Hello, YieldAlley readers! Earlier this week, we launched our Facebook Income Investing group. Please join and invite others if you’d like to engage in discussion with fellow users and ourselves. If you have any real-time questions or feedback, we will be most active in the Facebook group and able to help you directly. The group will be invite-only in the future to maintain a high-quality discussion.

In this week’s newsletter:

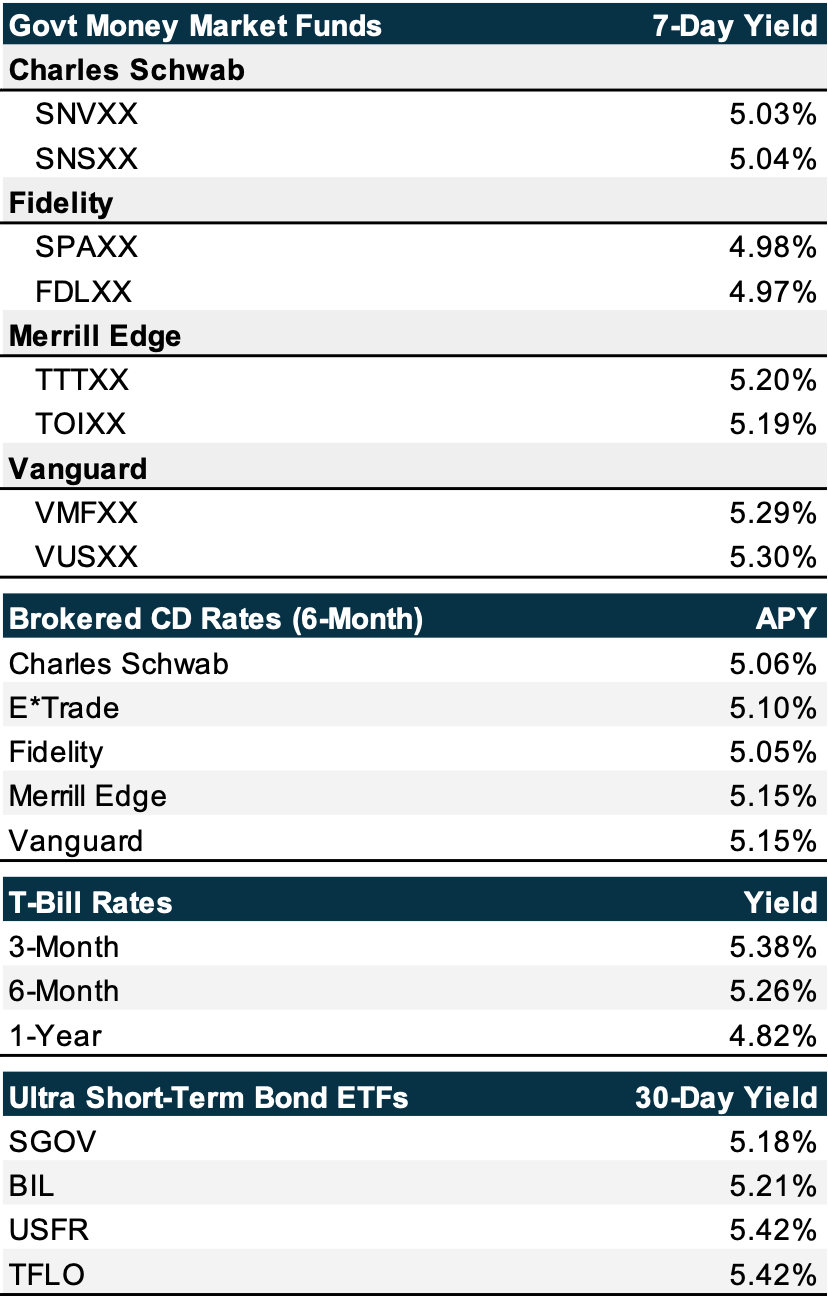

Rates Roundup for money market funds, brokered CDs, Treasury bills, and ultra short-term bond ETFs.

Read of the Week: A Brief Introduction to Income Investing

Elsewhere: Meta announces its first-ever dividend, Credit card companies are raising their fees

As of February 2, 2024

Last week, we mentioned that there would be a series of important earnings results this week. Turns out, some results were pretty good. Big Tech roared this past Friday, due to strong earnings from Amazon and Meta (Facebook). Nvidia also climbed off the back of this news. However, Apple and Alphabet (Google) had less impressive results, with Apple warning about a potential slowdown in China.

Meanwhile, the U.S. economy added 353,000 jobs in January. That was almost twice as many as forecasted. Investors are now lowering their expectations for an interest rate cut in March. The Federal Reserve has consistently insisted that it may be too soon to cut interest rates, and the latest jobs report seems to support that. The Fed will typically cut rates when the economy is weaker to increase demand.

Read our cash guides on Charles Schwab, Fidelity, Merrill Edge, and Vanguard to compare rates across money market funds and CDs to earn the highest cash rates.

A Brief Introduction to Income Investing

We know our readers have a broad-based interest in income investing. With the help of YieldAlley readers, we hope to be the premiere destination for income investing discussion, strategies, and frameworks to create an optimized income portfolio for any life situation!

In a nutshell, income investing is a preferred strategy for those who value consistent returns and compounding for the long term. You may also be unwilling to sacrifice spending today for tomorrow. Instead of just focusing on returns from capital appreciation (say, a rise in the price of a stock), income investing also focuses on generating income from investments.

Who uses income investing?

Income investing is most often used as a retirement planning strategy. But retirees are far from the only ones who benefit from an income investing strategy. Large university endowments, non-profit foundations, and even some Fortune 500 companies are designed to withdraw a certain percentage of their investments yearly to meet their objectives.

A new, younger crowd has also gravitated towards income investing as a way to supplement their salary and earn passive income on the side.

Why is income investing such a compelling strategy?

Would you rather have a 5 percent yield for five years or a series of returns that are up 13 percent in the first year, then up 12 percent, down 35 percent, up 40 percent, and up 5 percent in the last year?

Many would choose the second scenario with 4 out of 5 years of positive returns. But the one year with a 35% drawdown means that the second scenario results in a 21% return. In the 5 percent yield scenario, you’d get a 28% return.

Income investing is compelling for those looking for stability. Minimizing large negative returns is key to the income investing strategy.

What are the primary income investing methods?

Fixed income investments generally provide the most stable source of investment income. This means bonds will always be a primary source of discussion.

But, there is a lot to talk about beyond the extremely safe Treasury bills that typically depict the bond market. Bonds represent a wide spectrum of risk — from safe bank CDs to high-yield corporate junk bonds. The global bond market, which is valued at $300 trillion compared to the $120 trillion global stock market, is a large opportunity that’s often ignored.

We won’t forget about stocks. Research has shown that large companies that pay dividends rarely cut them. In fact, from 1995 until now, only 29 percent of dividend-paying companies have cut them, and those who did so were faced with a dire economic and corporate circumstance.

Where do we start with income investing?

For starters, we want to first educate YieldAlley readers on the closest thing to risk-free income investing. These days, cash investments are still providing risk-free yields of over 5%, a fantastic return for doing absolutely nothing.

We will then move on to strategies to implement TIPS, municipal bonds, corporate bonds, and total return bond portfolios — which take advantage of both price increases as well as income. While we will shy away from recommending specific stock recommendations, we will also review dividend-paying stocks and ETFs.

Expect to hear about any new topics first in this newsletter. Thank you for being here with us on this journey!

Meta announces its first-ever dividend

On Thursday, Meta announced its first-ever dividend. Shareholders will receive a quarterly dividend of 50 cents per share, or $2 a year per share. This equates to a dividend yield of roughly 0.4% based on Friday’s share price of $480.

The average yield for a dividend-paying stock in the S&P 500 is around 2%. Meta’s is much lower, but companies usually start smaller.

The first Meta dividend is set to be paid out in March, and investors can look forward to dividend growth, in addition to hopefully stock returns.

Credit card companies are raising their fees

American Express and Delta Air Lines are changing up their co-branded credit cards. In return for a higher fee, the companies are offering new rewards to frequent flyers, such as expanding the destinations for companion certificates. Cardholders will also get credits for booking restaurants at the Resy reservation system and for certain ride-share trips.

The Delta SkyMiles American Express Reserve and Reserve Business cards will have an annual fee of $650, up from $550. The Platinum fee increases to $350 from $250, whereas the Gold cards will rise to $150 from $99.

Credit cards, if maintained appropriately, can be an effective source of cashback and travel points. While it does not move the needle compared to investing, it doesn’t hurt to set up a spending system that also rewards us, especially if it’s low effort.

We’d love to hear from you. If you have any feedback or thoughts, please feel free to directly respond to this email with your message. Our ChatGPT bot is also available for your questions, as is our Facebook group.

If you enjoyed this newsletter, please subscribe here. Investing and saving is more fun with friends and family. You can forward this newsletter to anyone who might find the advice in this email useful!