Happy New Year, YieldAlley readers! This year, our resolution is to continue to share strategies and learnings for you to maximize your cash returns. For more sophisticated and advanced investors, we’ll also be sharing more advanced income investing techniques to create a portfolio that earns you income with little volatility.

In this week’s newsletter:

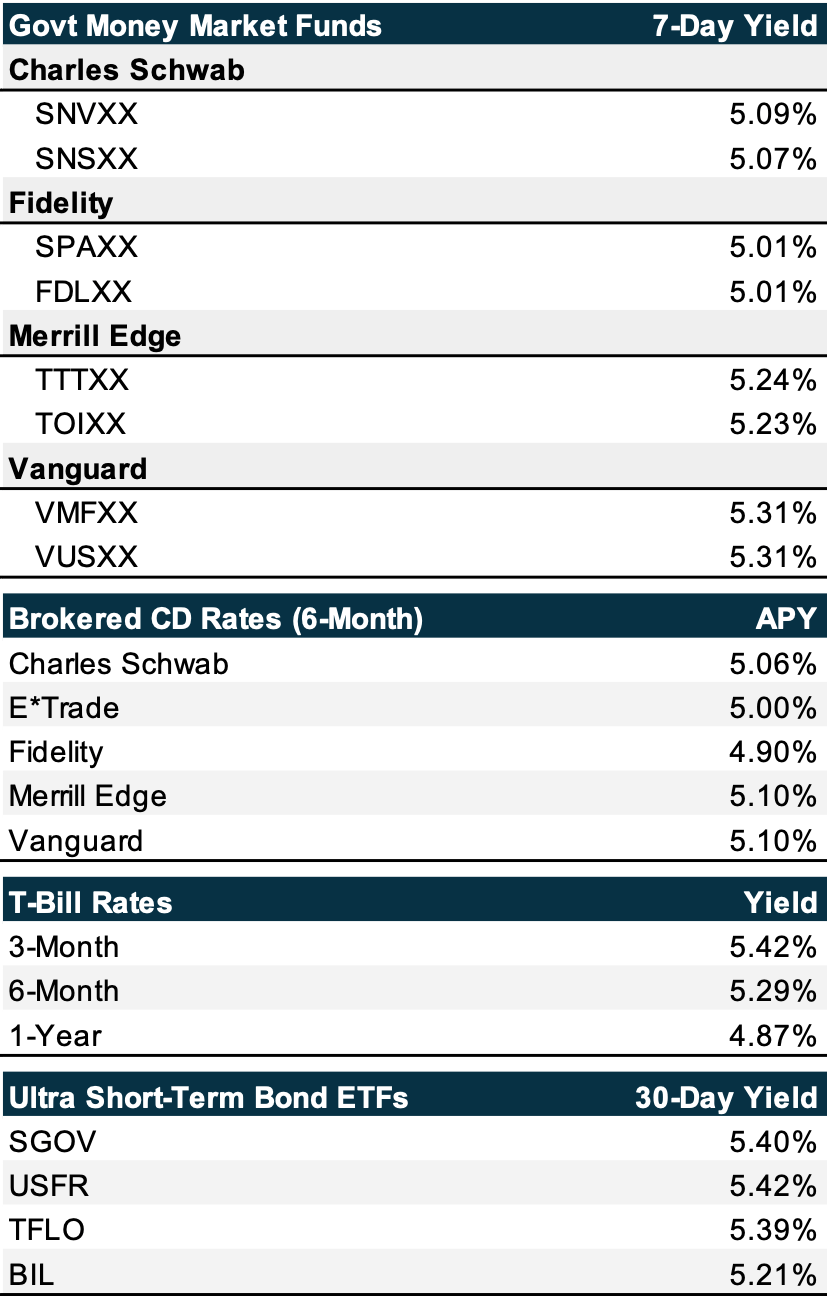

Rates roundup for money market funds, brokered CDs, Treasury bills, and ultra short-term bond ETFs.

Earn yields of over 5% on cash with the lowest-hanging and easiest yield opportunity in the market.

Elsewhere: Bond ETFs Are Growing in Popularity, Have We Achieved The Mythical Soft Landing?

As of January 5, 2024

Government money market fund rates continue to hover around the 5% range, with Vanguard consistently providing higher yields than its peers. On the other hand, 6-month brokered CD rates have fallen considerably in the past month. They now offer around 5.00% from 5.50% just a few weeks ago. This mirrors the trend in interest rates, as seen in the decline in the 6-month T-Bill rate. Meanwhile, we believe that ultra short-term bond ETFs continue to offer the best combination of liquidity and yield.

To learn more about the minimum investments for each investment and brokerage-specific features such as sweeps and instant settlement, read our cash guides on Fidelity, Charles Schwab, and Vanguard.

Taking Advantage of Low-Hanging Yield

As we begin the new year, we want to reiterate that you should always be earning income on your cash. Americans have stashed roughly $11 trillion in our bank savings accounts, which earn a measly 0.01% interest rate. At the same time, the banks pocket most of the interest income earned off our deposits.

Luckily, we can bypass the banks altogether and earn this interest income ourselves by holding cash-like investments. The easiest way to get started is to use a brokerage to buy money market funds, brokered CDs, T-Bills, and ultra short-term bond ETFs. These are considered the safest investments in the world since we can easily sell them and get our original investment back.

We have written about brokerage-specific strategies to take advantage of these cash-like investments. The most popular brokerages include Fidelity, Charles Schwab, and Vanguard. It’s worth comparing which platform is best for you as they’re all different.

In 2024, we’ll likely experience a changing interest rate environment. Most investors are expecting the Fed to cut rates. But there will always be opportunities to earn income on your cash regardless of the market environment, which we’ll keep you apprised of. Regardless, we highly recommend reading these guides and getting used to your arsenal of tools.

Elsewhere

Bond ETFs Are Growing In Popularity

In October 2023, Schwab published a report that millennials have been embracing bond ETFs more than other generations. Two days ago, BlackRock announced that a record $300 billion flowed into its bond ETFs in 2023, and that it expects its bond ETFs to grow to $6 trillion in assets under management from $2 trillion today.

We certainly see a very pronounced trend in a shift towards income investing through bond ETFs, which we also commonly recommend. SGOV and TFLO are BlackRock ultra short-term Treasury bond ETFs, and launched in 2020 and 2014 respectively. As relatively newer products, there was a conscious effort to make these ETFs have increased benefits over traditional mutual funds, including trading throughout the day and lower fees (read: better liquidity and higher yields).

Have We Achieved The Mythical Soft Landing?

Janet Yellen, the U.S. Treasury Security, has declared that the U.S. economy has achieved a soft landing. A soft landing refers to lowering inflation without damaging the labor market. In the past 80 years, the Federal Reserve has never achieved this feat.

Yellen announced this after the December jobs report which exceeded expectations. Inflation for 2023 is expected at 3.2% while wages rose 4.1%, which means wages exceeded price growth in 2023.

If you enjoyed this newsletter, you can subscribe here.