Hello, YieldAlley readers! In this week’s newsletter:

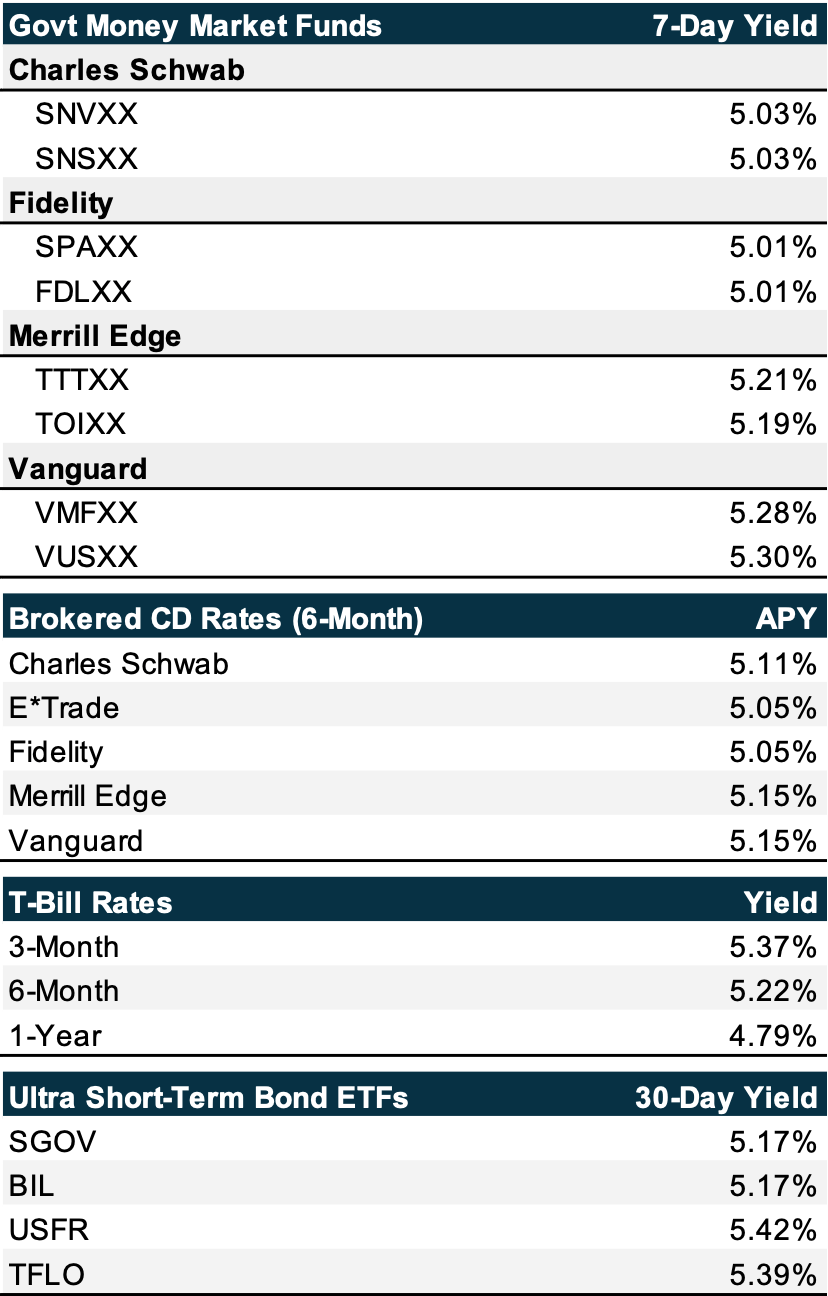

Rates Roundup for money market funds, brokered CDs, Treasury bills, and ultra short-term bond ETFs.

Read of the Week: Core Principles for Cash Investments

Elsewhere: Layoffs in the tech and media industries continue, U.S. is moving to T+1 later this year

As of January 26, 2024

The S&P 500 continued to gain this week. On Thursday, economic data showed higher than expected economic growth in the fourth quarter of 2023. On Friday, December inflation data (measured by the PCE, or personal consumption expenditures price index) were in line with expectations. This sets the stage for a round of potential interest rate cuts (which will similarly impact the yields listed above) while we have cautious signals that the economy has steered clear of a deep recession.

Many companies will be reporting earnings next week. This includes the “Magnificent Seven”, a group of seven companies that have been largely responsible for driving the growth in this stock market. Tesla, the world’s 11th largest company and a member of the Magnificant Seven, reported weaker-than-expected fourth-quarter results this past Wednesday. Alphabet, Apple, Amazon, Meta Platforms, and Microsoft will be reporting their results next week.

To learn how to earn the highest cash rates on each brokerage, read our cash guides on Charles Schwab, Fidelity, Merrill Edge, and Vanguard.

Core Principles for Cash Investments

While we have introduced several actionable strategies and investments to maximize your cash returns, we want to remind readers of YieldAlley’s core principles around how we choose which cash investments to share with you. This will also be helpful for any reader who wants to research and evaluate their own opportunities.

Our core principles around cash investments are as follows:

The investment must generate safe and consistent returns.

The investment is convenient and liquid for when we need cash.

We search for ultra low cost investments with no hidden fees.

Let’s review each principle in brief.

Safe and Consistent Returns

It's common for individuals to set aside cash in an emergency fund or save for a substantial future purchase or investment. However, rather than letting this cash sit idle, it can be actively used in the safest investment avenues.

Today, the key to this approach is leveraging U.S. Treasury bills, or the funds and Exchange-Traded Funds (ETFs) that include them in their portfolios. T-Bills are globally recognized as one of the safest investments, backed directly by the full faith and credit of the U.S. government. This means the U.S. government is guaranteed to pay interest payments and our initial investment upon maturity.

Because of their safety and liquidity, many countries around the world hold these same Treasury bills as part of their cash reserves.

Convenient and Liquid

Cash investments must always be easily retrieved and liquidated for cash. These investments should effectively be treated as cash, and there should be no early penalties or fees for withdrawing our funds to cash.

We note that sales of most Treasury and government money market funds and ETFs have a settlement time of a day or two. However, a sale of a Treasury money market fund or ETF will sell for the same price that we bought it at. The same cannot be said about stocks or other bonds, where prices can fluctuate and investors will feel more anxiety about “exiting at the right price”.

Ultra Low Cost

We are always looking for the lowest cost solution. Why? Fewer costs mean more yield for us.

An extreme example is how banks make money. The investments we recommend to you are the same ones our banks buy with our deposits. We deposit our money for free and get features such as bill pay and ATM withdrawals, but the hidden cost is that the banks take 99% of our interest income and barely pass anything on to us!

Some Treasury money market funds and ETFs have higher fees than others. So, our goal is to always search for ultra low cost solutions that will maximize returns for the investor. When balancing this with the first two principles of being safe and liquid, we can build a cash portfolio that generates consistent income in many market conditions.

Layoffs in the tech and media industries continue

Earlier this week, Salesforce announced a layoff of 700 employees or around 1 percent of its total global workforce. This follows earlier job cuts this year from Google, Amazon, Microsoft, eBay, and numerous other startups. In media, the LA Times reduced 20 percent of its newsroom, while Sports Illustrated has already been shuttered. On Friday, Business Insider, recently in the news for its spat with hedge fund manager Bill Ackman, laid off 8% of its employees.

Many note that tech companies are ramping up investment into AI at the same time, and may be reducing their workforce to invest more heavily into AI. This reduction in staff is occurring as these companies prepare to announce their earnings for the fourth quarter, amid investor expectations for more disciplined cost-cutting measures.

The U.S. is moving to T+1 later this year

In May 2024, most U.S. settlements will move from T+2, or two business days to settle a trade after it’s executed, to T+1, or one business day.

This is great news for U.S. investors, who will benefit from improved liquidity. Many of the cash investments we recommend, including non-sweep money market funds and Treasury ETFs, will benefit from the shortening of this settlement period. In practical terms, this means that when liquidating cash investments, you get access to your cash in one day instead of two! As a reminder, certain brokerages, such as Fidelity and Vanguard, treat some of their money market funds as cash, with instant settlement when you sell them.

We’d love to hear from you. If you have any feedback or thoughts, please feel free to directly respond to this email with your message. Our ChatGPT bot is also available for your questions.

If you enjoyed this newsletter, please subscribe here. Investing and saving is more fun with friends and family. You can forward this newsletter to anyone who might find the advice in this email useful!