Hello, YieldAlley readers! In this issue:

Municipal Bonds Can Offer Triple-Tax-Free Income for Smart Investors

Tech Shares Advance While Treasury Yields Continue Their October Climb

20 Rules for Markets and Investing

And more!

NEWS

Standout Stories

🐂 Defining Bull and Bear Markets (A Wealth of Common Sense)

📕 20 Rules for Markets and Investing (Bilello)

🇺🇳 Why countries are seeking to build “sovereign AI” (Sherwood)

🇺🇸 Americans are feeling better about the economy after the Fed’s jumbo rate cut (CNN)

📈 Vanguard High Dividend Yield ETF Is One of Morningstar’s Favorites (Morningstar)

MARKET THOUGHTS

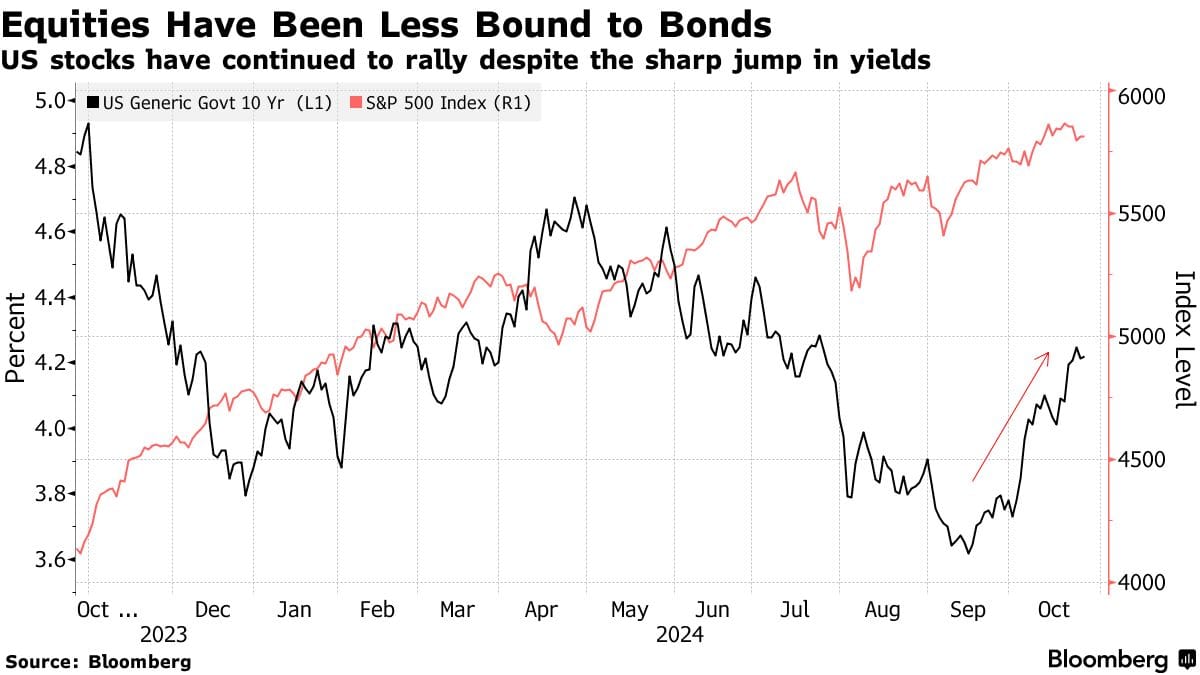

Tech Shares Advance While Treasury Yields Continue Their October Climb

U.S. stocks showed mixed performance on Friday:

Tech and consumer discretionary stocks led gains.

The broader S&P 500 moved modestly lower.

Cyclical sectors, including financials and utilities, lagged.

Bond yields continue to climb:

10-year Treasury yield rose 0.04% to 4.24%.

Yields are significantly above their September low of 3.61%.

Rising yields reflect stronger-than-expected economic data.

Q3 earnings season shows mixed results:

36% of S&P 500 companies have reported.

74% have beaten expectations, in line with 10-year average.

Earnings growth tracking at 3.4% year-over-year, below initial 4.1% forecast.

Financials, utilities, and consumer discretionary showing strongest upside surprises.

Housing market shows divergent trends:

Existing home sales declined 1.0% in September to lowest pace since 2010.

New home sales jumped 4.1%, exceeding expectations.

Median home prices up 3.0% year-over-year.

Housing inventory remains 25% below pre-pandemic levels.

Looking ahead to key economic data:

October jobs report expected to show 100,000 jobs added, down from 223,000.

Unemployment rate forecast to hold steady at 4.1%.

Average hourly earnings expected to moderate to 0.3% month-over-month.

Major tech companies (Apple, Microsoft, Alphabet, Amazon) report earnings next week.

INCOME BUILDING

Municipal Bonds Can Offer Triple-Tax-Free Income for Smart Investors

We've covered several key players in the fixed income market: U.S. Treasuries, the bedrock of safety; agency bonds, which offer modest yield premiums with government backing; and investment-grade corporate bonds, providing higher yields for those willing to accept corporate credit risk.

Now, let's explore municipal bonds (or "munis"), which occupy a unique position in the fixed income landscape thanks to their tax advantages.

Municipal bonds are debt securities issued by states, cities, counties, and other government entities below the federal level. These bonds finance essential public projects like highways, schools, hospitals, and other infrastructure developments. The municipal bond market represents a substantial portion of the U.S. fixed income universe, with three states - California, New York, and Texas - consistently accounting for the largest share of issuance.

In the credit risk spectrum, U.S. Treasuries remain the risk-free benchmark, backed by the federal government's full faith and credit. Agency bonds follow closely behind, with entities like Ginnie Mae enjoying explicit federal backing, while Fannie Mae and Freddie Mac benefit from implicit government support. Municipal bonds come next in the safety hierarchy, followed by investment-grade corporate bonds.

The yield relationship between these securities reflects their risk levels. While Treasuries set the baseline yield, agency bonds typically offer a modest premium. Corporate bonds push yields higher to compensate for credit risk. Municipal bonds present an intriguing case - their nominal yields often appear lower than their taxable counterparts, but their tax-equivalent yields can outperform all these options for investors in higher tax brackets.

Types of Municipal Bonds

Municipal bonds come in two primary varieties, each with distinct characteristics and risk profiles. General Obligation (GO) bonds represent about 30% of the investment-grade muni market and are backed by the full taxing power of the issuing state, city, or county. When investors purchase GO bonds, they're essentially relying on the issuer's ability to levy and collect taxes to meet their obligations. Think of GO bonds as similar to Treasuries, but at the state or local level - they're backed by the government's ability to tax.

Revenue bonds make up the remaining approximately 70% of the investment-grade muni market. These bonds operate differently, backed by revenues from specific projects or sources - imagine a toll road where the collected tolls pay bond investors, or a municipal water system where utility bills service the debt. The success of the specific project directly affects the bond's performance, which is why revenue bonds typically offer higher yields than GO bonds. This structure makes them more similar to corporate bonds, where the business's success determines the bond's performance.

Credit Risk and Safety Considerations

While municipal bonds have historically demonstrated lower default rates than corporate bonds, they don't offer the same level of safety as Treasuries. Notable examples like Detroit's 2013 bankruptcy serve as reminders that municipal defaults, while rare, can occur. However, these cases stand out precisely because they're exceptional — the overall municipal bond market has maintained remarkably low default rates over time.

The Tax Advantage Edge

The defining feature of municipal bonds is their tax treatment. While corporate bonds face full taxation and Treasury interest faces federal taxation, municipal bond interest is exempt from federal taxes. For residents of the issuing state, these bonds often escape state and local taxes as well. This "triple-tax-free" status can make municipal bonds particularly powerful for investors in higher tax brackets.

To understand the impact, consider this: a municipal bond yielding seemingly modest returns might actually outperform higher-yielding corporate bonds or Treasuries on an after-tax basis for investors in top tax brackets. This is why comparing municipal bond yields to other bonds requires calculating their tax-equivalent yield - the taxable yield an investor would need to earn to match the municipal bond's tax-free return.

Who Should Consider Municipal Bonds?

Municipal bonds tend to work best for investors who meet several criteria. First, they should be in higher tax brackets where the tax exemption provides meaningful value. Second, they typically should be planning to hold these bonds in taxable accounts, as the tax advantage is redundant in retirement accounts. Third, they should be comfortable with slightly lower liquidity compared to Treasuries or large corporate bonds.

Think of municipal bonds as a tax-efficient tool rather than just another bond option. They work best as part of a broader fixed-income strategy, complementing rather than replacing other bond types. For instance, an investor might hold Treasuries for maximum safety, corporate bonds for yield, and municipal bonds for tax-efficient income.

What's Your Take?

Having explored the major categories of investment-grade bonds, from Treasuries to municipal bonds, we're curious about your fixed income strategy. How do you balance the pure safety of Treasuries, the modest yield bump of agency bonds, the higher yields of corporate bonds, and the tax advantages of municipal bonds?

Share your insights—we're eager to learn how you're building your fixed income portfolio.

INCOME BUILDING

Cash Rates

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 4.54%

SPAXX (Fidelity Government Money Market Fund): 4.49%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 4.768

VMFXX (Federal Money Market Fund): 4.76%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 4.40%

E*Trade: 4.35%

Fidelity: 4.45%

Merrill Edge and Merrill Lynch: —

Vanguard: 4.35%

ETFs

SGOV (iShares 0-3 Month Treasury Bond ETF): 4.89%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 4.68%

USFR (WisdomTree Floating Rate Treasury Fund): 4.69%

TFLO (iShares Treasury Floating Rate Bond ETF): 4.71%

BONUSES

Brokerage, Bank and Credit Card Bonuses

Brokerage Bonuses

E*Trade (still active): Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Bank Bonuses

BMO Harris (active) — Earn up to a $560 bonus when you open a new Smart Advantage or BMO Harris Premier checking account. Offer here.

Availability: Nationwide

Soft credit inquiry

Credit Card Bonuses

Chase Ink Preferred (active) — Get 120,000 Ultimate Rewards bonus points when you spend $8,000 in the first three months after account opening. Offer here.

American Express Hilton Surpass Card (active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

Picture of the Week