Hello, YieldAlley readers! In this issue:

Filing Fidelity State Income Tax Exemptions in 2025

Markets Retreat from Record Highs as Consumer Spending and Tariff Concerns Mount

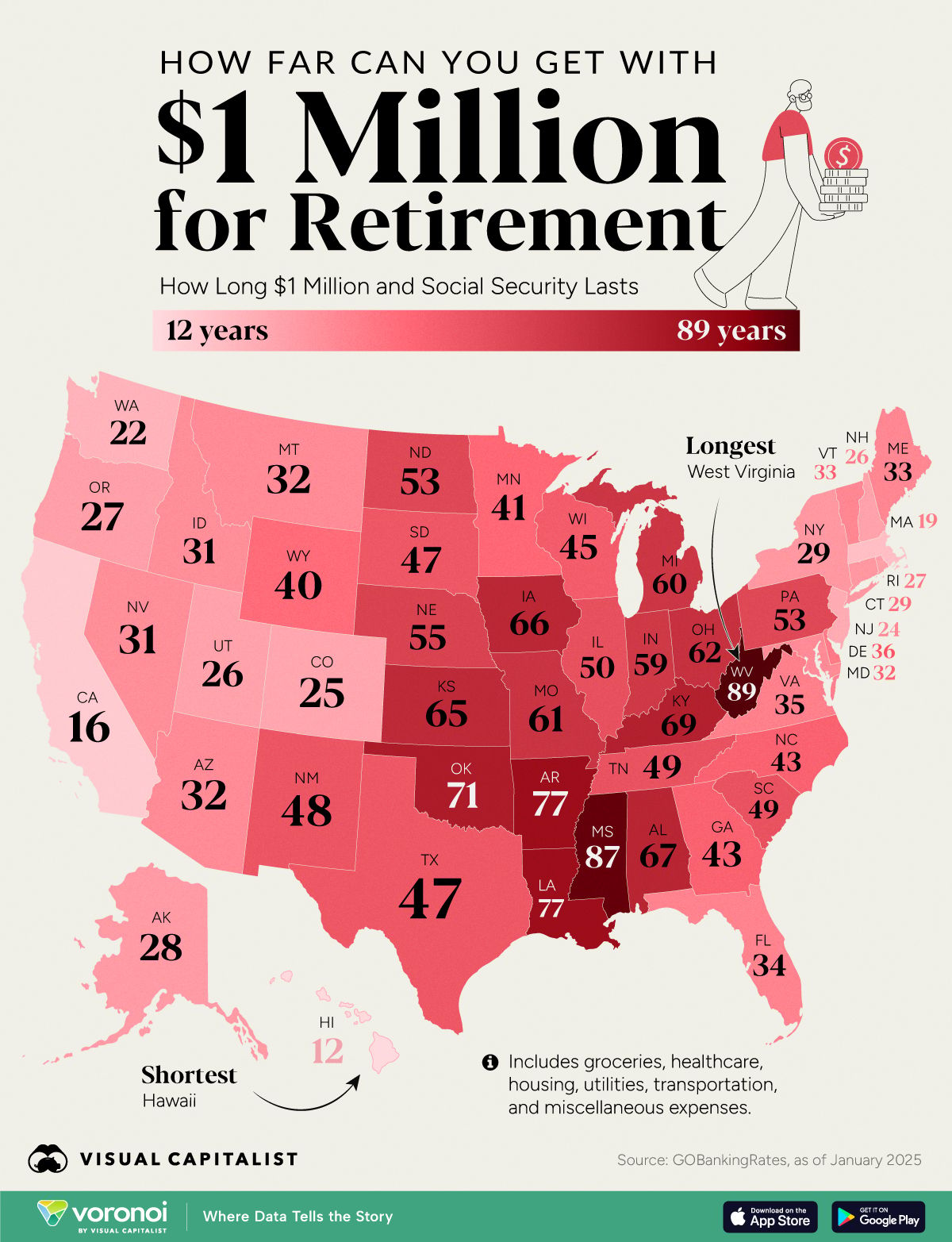

How Far $1 Million Gets You in Retirement In Each U.S State

And more!

NEWS

Standout Stories

🏦 SEC Launches Cyber and Emerging Technologies Unit Aimed at Safeguarding Investors (Latham)

📲 Which iPhone 16 Model Should You Buy? (Wired)

👟 Birkenstock sandals are not works of art, German court rules (NY Post)

📚 10 Stock and Bond Market Insights That Are Hardly ‘Dull’ (Morningstar)

📬 Trump wants to shake up the US Postal Service. Here’s what it’ll mean for your deliveries. (CNN)

MARKET THOUGHTS

Markets Retreat from Record Highs as Consumer Spending and Tariff Concerns Mount

ECONOMY

Economic sentiment deteriorated in February, with the University of Michigan's Consumer Sentiment Index dropping nearly 10% to 64.7, reflecting declining consumer confidence across all measured aspects of the economy. Inflation expectations jumped significantly to 4.3% for the year ahead, up from 3.3% in January. Consumer concerns were particularly evident in durables, with buying conditions plunging 19% due to anticipated tariff-induced price increases. The housing sector showed weakness, with the National Association of Home Builders' housing market index falling to 42 in February from 47 in January (on a scale where any reading below 50 indicates that builders view conditions as poor rather than favorable). This drop to a five-month low reflects builders' diminishing confidence due to elevated mortgage rates, high housing costs, and tariff uncertainties. January housing starts, which measure the number of new residential construction projects beginning each month, declined nearly 10% to an annual rate of 1,366,000 units. Business activity approached stagnation, with the S&P Global flash Composite PMI hitting a 17-month low of 50.4 (where 50 marks the dividing line between expansion and contraction), as services activity contracted to a two-year low of 49.7.

STOCKS

U.S. equity markets ended the holiday-shortened week lower despite reaching record highs midweek. The decline was particularly pronounced after Walmart's cautious forward guidance sparked broader concerns about consumer spending. The S&P 500 fell to 6,013.13 (-101.50), while the Dow Jones dropped to 43,428.02 (-1,118.06). Markets were also pressured by President Trump's announcement of potential new tariffs on automobiles, pharmaceuticals, and lumber products. The Nasdaq Composite declined to 19,524.01 (-502.77), while smaller-cap indices showed greater weakness, with the S&P MidCap 400 and Russell 2000 falling by -0.61% and -1.56% YTD respectively.

FIXED INCOME

Treasury markets strengthened following the release of Federal Reserve meeting minutes, which indicated policymakers' intention to maintain current rates until inflation shows improvement. The bond market rally intensified after weak PMI data on Friday. Municipal bonds posted modest positive returns, supported by seasonal reinvestments and reduced issuance. Investment-grade corporate bonds faced challenges with negative returns despite heavy new issuance, while the high-yield market experienced lower-than-average trading volumes with limited new deals.

INCOME BUILDING

Filing Fidelity State Income Tax Exemptions in 2025

As taxpayers begin receiving their 2024 brokerage 1099 forms, an important tax advantage often goes overlooked: state and local tax exemptions on interest earned from U.S. government obligations within money market funds.

Recently Released: Fidelity's 2024 U.S. Government Obligation Percentages

Fidelity has published their U.S. Government Obligation (GOI) percentages for 2024 through their institutional portal, while the retail-focused documentation is still pending. However, since the underlying percentages remain consistent across all versions, investors can utilize this information for tax planning. Here are the key figures for Fidelity's most popular money market funds:

Core Money Market Funds and Their Government Obligation Percentages:

Fidelity Treasury Only Money Market Fund (FDLXX)

CUSIP: 31617H300

GOI Percentage: 97.0032%

Notable for having the highest government obligation percentage

Fidelity Government Money Market Fund (SPAXX)

CUSIP: 31617H102

GOI Percentage: 55.0877%

Common default core position for many accounts

Fidelity Government Cash Reserves (FDRXX)

CUSIP: 316067107

GOI Percentage: 57.1917%

Fidelity Treasury Money Market Fund (FZFXX)

CUSIP: 316341304

GOI Percentage: 50.5640%

Important Note: Does not qualify for tax exemption in California, Connecticut, and New York due to insufficient U.S. Government securities investment

Fidelity Government Money Market Fund Premium Class (FZCXX)

CUSIP: 31617H706

GOI Percentage: 55.0877%

Requires $100,000 minimum investment

Offers approximately 0.10% higher annual yield compared to SPAXX due to lower expense ratio

How to Calculate Your State Tax-Exempt Amount

The calculation process is straightforward but must be done manually:

Locate your total "ordinary dividends" amount in Box 1a of your Form 1099-DIV

Multiply this amount by the fund's GOI percentage

The resulting figure represents your potentially state tax-exempt income

For example: If you earned $5,000 in dividends from FDLXX in 2024, multiply $5,000 × 97.0032% = $4,850.16 in potentially state tax-exempt income. In a state with a 9% income tax rate, this could result in approximately $436.51 in tax savings.

State-Specific Considerations

Several states have specific requirements for exemption eligibility:

California, Connecticut, and New York require funds to maintain at least 50% of assets in U.S. government securities at each quarter-end during the tax year

Some funds, like FZFXX, may not meet these threshold requirements

State tax savings can be substantial, particularly in high-tax states

Important Notes:

Most tax software won't automatically calculate these exemptions

Consider confirming the process with a tax professional

Keep detailed records of your calculations

Verify current state-specific requirements, as they may change

After-Tax Yield Implications

Despite lower headline yields, funds with higher GOI percentages like FDLXX may actually provide better after-tax returns for investors in high-tax states. For instance, in states with approximately 10% income tax rates, the tax savings from FDLXX's higher government obligation percentage could outweigh the higher pre-tax yields of funds like SPAXX or FZFXX.

Conclusion

While claiming state tax exemptions on money market fund interest requires additional effort during tax preparation, the potential savings make it worthwhile for many investors. Understanding your fund's government obligation percentage and properly documenting these exemptions can lead to meaningful tax reductions, particularly for larger cash positions in high-tax states.

INCOME BUILDING

Cash Rates

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 4.09%

SPAXX (Fidelity Government Money Market Fund): 4.00%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 4.19%

VMFXX (Federal Money Market Fund): 4.25%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 4.35%

E*Trade: 4.35%

Fidelity: 4.30%

Merrill Edge and Merrill Lynch: —

Vanguard: 4.30%

ETFs (30-Day Yields)

SGOV (iShares 0-3 Month Treasury Bond ETF): 4.22%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 4.14%

USFR (WisdomTree Floating Rate Treasury Fund): 4.22%

TFLO (iShares Treasury Floating Rate Bond ETF): 4.21%

BONUSES AND DEALS

Free TurboTax Deluxe & Premium for $0

TurboTax is offering completely free tax filing ($0 Federal and $0 State) for all tax situations through their mobile app, representing a significant departure from their previous Free Edition limitations. The offer has the following requirements:

Must not have used TurboTax to file taxes last year

Must start and file taxes using the TurboTax mobile app

Only applies to DIY tax filing - TurboTax Live products are excluded

Must complete filing by February 28, 2025

Includes all tax situations (Standard, Deluxe, and Premium products)

Both Federal and State e-File are included at no additional cost

The mobile app experience is designed to be user-friendly, featuring the ability to upload tax forms by taking pictures rather than manual data entry. For those who prefer working on a larger screen, TurboTax allows users to switch to a web browser during the middle of the process, as long as they start and complete their filing through the app. This flexibility maintains the free filing benefit while accommodating different user preferences.

The promotion represents a stark contrast to TurboTax's past practices, where they faced criticism for advertising free filing but often requiring upgrades for common tax situations like having a 1099-MISC form. This new offer covers more complex tax situations, including investment income, itemized deductions, and rental income, with both Federal and State e-File included at no additional cost. However, the offer excludes TurboTax Live products and must be completed by the February 28 deadline, which may be challenging for those waiting on late brokerage forms.

For comparison, TurboTax's regular pricing can be substantial: TurboTax Premium normally costs $89 for Federal filing plus $39 per State. Even with common discounts of around 30% off, users typically end up paying close to $100 total for their tax filing, making this free offer particularly valuable for those who qualify.

Picture of the Week