Hello, YieldAlley readers! In this issue:

Corporate Bonds, The Second Largest Bond Market, Offer Unique Opportunities

Market Optimism Persists Despite Mixed Signals and Valuation Concerns

Bonds are riskier than stocks? 2.7% Safe Withdrawal Rate?

And more!

NEWS

Standout Stories

💰 Who died and left the US $7 billion? (Sherwood)

👨💼 AI CEO goes full techno-optimist in 15,000-word paean to AI (TechCrunch)

🏦 Bonds are riskier than stocks? 2.7% Safe Withdrawal Rate? (Bogleheads)

🇺🇸 Should I be worried about the US election?(Vanguard)

☢️ Google will help build seven nuclear reactors to power its AI systems (Yahoo Finance)

MARKET THOUGHTS

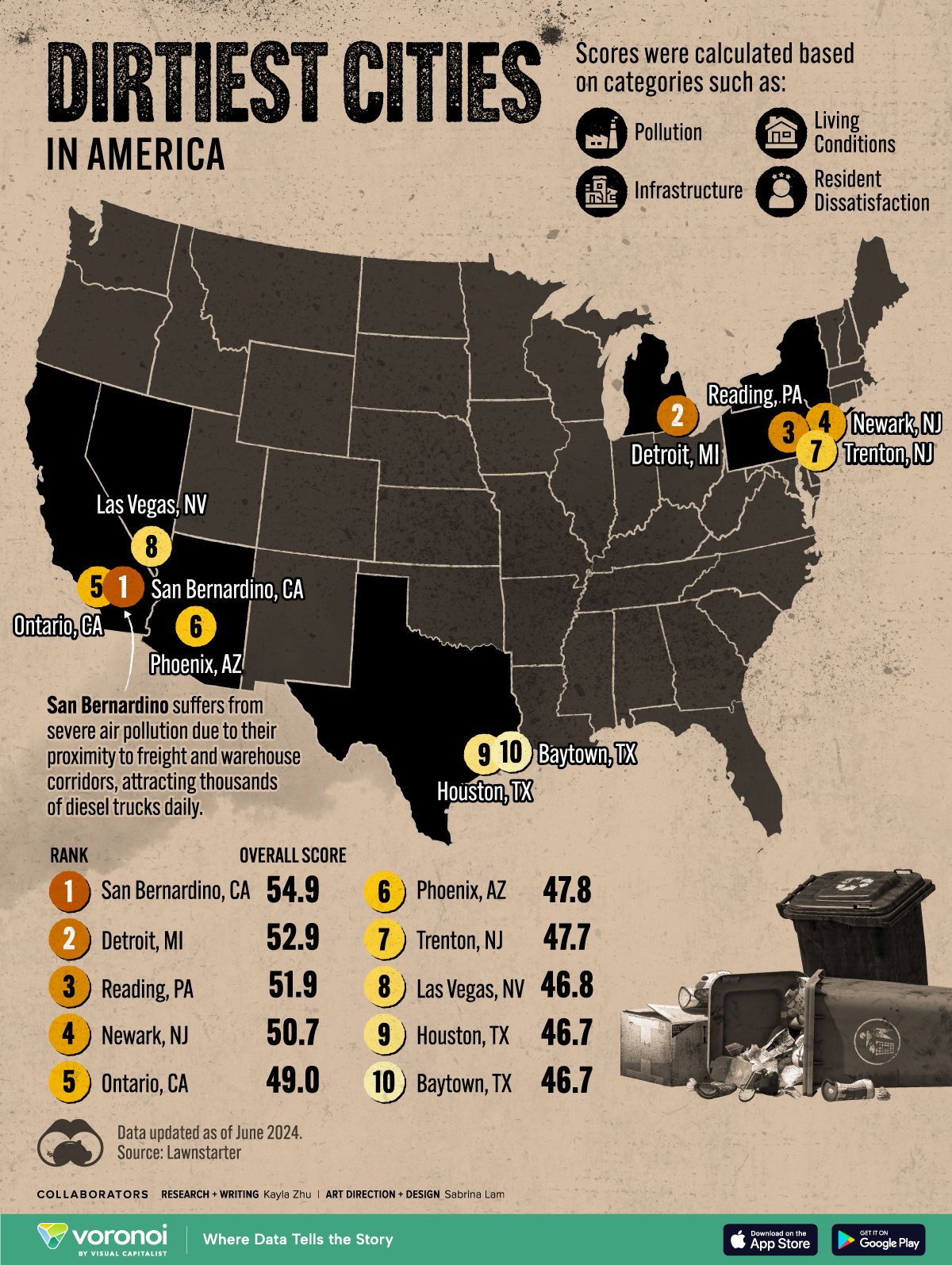

Market Optimism Persists Despite Mixed Signals and Valuation Concerns

U.S. stocks extend rally:

S&P 500 posts sixth straight weekly gain, up nearly 1%.

Index has almost doubled since early 2020.

Tech sector leads, with Netflix and Nvidia showing strength.

Economy shows resilience:

September retail sales beat expectations.

Q3 GDP growth estimate revised up to 3.4%.

Consumer spending and job market remain robust.

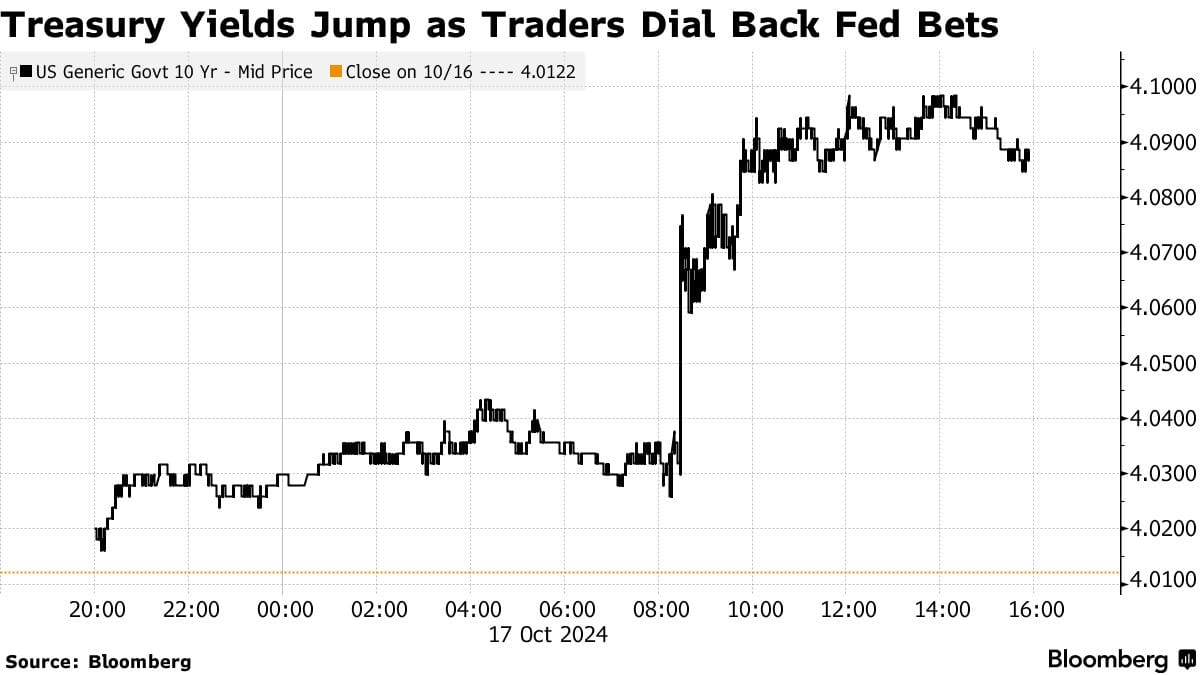

Fed policy outlook shifts:

Expectations for aggressive rate cuts decrease.

Markets now anticipate 42 basis points of cuts in Nov/Dec.

10-year Treasury yield rises to 4.09%.

Earnings season starts positively:

Banks report optimistic outlooks.

S&P 500 Q3 earnings growth forecast improves to 6.5%.

Mixed market sentiment:

Some managers bullish on earnings and consumer strength.

Others cautious due to high valuations and tightening spreads.

Increased use of hedging strategies observed.

Asset managers near record long positions in U.S. stocks.

Commodity movements:

Oil prices drop below $70, largest weekly fall in a month.

Gold hits record highs, suggesting some risk aversion.

Key factors to watch:

Potential election-related market volatility.

Broadening of earnings growth beyond tech.

Possible signs of labor market weakening.

INCOME BUILDING

Corporate Bonds, The Second Largest Bond Market, Offer Unique Opportunities

While we have frequently discussed government bonds and Treasuries in the past (with last week’s issue talking about the opportunity in agency bonds), corporate bonds are second only to government bonds in the global bond market in terms of size. Corporate bonds are vastly more versatile securities, with a wide array of maturities, yields, and credit quality. As a result, income investors sometimes seek corporate bonds in search of higher yields compared to government bonds.

Corporate bonds are, at their core, debt instruments issued by companies to raise capital. When a corporation needs funds to expand operations, finance new ventures, or manage existing debt, they often turn to the bond market. By issuing bonds, companies essentially borrow money from investors, promising to repay the principal at a specified future date (the maturity date) while making regular interest payments along the way.

Unlike stocks, which represent ownership in a company, corporate bonds represent ownership of a company's debt. This distinction is crucial for understanding the risk-reward profile of these investments. Bondholders are creditors, not owners, and their claim on the company's assets typically takes precedence over shareholders in the event of financial distress.

Corporate bonds come in various forms, primarily differentiated by their maturity and credit quality. Maturities generally fall into three categories: short-term (up to five years), medium-term (five to 12 years), and long-term (over 12 years). Credit quality, on the other hand, is assessed by independent rating agencies like Moody's and Standard & Poor's, who evaluate the issuer's creditworthiness. This rating significantly influences the interest rate the company must offer to attract investors – lower-rated issuers typically need to offer higher yields to compensate for the increased risk.

Source: PIMCO

For the income investor considering purchasing corporate bonds for the first time after having held government bonds, we recommend U.S. investment-grade corporate bonds. These high-quality securities share several characteristics with US Treasuries, which are often considered the safest investments available. Like Treasuries, investment-grade corporate bonds are issued by financially stable entities and carry minimal default risk — which means the company issuing the bond is unlikely to go bankrupt or experience financial distress. This is crucial for investors who want to rely on consistent interest payments and the return of their principal at maturity.

In contrast, high-yield or "junk" bonds, while offering potentially higher returns, come with significantly greater risk of default and price volatility. These lower-rated securities, issued by companies with less stable financial positions, are generally more suitable for investors with a higher risk tolerance and the ability to weather potential losses.

Corporate bonds are generally best considered as additional portfolio diversification to your other fixed income assets. This is easily achieved with a corporate bond fund or a fixed income fund. Generally speaking, it’s difficult for an individual investor to assess the true financial health of a company. While creditors will be paid back before shareholders, there is no guarantee you will be repaid your entire principal. This is not a risk with U.S. Treasuries. You can easily get exposure to corporate bonds through a general fixed income funds, which will hold a diversified portfolio of various fixed income securities (including both U.S. government Treasuries and various corporate bonds). These funds make it simple to achieve exposure to various fixed income securities.

What's Your Take?

We're curious to hear your thoughts on corporate bonds. Have you considered incorporating them into your fixed income strategy?

Share your insights - we're eager to learn how you're approaching the corporate bond market. Are you focusing on investment-grade issues, or are you willing to dip into the high-yield sector for extra income?

INCOME BUILDING

Cash Rates

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 4.55%

SPAXX (Fidelity Government Money Market Fund): 4.60%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 4.73%

VMFXX (Federal Money Market Fund): 4.79%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 4.35%

E*Trade: 4.75%

Fidelity: 4.30%

Merrill Edge and Merrill Lynch: —

Vanguard: 4.30%

ETFs

SGOV (iShares 0-3 Month Treasury Bond ETF): 4.95%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 4.79%

USFR (WisdomTree Floating Rate Treasury Fund): 4.75%

TFLO (iShares Treasury Floating Rate Bond ETF): 4.77%

BONUSES

Brokerage, Bank and Credit Card Bonuses

Brokerage Bonuses

E*Trade (still active): Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Bank Bonuses

BMO Harris (active) — Earn up to a $560 bonus when you open a new Smart Advantage or BMO Harris Premier checking account. Offer here.

Availability: Nationwide

Soft credit inquiry

Axos Bank (active) — $500 when you open a new rewards checking account with promo code RC500 and certain requirements. Offer here.

Availability: Nationwide

Soft credit inquiry.

Credit Card Bonuses

Chase Ink Preferred (active) — Get 120,000 Ultimate Rewards bonus points when you spend $8,000 in the first three months after account opening. Offer here.

American Express Hilton Surpass Card (active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

Picture of the Week