Hello, YieldAlley readers! We released our AI chatbot on ChatGPT earlier this week. Try it out and engage with all the YieldAlley data and content you’ve been consuming!

In this week’s newsletter:

Rates Roundup for money market funds, brokered CDs, Treasury bills, and ultra short-term bond ETFs.

Introducing the YieldAlley ChatGPT Bot

Read of the Week: Are High-Yield Savings Accounts Worth It?

Elsewhere: Countries that first raised rates are now cutting them, U.S. home sales sank to a 30-year low in 2023

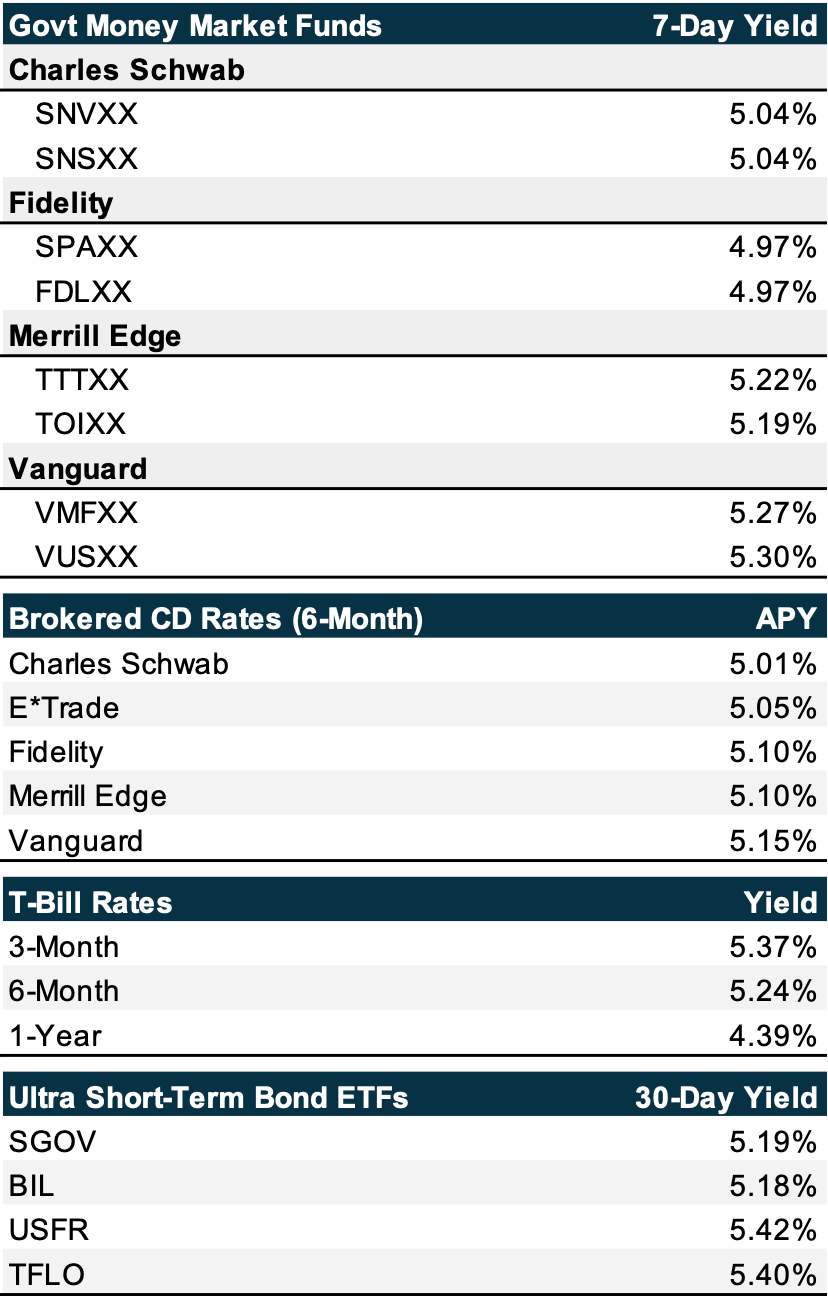

As of January 19, 2024

The S&P 500 continues to climb. It reached an all-time high on Friday, surpassing the previous high set in January 2022. Meanwhile, the 10-year Treasury yield rose around 4 basis points to 4.14% after a strong than expected jobs report came in on Thursday. One basis point equals 0.01%. Treasury yields are at their highest so far this year.

On January 25th, U.S. economic data will release an estimate of fourth-quarter economic growth, an important signal for whether the Federal Reserve will cut rates.

To learn how to earn the highest cash rates on each brokerage, read our cash guides on Charles Schwab, Fidelity, Merrill Edge, and Vanguard.

Introducing the YieldAlley ChatGPT Bot

We’re excited to announce that we launched the YieldAlley Personal Finance & Savings Expert AI Bot on ChatGPT earlier this week.

The YieldAlley AI bot is a more convenient way to interact with the YieldAlley knowledge database.

For example, you can ask YieldAlley AI what the best options to maximize your cash returns on Fidelity are. YieldAlley AI will automatically summarize our guide. You’ll be able to ask follow-up questions, such as what the current Fidelity CD rates are, or what the step-by-step process is to buy a Treasury bill.

Give the chatbot a try! As always, YieldAlley AI is providing information for educational purposes only, not financial advice.

Are High-Yield Savings Accounts Worth It?

High-Yield Savings Accounts, more commonly known as HYSAs, are one of the most common places to stash cash. There are many reasons why HYSAs are so popular:

Many HYSAs, especially from online banks, offer higher yields compared to traditional savings accounts. Most HYSAs are paying around 4.50% APY these days, with promotional offers as high as 5.50%.

HYSAs commonly allow instant transfers or ATM access for immediate cash on hand.

HYSAs cannot lose money up to $250,000. The cash in a HYSA is insured by the FDIC up to $250,000.

If you are unwilling to consider other cash investments, the HYSA is a better alternative to keeping cash in a traditional savings account.

But HYSAs also have shortcomings. Let’s review these in relation to each of the benefits listed above:

The highest HYSAs yields are almost always promotional offers. Banks will pay new depositors this yield for a short amount of time, such as 3 months. The bank can and will drag its feet on increasing rates when the Fed rate rises.

Savings accounts must follow Regulation D, which historically limited “convenient transaction” withdrawals to six times a month. In 2020, the government stopped enforcing this, but many banks and credit unions have kept this restriction. And while online transfers fall under the definition of a “convenient transaction”, withdrawals at ATMs also do not.

The $250,000 FDIC insurance coverage applies to all deposits per individual per bank. However, you can get uncapped insurance coverage or safety through brokered CDs or Treasury Bills.

The YieldAlley reader will know that we certainly prefer other investments that pay higher yields which have the same if not better features of HYSAs. While we suggest you read existing YieldAlley guides for more detail, we’ll briefly recap some benefits of better cash investments.

Treasury Money Market Funds are still paying 5% and benefit from a state tax exemption (which HYSAs do not), as mentioned in our last newsletter. Meanwhile, Betterment offers the highest HYSA rate right now at 5.50%. But after 3 months, this drops to 4.75%.

Brokered CDs are bank CDs you can buy at a brokerage, and offer higher yields than their bank CD counterparts. Because you can buy multiple CDs from different banks at a brokerage. You get $250,000 for each bank you buy CDs from. Brokered CDs allow you to easily expand your FDIC coverage (a DIY approach to an insured cash sweep).

Treasury Bills are also directly backed by the full faith and credit of the U.S. government. There’s nothing safer — remember, the U.S. government also backs the same FDIC that offers your HYSA insurance!

Treasury ETFs such as SGOV, USFR, and TFLO offer higher yields of around 5.40%, which is consistently higher than non-promotional HYSA yields. For us, it’s much more convenient to hold a Treasury ETF than to bank hop to capture promotional HYSA yields.

In our opinion, the yields, liquidity, safety, and other features of these investments far outweigh the benefits of HYSAs. We understand there is some friction involved in transferring cash from your bank to a brokerage to buy these investments. Remember this is intentional and by design from your bank to keep your cash in their products.

You can take matters into your own hands and get the best outcomes and yields for yourself. All it takes is 15 minutes a week following our step-by-step guides which walk you through each process.

Elsewhere

Countries that first raised rates are now cutting them

Eight countries (Brazil, Chile, Hungary, New Zealand, Norway, Peru, Poland, and South Korea) began to tighten monetary policy in 2021. These countries hiked many months ahead of the Federal Reserve and the European Central Bank and did so more aggressively. Despite this, inflation continued to rise in 2022 and 2023 in most of these countries.

Now, inflation is sharply dropping in some of these nations. In response, those central bankers are cutting interest rates to increase economic output and growth. Core inflation in Hungary has dropped 15% since the start of 2023. Every good and service in Poland experienced a 2% price rise in 2022, whereas only 90% were impacted in 2023.

It’ll be interesting to monitor developments across the world as we continue to track inflation and the economy in the U.S.

U.S. home sales sank to a 30-year low in 2023

Meanwhile, the number of homes purchased in the U.S. was just 4.09 million in 2023, 19% lower than in 2022. This is the fewest number of homes sold annually since 1995.

The median price for a home in 2023 was a record high of $389,800. The pool of first-time buyers was just under 30%, compared to around 40% in the 1990s.

Last year, 30-year U.S. mortgage rates skyrocketed past 7%. Mortgage rates, which have cooled to around 6.6% this week, will have a large impact on supply and demand and whether the home market will substantially improve this year. Some investors are betting that rate cuts from the Federal Reserve will help improve the market.

We’d love to hear from you. If you have any feedback, thoughts, or questions, please feel free to directly respond to this email with your message.

If you enjoyed this newsletter, please subscribe here. Investing and saving i more fun with friends and family. You can easily forward this newsletter to anyone who might find the advice in this email useful!