Hello, YieldAlley readers! In this week’s newsletter:

Cash Income Opportunities: Money market funds, brokered CDs, Treasury bills, and ultra short-term bond ETFs.

Read of the Week: How The Dividend Aristocrats Can Make You Wealthy

Elsewhere: Reddit IPO, Meta and Salesforce dividends, Tesla woes, US money market funds see large inflows, Biden signs $1.2 trillion spending plan

Cash Income Opportunities For the Week Ending March 22, 2024

Government Money Market Funds (7-Day Yields)

Charles Schwab Money Market Funds

SNVXX (Schwab Government Money Fund - Investor Shares): 5.02%

SNSXX (Schwab U.S. Treasury Money Fund - Investor Shares): 5.01%

Fidelity Money Market Funds

SPAXX (Fidelity Government Money Market Fund): 4.97%

FDLXX (Fidelity Treasury Only Money Market Fund): 4.96%

Merrill Edge and Merrill Lynch Money Market Funds

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 5.19%

TOIXX (Federated Hermes Treasury Obligations Fund - Institutional Class): 5.16%

Vanguard Money Market Funds

VMFXX (Federal Money Market Fund): 5.27%

VUSXX (Treasury Money Market Fund): 5.29%

Brokered CD Rates (6-Month)

Charles Schwab: 5.36%

E*Trade: 5.30%

Fidelity: 5.30%

Merrill Edge and Merrill Lynch: 5.30%

Vanguard: 5.35%

T-Bill Rates

3-Month: 5.37%

6-Month: 5.30%

1-Year: 4.98%

Ultra Short-term Treasury Bill and Floating Rate Note ETFs (30-Day Yields)

SGOV (iShares 0-3 Month Treasury Bond ETF): 5.37%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 5.36%

USFR (WisdomTree Floating Rate Treasury Fund): 5.37%

TFLO (iShares Treasury Floating Rate Bond ETF): 5.40%

How The Dividend Aristocrats Can Make You Wealthy

The S&P 500 Dividend Aristocrats are an elite group of S&P 500 stocks that have increased their dividends annually for the past 25 years. This means these companies continued to raise dividends through significant periods of recession and economic downturns, such as the dot-com bubble in the late 90s and the Global Economic Crisis in 2007-2008.

There are three requirements to be a Dividend Aristocrat:

Size: The company must be in the S&P 500.

Growth: The company must have raised its dividends for a minimum of 25 consecutive years.

Liquidity: Must meet minimum market cap and trading volume requirements.

Currently, 67 companies are considered Dividend Aristocrats. The full list of companies can be found here. They span various industries, including health care, consumer goods, financial, and industrial sectors. One sector in which the Dividend Aristocrat Index is underweight relative to the S&P 500 is the Technology sector.

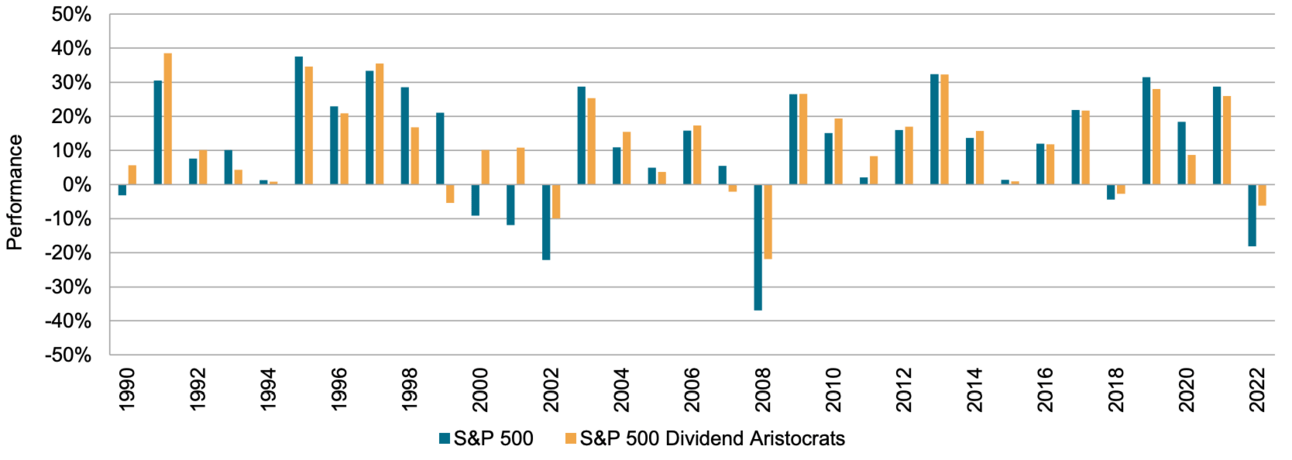

From 1989 to 2023, the S&P 500 Dividend Aristocrats outperformed the S&P by 0.11%, but with much less volatility and drawdown. In the months when the S&P 500 is down, the S&P 500 Dividend Aristocrats have outperformed the index 70% of the time. Below is a chart that shows the historical annual performance.

Source: S&P 500

Investors looking for capital growth and dividend income may be interested in the S&P 500 Dividend Aristocrats. As a group of companies, the Dividend Aristocrats have shown higher risk-adjusted returns than just the S&P 500 and represent a group of stable, growing, and healthy cash-flow businesses. The highest-paying Dividend Aristocrat is Leggett & Platt with a 9% dividend yield.

The Dividend Aristocrats represent an Income Opportunity we call Dividend Growth Investing. By combining capital appreciation in undervalued stocks that pay a stable and growing dividend, investors take advantage of both income and growth instead of owning an overvalued company that doesn’t pay a dividend.

In the future, we will highlight specific dividend income opportunities within and outside the Dividend Aristocrats index. For example, both Meta (parent company of Facebook) and Salesforce will begin paying a dividend in 2024, highlight another income opportunity.

We’d love to hear from you. If you have any feedback or thoughts, please feel free to directly respond to this email with your message. Our ChatGPT bot is also available for your questions, as is our Facebook group.

If you enjoyed this newsletter, please subscribe here. Investing and saving is more fun with friends and family. You can forward this newsletter to anyone who might find the advice in this email useful!