Hello, YieldAlley readers! In this issue:

S&P hits an all-time high.

Dividend investing in today’s stock market.

How to track and monitor the highest cash rates.

And more!

NEWS

Standout Stories

📈 Nvidia’s Ascent to Most Valuable Company Has Echoes of Dot-Com Boom (WSJ)

✈️ Europe Has a New Economic Engine: American Tourists (WSJ)

🏡 Home Prices Hit Record High in May as Sales Stall (CNBC)

🎤 Queen Catalog to Be Acquired by Sony Music for £1 Billion (Variety)

👾 Thousands of Car Dealerships Across the U.S Hacked (CBS)

MARKET THOUGHTS

S&P 500 Hits a Fresh All-Time High While Corporate Bonds See Some Cracks

Stocks recorded modest gains during the shortened trading week, with the S&P 500 Index reaching fresh all-time highs.

Value stocks outperformed growth shares.

Major benchmarks outperformed the technology-heavy Nasdaq Composite.

Friday was a triple-witching day with approximately USD 5.5 trillion in options expiring.

Easing labor demand and dwindling savings made consumers more cautious.

Retail sales increased only 0.1% in May, down from a revised 0.2% decrease in April.

Sales at bars and restaurants fell 0.4%.

Sales at grocery stores also fell 0.4%, possibly due to price cuts in certain food categories.

Longer-term Treasury yields moved lower with lackluster retail sales data but ended modestly higher with stronger S&P Global readings.

Bond prices and yields move in opposite directions.

Tax-exempt municipal bond yields held steady with light secondary trading volumes despite heavy issuance.

Investment-grade corporate bond market saw heavy issuance early in the week, surpassing expectations by Tuesday.

Improved investor sentiment and equity gains supported high-yield bond performance.

Economic slowdown signs and potential Federal Reserve rate cuts bolstered risk asset performance overall.

INCOME BUILDING

Dividend Investing in Today’s Stock Market

In today's market, dividend investing requires a nuanced approach, balancing yield, growth, and total return. While the S&P 500 yields a mere 1.5%, a well-constructed dividend portfolio can achieve yields of around 4%. This significant yield differential underscores the importance of active management in dividend investing.

The Internal Rate of Return (IRR) serves as a crucial valuation metric, with a target of 8% total return through a combination of 4% yield and 4% dividend growth. This balanced approach optimizes both current income and future growth potential.

Historical data reveals a strong correlation between dividend growth and share price appreciation. For companies consistently paying dividends since 1972, the correlation (R-squared) is 0.8287. This relationship, while weakening in recent decades, still provides valuable insights for identifying potential long-term winners.

The power of dividend growth is illustrated through the concept of yield on cost. A $1 million investment yielding 4% initially, with 6% annual dividend growth, would see its yield on cost rise to 5.35% after five years if dividends are taken, or 6.51% if reinvested. This compounding effect is a cornerstone of successful dividend investing strategies.

In the current market environment, dividend investors should focus on the following sectors:

Utilities

Telecom

Pipelines

Integrated energy

Regional banks

Pharmaceuticals

Select REITs

Consumer staples

These sectors offer the best opportunities for sustainable dividends in today's market.

Conventional wisdom regarding tax strategy is worth challenging. Avoiding dividend-paying stocks solely for tax reasons can actually lower pre-tax returns. This suggests focusing on total after-tax returns rather than tax minimization alone.

Portfolio construction is critical, and the more sophisticated investor may have a diversified portfolio of 30-50 stocks to mitigate the impact of potential dividend cuts. (Alternatively, selecting the right dividend ETF can help with this). This approach balances yield, growth potential, and risk. Additionally, "accretive trading" - tactically adjusting positions to increase portfolio yield - can enhance income over time, especially in sectors prone to cyclical repricing.

Managing dividend cuts is an essential skill. While minimizing such instances is crucial, the impact on a well-diversified portfolio is often minimal. Occasionally, adding to a position after a dividend cut can be beneficial if the company's long-term prospects improve as a result.

Despite the rise of non-dividend paying stocks, particularly in the tech sector, approximately 75% of the top 500 U.S. companies still pay dividends. This provides a substantial universe for dividend investors to work with, even as the broader market has shifted towards growth and momentum strategies.

For the advanced dividend investor, success in today's market requires a deeper understanding of company fundamentals, sector dynamics, and the interplay between yield, growth, and total return. The goal is to construct a portfolio that not only provides substantial current income but also positions itself for long-term dividend growth and capital appreciation.

By focusing on these key points and implementing a disciplined approach to stock selection, portfolio construction, and ongoing management, dividend investors can build and maintain a robust portfolio designed for both current income and long-term growth in today's challenging market environment.

INCOME BUILDING

Cash Rates

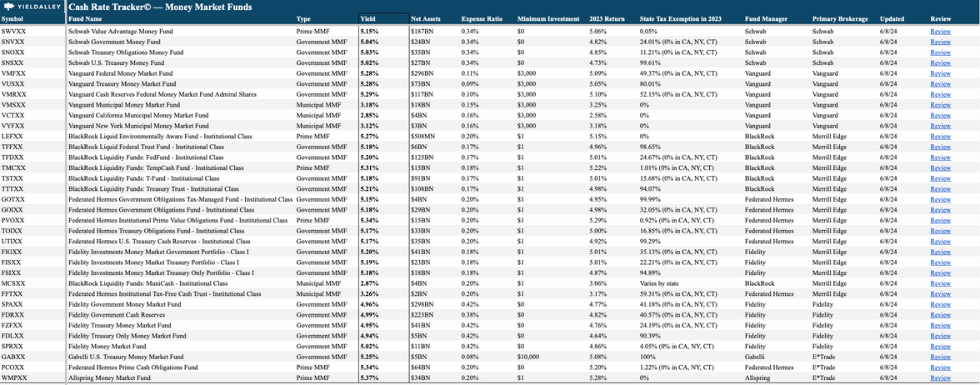

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 5.02%

SPAXX (Fidelity Government Money Market Fund): 4.97%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 5.19%

VMFXX (Federal Money Market Fund): 5.27%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 5.42%

E*Trade: 5.40%

Fidelity: 5.40%

Merrill Edge and Merrill Lynch: 5.45%

Vanguard: 5.40%

ETFs

SGOV (iShares 0-3 Month Treasury Bond ETF): 5.27%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 5.21%

USFR (WisdomTree Floating Rate Treasury Fund): 5.32%

TFLO (iShares Treasury Floating Rate Bond ETF): 5.32%

Want To Get the Highest Cash Yields?

With the YieldAlley Cash Rate Tracker©, you can now easily compare and track the latest money market fund and cash rates by brokerage. Get all the details you need including fund type, yields, expense ratios, and tax benefits in a single spreadsheet.

Refer one person to this newsletter for instant access.

BONUSES

Brokerage, Bank and Credit Card Bonuses

Brokerage Bonuses

E*Trade (still active): Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Bank Bonuses

Chartway Federal Credit Union (new) — $200 cash back when you open a new checking account using promo code 200CASH. Offer here.

Availability: Nationwide

Soft credit inquiry.

Axos Bank (new) — $500 when you open a new rewards checking account with promo code RC500 and certain requirements. Offer here.

Availability: Nationwide

Soft credit inquiry.

Eastern Bank (still active) — $350 when you open a new checking account with a direct deposit of $4,000 or more. Offer here.

Availability: MA, NH, ME, or RI

Soft credit inquiry.

Discover Savings Account (still active) — With your first Discover Savings account, earn a $150 bonus with a $15,000 deposit, or a $200 bonus with a $25,000 deposit. Use offer code GOBP623. Offer here.

Availability: Nationwide

Soft credit inquiry.

USC Credit Union (still active) — $250 bonus when you open a new checking account and set up direct deposit with a $1,000 minimum direct deposit every 30 days for the first 90 days of checking account AND make a minimum of ten (10) debit transactions every 30 days for the first 90 days of checking account opening. Use promo code SPRING24. Offer here.

Availability: CA.

Soft credit inquiry.

Credit Card Bonuses

Citi Strata Premier (new) — 75,000 points after $4,000 in spend within the first three months. Offer here.

Bank of America Sonesta (new) — 120,000 points after $2,000 in spend on the first 90 days of account opening. Offer here.

American Express Hilton Surpass Card (still active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

Picture of the Week