Hello, YieldAlley readers! In this issue:

Weak jobs report sparks market selloff.

Interpreting DDRM Results (Part 4 of DDRM Fundamentals).

Meta bids millions for celebrity voices in AI.

The best way to track and monitor the highest cash rates.

And more!

NEWS

Standout Stories

🤖 Hedge fund Elliott warns AI trades like Nvidia are in ‘bubble land’s (Fortune)

💰 Berkshire’s mounting cash pile could top $200 billion as Buffett continues selling stock (CNBC)

🤑 Meta bids millions for celebrity voices in AI race (Fortune)

🏠 Mortgage rates plunge to the lowest level in more than a year after weak employment report (CNBC)

📊 Changes in Retirement Savings Rules to Know Before Year’s End (WSJ)

MARKET THOUGHTS

Weak Jobs Report Sparks Market Selloff, Fuels Fed Rate Cut Expectations

U.S. stock markets closed sharply lower following weaker-than-expected jobs data, stoking economic growth concerns.

Nonfarm payrolls increased by only 114,000 in July, well below the expected 175,000.

The unemployment rate rose to 4.3%, the highest level since 2021.

The Nasdaq Composite entered correction territory, down 10% from its July 10 peak.

The VIX "fear gauge" jumped over 25% to its highest level since March 2023.

Bond markets rallied as investors sought safety, pushing yields lower.

The 10-year Treasury yield fell to 3.79%, the lowest since December 2022.

Futures markets are now pricing in a 70% chance of a 0.5% rate cut in September.

Investors expect a total of 1.25% in rate cuts before year-end.

Corporate earnings season is showing mixed results with some notable disappointments.

78% of reporting S&P 500 companies have beaten expectations so far.

Overall S&P 500 earnings are expected to grow by about 10% for Q2.

However, tech giants like Amazon and Intel provided cautious guidance, impacting their stock prices negatively.

Market sentiment has shifted from inflation concerns to recession fears.

Consumer discretionary stocks were hit hard on spending slowdown worries.

Defensive sectors like consumer staples performed better, reflecting a "risk-off" environment.

Small-cap stocks were under significant pressure, with the Russell 2000 losing 6% for the week.

INCOME BUILDING

Interpreting DDRM Results (Part 4 of DDRM Fundamentals)

Welcome to the fourth installment of our series on the Dividend Drill Return Model (DDRM). In this article, we'll explore how to interpret the outputs of the DDRM to make informed dividend investing decisions. We'll discuss what the results mean, key factors to consider, and common pitfalls to avoid.

Understanding DDRM Outputs

The DDRM generates several key outputs:

Dividend Growth: The projected annual growth rate of the dividend, based on the company's core business growth and potential share buybacks.

Total Return Estimate: The expected annual total return, equal to the current dividend yield plus the projected dividend growth rate.

Cost of Growth Per Share: The earnings per share the company must retain to fund its projected growth rate. A high cost of growth can constrain dividend increases.

Funding Gap: The difference between earnings and the sum of dividends paid and the cost of growth. A positive funding gap indicates excess earnings that could be used for buybacks or additional dividends. A negative gap suggests the current payout may not be sustainable.

Let's see how to interpret these outputs using Procter & Gamble (PG) as an example, with data as of December 29, 2023:

Inputs:

Stock Price: $152.75

Dividend Rate: $3.65 annually

EPS: $6.02 (forward estimate)

Core Growth Rate: 5%

ROE: 35%

Outputs:

Cost of Growth Per Share = (5% / 35%) * $6.02 = $0.86

Funding Gap = $6.02 - $3.65 - $0.86 = $1.51

Share Change = $1.51 / $152.75 = 1.0%

Dividend Growth = 5% + 1.0% = 6.0%

Total Return Estimate = (3.65 / 152.75) + 6.0% = 2.4% + 6.0% = 8.4%

The 6.0% dividend growth projection seems reasonable given P&G's long history of consistent dividend increases. The model suggests P&G can fund this growth through a combination of core business expansion (5%) and share buybacks (1%).

The 8.4% total return estimate looks attractive for a stable consumer staples company. It consists of a 2.4% starting yield plus the 6% projected dividend growth. This aligns with P&G's long-term annual return of around 8-10% over the past few decades.

The cost of growth per share is a manageable $0.86. With EPS of $6.02, P&G would still have ample earnings to cover its current $3.65 annual dividend even after funding growth. The positive $1.51 funding gap confirms this, indicating excess earnings that P&G can use for buybacks, as the 1% estimated share change reflects.

Key Interpretation Principles

Consider the company's historical dividend growth and payout ratio trends. Is the DDRM projection in line with the company's established dividend growth rate and payout ratio range? If not, what's changed?

Evaluate the reasonableness of core growth and ROE assumptions. Are they consistent with the company's historical performance and the industry's growth prospects? Conservative estimates lead to more reliable projections.

Analyze the funding gap and estimated share change. A persistently negative funding gap could foreshadow a dividend cut. Conversely, a wide positive gap provides a cushion to maintain dividend growth even if earnings disappoint.

Examine the total return projection in the context of your investment goals and the stock's risk profile. Is the expected return sufficient compensation for the risks? How does it compare to returns from other investment opportunities?

Common Pitfalls to Avoid

Expecting unsustainably high dividend growth rates, especially from mature companies. Very few companies can consistently grow dividends at double-digit rates over the long run.

Overlooking deteriorating business fundamentals or industry disruption that could derail dividend growth, even for companies with long dividend growth streaks.

Anchoring to overly optimistic growth assumptions that don't align with the company's revenue, earnings and cash flow growth prospects.

Ignoring payout ratio trends. An increasing payout ratio can be a red flag, as it means dividend growth is outpacing earnings growth. This could lead to a dividend growth slowdown or cut if earnings falter.

Key Takeaways

DDRM outputs provide a useful framework for projecting dividend growth and total return potential, but they're based on assumptions about the future that may prove inaccurate.

To effectively interpret DDRM results, investors must have a solid understanding of the company's business model, competitive advantages, industry dynamics, and historical financial performance.

The DDRM is a powerful tool, but it's not a crystal ball. Use it as part of a comprehensive dividend investing strategy that also incorporates qualitative analysis and a long-term perspective.

Coming Up

In the final installment of our DDRM Fundamentals series, we'll walk through practical case studies applying the DDRM to real-world dividend stock analysis. We'll evaluate companies from different sectors and dividend growth categories to demonstrate how to use the DDRM in your investment process. Stay tuned!

INCOME BUILDING

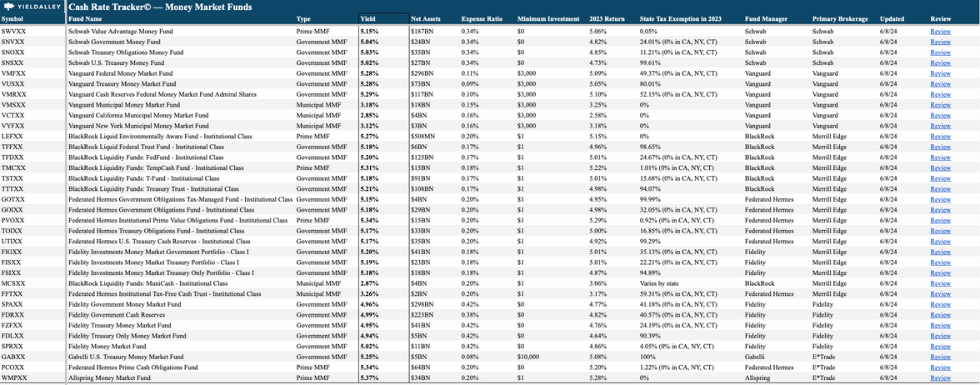

Cash Rates

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 5.02%

SPAXX (Fidelity Government Money Market Fund): 4.98%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 5.19%

VMFXX (Federal Money Market Fund): 5.29%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 4.81%

E*Trade: 5.00%

Fidelity: 4.75%

Merrill Edge and Merrill Lynch: 5.15%

Vanguard: 4.75%

ETFs

SGOV (iShares 0-3 Month Treasury Bond ETF): 5.25%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 5.20%

USFR (WisdomTree Floating Rate Treasury Fund): 5.34%

TFLO (iShares Treasury Floating Rate Bond ETF): 5.33%

Want To Track the Highest Cash Yields?

Refer just one person to the YieldAlley newsletter for instant access to the YieldAlley Cash Rate Tracker©.

This simple spreadsheet lets you easily compare and track the best cash rates and investments.

Get all the details on the best money market funds and ETFs in a single spreadsheet.

BONUSES

Brokerage, Bank and Credit Card Bonuses

Brokerage Bonuses

E*Trade (still active): Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Bank Bonuses

U.S. Bank (active) — Earn up to a $450 bonus when you open a new Smartly checking account when you use promo code 2024JUL. Offer here.

Availability: Nationwide

Soft credit inquiry.

Axos Bank (active) — $500 when you open a new rewards checking account with promo code RC500 and certain requirements. Offer here.

Availability: Nationwide

Soft credit inquiry.

Credit Card Bonuses

Chase Ink Preferred (active) — Get 120,000 Ultimate Rewards bonus points when you spend $8,000 in the first three months after account opening. Offer here.

Capital One Venture (active) — Enjoy $250 on Capital One Travel in your first year and earn 75,000 bonus miles after spending $4,000 in the first 3 months. Offer here.

American Express Hilton Surpass Card (active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

Picture of the Week