

SPAXX (Fidelity Government Money Market Fund): 4.47%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 4.57%

VMFXX (Federal Money Market Fund): 4.69%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 4.45%

E*Trade: 4.35%

Fidelity: 4.40%

Merrill Edge and Merrill Lynch: —

Vanguard: 4.40%

ETFs

SGOV (iShares 0-3 Month Treasury Bond ETF): 4.83%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 4.59%

USFR (WisdomTree Floating Rate Treasury Fund): 4.67%

TFLO (iShares Treasury Floating Rate Bond ETF): 4.69%

BONUSES

Brokerage, Bank and Credit Card Bonuses

Brokerage Bonuses

E*Trade (still active): Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Bank Bonuses

BMO Harris (active) — Earn up to a $560 bonus when you open a new Smart Advantage or BMO Harris Premier checking account. Offer here.

Availability: Nationwide

Soft credit inquiry

Credit Card Bonuses

Chase Ink Preferred (active) — Get 120,000 Ultimate Rewards bonus points when you spend $8,000 in the first three months after account opening. Offer here.

American Express Hilton Surpass Card (active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

Picture of the Week