Hello, YieldAlley readers! In this issue:

The ECB cuts rates for the first time since 2019.

Warren Buffett’s Berkshire owns 3% of all existing Treasury bills.

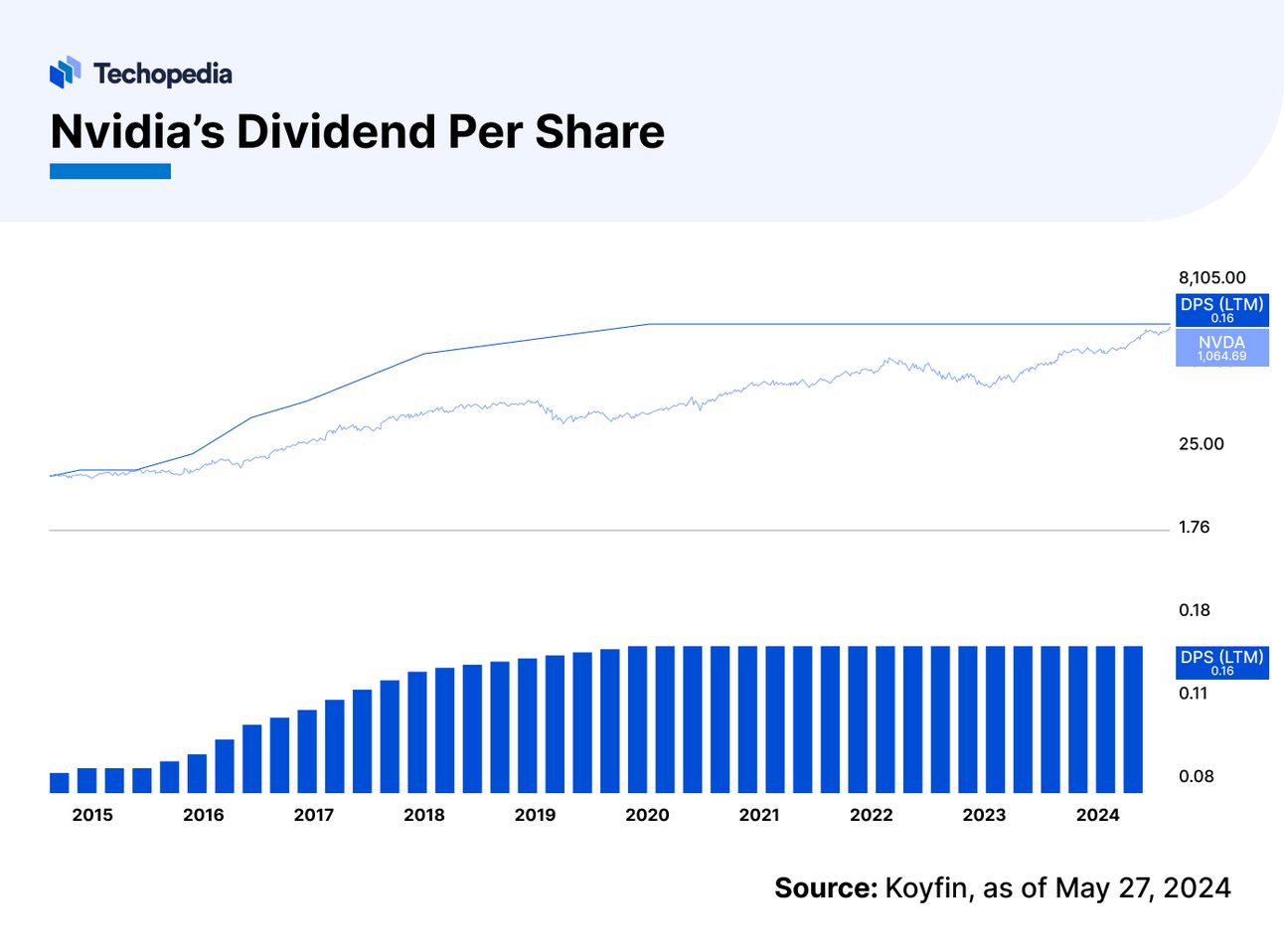

Why Nvidia’s 150% dividend increase doesn’t matter.

Top performing dividend stocks in May 2024.

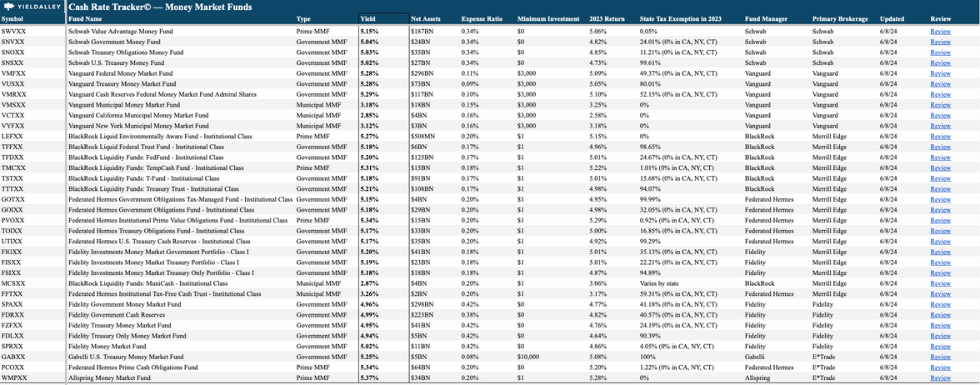

The easiest way to compare money market fund rates.

And more!

Fixed Income and Cash Income

The ECB Has Now Cut Rates, In Stark Contrast with the U.S. Fed’s Policy

The European Central Bank (ECB) cut interest rates for the first time since 2019. The benchmark deposit rate was lowered to 3.75% from 4%. This move widens the policy gap with the Federal Reserve, which isn't expected to cut rates soon. ECB President Christine Lagarde indicated that future rate decisions will depend on economic data, highlighting persistent inflationary pressures despite recent rate hikes. The rate cut signals potential relief for households and businesses in Europe, contrasting with the robust U.S. economy where growth remains strong. Market expectations suggest further rate cuts from the ECB, Fed, and Bank of England by year-end.

💵 Berkshire Hathaway now owns 3% of the entire Treasury bill market. The company holds $158 billion in T-bills as of March 2024. This aggressive purchase strategy is driven by higher short-term rates, with Berkshire benefiting from its substantial cash reserves, which totalled $189 billion. Warren Buffett's conglomerate buys 3 and 6-month T-bills weekly, sometimes in increments of $10 billion. Buffett finds cash more attractive than other assets, especially stocks, amid the current economic conditions. The Federal Reserve's interest rate hikes since March 2022 have made short-term Treasurys appealing, significantly enhancing Berkshire's returns from its cash holdings.

💰 US money-market fund assets rose for the seventh consecutive week, with $23 billion in inflows bringing the total to $6.09 trillion as of June 5, the highest since early April. Retail and institutional investors continue to favor money funds, anticipating elevated short-term rates as the Federal Reserve maintains its tight monetary policy. Government fund assets increased by $16.4 billion to $4.92 trillion, while prime funds grew by $5.3 billion to $1.04 trillion. Government money market funds are one of the best cash alternatives, especially in a brokerage account with a money market fund sweep. Fed officials signal that interest rates will remain high due to slow cooling inflation, with potential rate cuts not expected until November.

All brokerage cash guides and playbooks can be found on YieldAlley.com.

Dividend Income

Nvidia’s 150% Dividend Increase Isn’t That Meaningful

🧠 How to think about Nvidia’s dividend increase. Two weeks ago, Nvidia announced a 150% dividend increase, raising its yield from 0.02% to 0.03%, with an annual payout of 4 cents per share. Despite this and a 10-for-1 stock split effective June 7, Nvidia's yield remains minimal compared to Alphabet and Meta Platforms. Nvidia's stock price growth has reduced its yield from over 2% in 2012 to current levels. The company's exceptional performance in AI accelerator chip demand is driving its bullish outlook for 2025. Despite China restrictions, strong relationships with Meta Platforms, Tesla, and cloud providers boost confidence. Nvidia's data center revenue, projected to grow 133% in fiscal year 2025, underscores its financial strength with $31.4 billion in cash and significant growth potential in AI and data center markets. But for dividend investors, Nvidia's dividend is virtually immaterial relative to its financial health and forward prospects. The primary driver of shareholder returns has come from stock buybacks and capital gains. Instead of dividends, these factors will likely be the ongoing focus for Nvidia shareholders for the foreseeable future.

📊 Here is our monthly recap on the Top 5 Performing U.S. Dividend Stocks in May 2024:

New York Community Bank (NYCB): Regional bank with a focus on real estate lending. Rose 24.2% in May but lost 64.2% over the past 12 months. Trading at $3.29 per share, its stock has a forward dividend yield of 1.22% and pays an annual dividend of $0.04 per share.

Lincoln Financial Group (LNC): Life insurance company providing retirement and financial planning services. Rose 21.0% in May and gained 66.3% over the past 12 months. At $32.99 per share, its stock has a forward dividend yield of 5.46% and an annual dividend of $1.80 per share.

Best Buy (BBY): Leading consumer electronics retailer with global operations. Gained 15.2% in May and rose 21.8% over the past 12 months. The stock’s $84.82 price gives it a forward dividend yield of 4.43%, with an annual dividend of $3.76 per share.

International Flavors & Fragrances (IFF): Specialty chemicals and consumer products manufacturer. Rose 13.6% in May and gained 28.1% over the past 12 months. Trading at $96.18 per share, it has a forward dividend yield of 1.66% and an annual dividend of $1.60 per share.

Pfizer (PFE): Major pharmaceutical company known for innovative drug development. Gained 13.5% in May but fell 20.3% over the past 12 months. Trading at $28.66 per share, its forward dividend yield is 5.86%, with an annual dividend of $1.68 per share.

Opportunities

Brokerage Bonuses

Brokerages can offer very generous bonuses for deposits. We recommend taking advantage of these bonuses, which can help you earn up to 7% APY on your cash. Brokerages are the best way for most people to purchase the investments we discuss. As always, we highly recommend reading the fine print with these offers. We earn no money from these offers.

E*Trade (still active): Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Opportunities

Bank Bonuses

While we recommend passive savers and investors consider brokered CDs, money market funds, or floating rate ETFs instead, some people may want to take advantage of bank bonuses and promotional rates. As always, we highly recommend reading the fine print with these offers. We earn no money from these offers.

Bank Bonuses

Eastern Bank (still active) — $350 when you open a new checking account with a direct deposit of $4,000 or more. Offer here.

Availability: MA, NH, ME, or RI

Soft credit inquiry.

Discover Savings Account (still active) — With your first Discover Savings account, earn a $150 bonus with a $15,000 deposit, or a $200 bonus with a $25,000 deposit. Use offer code GOBP623. Offer here.

Availability: Nationwide

Soft credit inquiry.

USC Credit Union (still active) — $250 bonus when you open a new checking account and set up direct deposit with a $1,000 minimum direct deposit every 30 days for the first 90 days of checking account AND make a minimum of ten (10) debit transactions every 30 days for the first 90 days of checking account opening. Use promo code SPRING24. Offer here.

Availability: CA.

Soft credit inquiry.

Opportunities

Credit Card Bonuses and Offers

Credit card signup bonuses are one of the easiest ways to earn extra income, as long as you are vigilant in managing payments, your credit score, and claiming bonuses. We know some of our readers are interested in the latest credit deals. As always, we highly recommend reading the fine print with these offers. We earn no money from these offers. The offers below show the best current offer at this time.

American Express Hilton Surpass Card (still active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

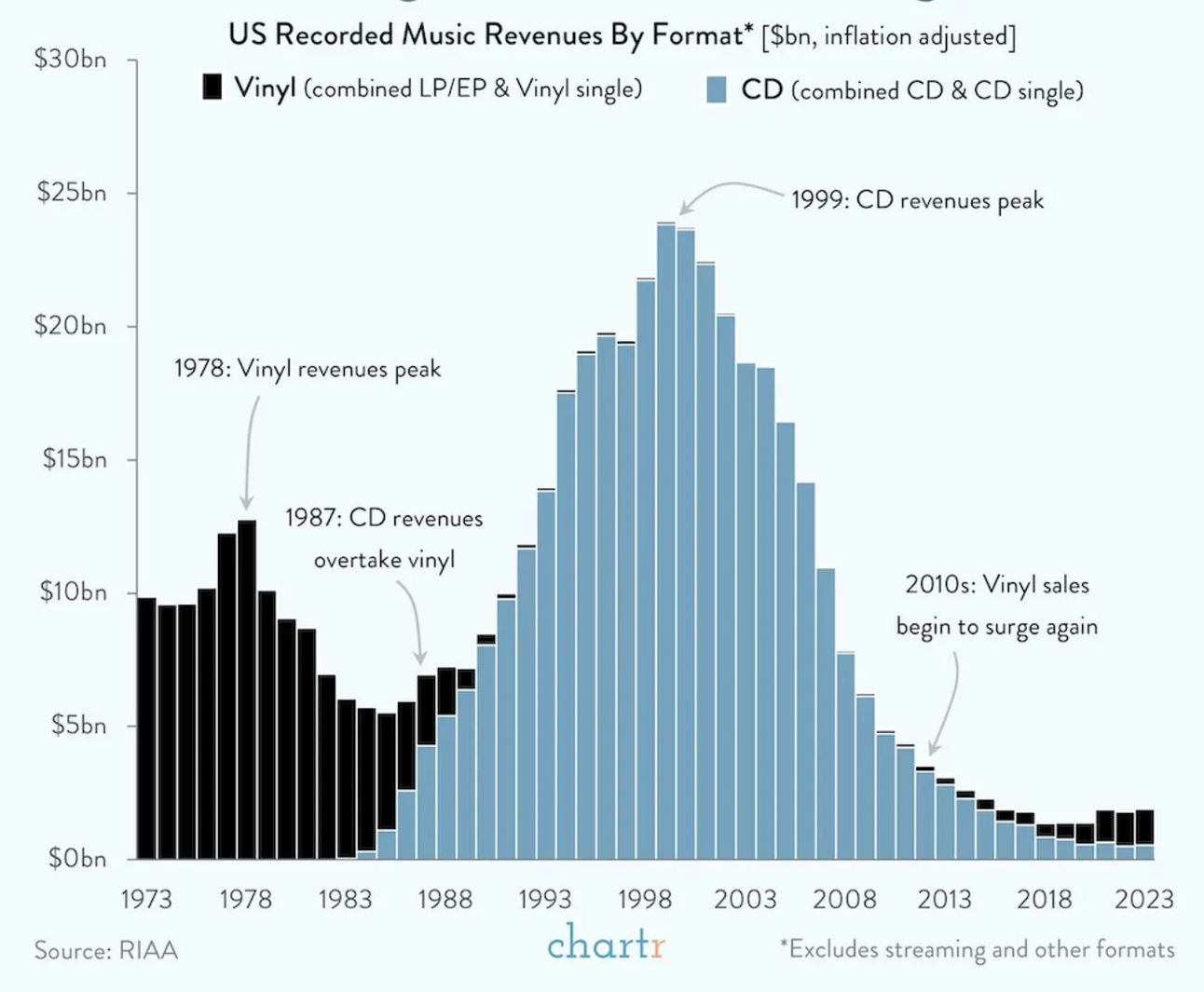

Picture of the Week

Vinyls are outselling CDs!

What We’re Reading

Is maximizing credit card rewards worth it? (Of Dollars and Data)

RoaringKitty of GameStop meme stock fame is back. (New York Times)

An inside look into OpenAI’s Sam Altman investment portfolio (worth $2.8bn). (WSJ)

The largest Ponzi scheme in Hollywood history. (New Yorker)

Working at Enron a year before its collapse. (Giuseppe Paleologo)

Get Access to the Free Cash Rate Tracker!

With the YieldAlley Cash Rate Tracker©, you can now easily compare and track the latest money market fund and cash rates across brokerages. Get instant access to the spreadsheet by forwarding the YieldAlley newsletter to one person!