Hello, YieldAlley readers! Our Facebook Income Investing group continues to be active. This week, we're giving a big shout-out to Wayne, Steve, and Thanh for their outstanding engagement. We emphasize a judgment-free environment, encouraging members to ask questions anonymously so our more seasoned members are always ready to assist. To ensure the quality of discussions remains high, the group will transition to invite-only access in the future.

In this week’s newsletter:

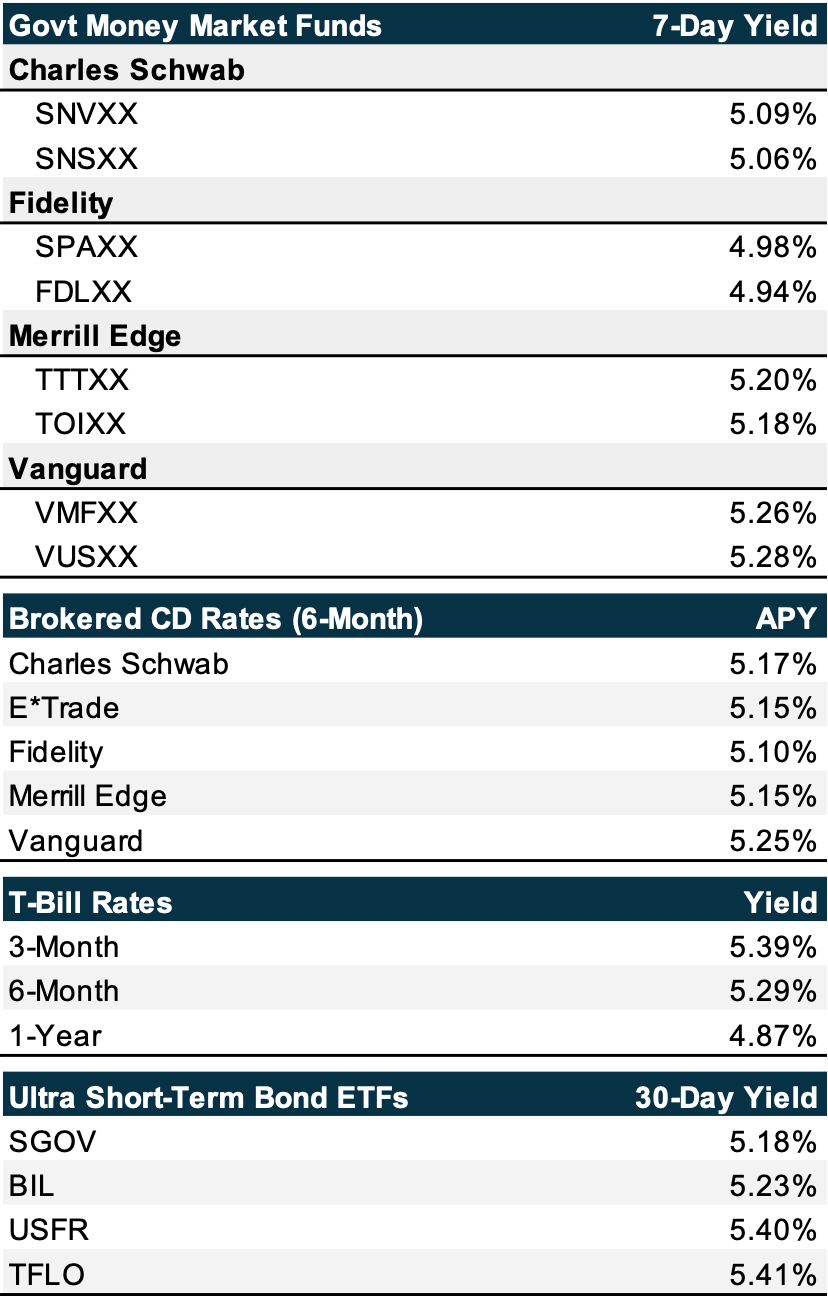

Rates Roundup for money market funds, brokered CDs, Treasury bills, and ultra short-term bond ETFs.

Read of the Week: Are T-Bills More Risky Than FDIC-Insured Savings?

Elsewhere: Is dividend investing coming back?, Young Americans’ wealth has grown by 80% since 2019

On Friday, Wall Street’s S&P 500 index closed above 5,000 for the first time. The stock market has had an unprecedented start to 2024, largely due to artificial intelligence and cloud computing companies. Many investors had expected a tough economy to depress prices. The Magnificent Seven — Microsoft, Apple, Alphabet, Amazon, Nvidia, Meta, and Tesla — drove 45 percent of the S&P 500’s return in January.

The strong economy means that Fed officials are in no rush to cut interest rates just yet. They need more evidence that inflation is trending towards the Fed’s 2% goal. Bond yields crept higher this week as a result.

Read our cash guides on Charles Schwab, Fidelity, Merrill Edge, Robinhood Gold, and Vanguard to compare rates across money market funds and CDs to earn the highest cash rates.

Are T-Bills More Risky Than FDIC-Insured Savings?

There’s a widespread perception that a bank account is the safest place for your cash. But what about Treasury bills and government money market funds and ETFs? Are they more risky, or as safe as FDIC-insured savings?

Both FDIC-insured savings (like CDs and deposits) and T-Bills are considered ultra-safe investments. The likelihood of either failing is minimal, only conceivable in a severe U.S. economic crisis.

FDIC Insured Products

Depositing cash in a bank is common, with the safety net being FDIC insurance (up to $250,000 per depositor, per bank), backed by the U.S. Government. This makes banks a traditionally safe place for your cash.

The Full Faith and Credit of the U.S. Government

On the other hand, Treasury bills are not FDIC-insured. These are debt instruments that are backed by the full faith and credit of the U.S. government. What does that mean?

The full faith and credit of the U.S. government refers to the United States federal government’s guarantee to honor its financial obligations. This guarantee is codified into the law. In an extreme economic downturn, it's hypothesized that T-Bill obligations would be prioritized over FDIC-insured deposits. Treasuries are globally held as safe reserves; their failure would signify a global financial crisis.

If T-Bills were to be paid first in such a scenario, holders of money market funds and ETFs would indirectly benefit. Of course, we would still have to rely on the fund manager (such as a Vanguard or Fidelity) to process redemptions.

Comparing the Two

Ultimately, we view neither CDs and savings accounts nor Treasury bills and their associated funds as safer than the other for everyday purposes. However, for those particularly safety-conscious, T-Bills might have a slight edge.

Actionable Tip: Debates on the safety of FDIC-insured versus Treasury bills are largely academic. Starting with a CD or HYSA is better than leaving cash idle. But explore other options for better yields, liquidity, and tax advantages, all of which are found in our max cash guides.

Is dividend investing coming back?

Dividend stocks have underperformed in the last decade. U.S. companies that pay a dividend yield of over 5% have returned 450% since the end of 2008, while companies that don’t pay dividends have returned nearly 1,200%. This difference is due to high-growth, cash-rich companies, particularly in the technology and healthcare sectors, that do not pay dividends.

We believe income investing, which incorporates dividend stocks and fixed-income bonds, strikes a middle ground for the modern investor who wants to compound consistent income and achieve a Sharpe ratio. The Sharpe ratio measures risk-adjusted returns. A well-optimized income portfolio can consistently outperform the market while reducing volatility. While the highs of our portfolio may not be as high as the market’s, our drops will also not be as drastic.

This is a fine middle ground for many of us who want to use investing as a supplement for income and a way to live our lives. Dividend stocks can play a large part in this income and total return strategy, and with both risk-free rates (Treasuries) and corporate bond rates at a generational high, we believe there the income generation portfolio is coming back into vogue.

Young Americans’ wealth has grown by 80% since 2019

For adults under 40, total wealth jumped by 80% since 2019. Those who are 40 to 54 saw their wealth grow 10% in the same period, and 30% for those over 55, according to a recent report from the New York Fed.

This is due to a large increase in stocks during this time, with the youngest generation also receiving most of the Covid-era stimulus which was put back into the stock market.

However, individuals under 40 held only 5.7% of the wealth in America, despite representing 37% of the population. So, while the wealth increase was much larger, it was also starting from a much smaller number.

We’d love to hear from you. If you have any feedback or thoughts, please feel free to directly respond to this email with your message. Our ChatGPT bot is also available for your questions, as is our Facebook group.

If you enjoyed this newsletter, please subscribe here. Investing and saving is more fun with friends and family. You can forward this newsletter to anyone who might find the advice in this email useful!