Hello, YieldAlley readers! In this issue:

8 key bond investing risks.

Recapping Fed Chair Powell's Jackson Hole speech.

Ford scraps all-electric SUV plan.

The best way to track and monitor the highest cash rates.

And more!

NEWS

Standout Stories

🤖 Alphabet's Waymo robotaxi unit doubles its paid rides in three months (Reuters)

🛒 Kamala Harris Wants to Ban Price Gouging. What Do Economists Say? (WSJ)

🚗 Ford scraps all-electric SUV plan, saying drivers want hybrids (NPR)

🏡 Home sales rose in July for the first time in five months (CNBC)

🚀 NASA to bring stranded astronauts back on SpaceX capsule, not Boeing Starliner (Fortune)

MARKET THOUGHTS

Fed Signals Rate Cuts, Stocks Rally as Markets Eye September Policy Shift

Fed Chair Powell, Bank of Canada Governor Macklem, and Bank of England Governor Bailey at Jackson Hole Economic Symposium

U.S. stocks posted strong gains following Fed Chair Powell's Jackson Hole speech, indicating a shift towards rate cuts.

All three major U.S. indexes moved higher by over 1% on Friday.

The S&P 500 has rebounded over 8% since the August 5 market decline.

The Nasdaq has rallied more than 10% in the same period.

Both indexes remain up over 17% year-to-date.

Fed Chair Jerome Powell signaled the central bank's readiness to begin cutting interest rates.

Powell stated that "the time has come for policy to adjust".

He noted growing confidence that "inflation is on a path to 2%".

The Fed is expected to cut rates by 0.25% at its September meeting.

Analysts anticipate two to three rate cuts total for 2024.

Market volatility has decreased significantly since early August.

The VIX "fear gauge" has dropped from a high of 65 to around 16.

This level is in line with the VIX's average for the year.

Upcoming inflation data will be crucial for market sentiment.

The PCE inflation report, the Fed's preferred measure, is due next Friday.

Headline PCE inflation is expected to tick up slightly to 2.6% from 2.5%.

Core PCE inflation is anticipated to rise to 2.7% from 2.6%.

Both figures remain below the Fed's 2024 forecasts.

The economic outlook remains cautiously optimistic.

The U.S. economy is seen as "cooling but not collapsing".

Inflation continues to moderate.

The unemployment rate of 4.3% is now above the Fed's 2024 expectation of 4.0%.

Analysts recommend using market volatility as an opportunity to diversify and rebalance portfolios.

INCOME BUILDING

8 Crucial Risks Every Bond Investor Must Understand

As we explore bond investing, it's essential to understand that while bonds are often viewed as a more conservative investment option compared to stocks, they come with their own set of risks. Let's examine eight key bond investing risks that every investor should be aware of.

Credit Risk:

This risk relates to the possibility of the bond issuer defaulting on their payments. It's particularly relevant for corporate bonds, where the issuer's financial health directly impacts their ability to meet debt obligations.Interest Rate Risk:

When interest rates rise, the value of existing bonds typically declines. This inverse relationship can significantly affect the market value of bond holdings, especially for longer-term bonds.Reinvestment Risk:

This occurs when interest rates fall, and investors face challenges reinvesting their interest payments and returned principal at lower rates, potentially impacting overall portfolio yield.Inflation Risk:

Inflation erodes the purchasing power of fixed bond payments. If inflation outpaces the bond's interest rate, investors may experience negative real returns.Liquidity Risk:

Some bonds may be difficult to sell quickly without incurring substantial losses, particularly those that are less frequently traded.Currency Risk:

For investors holding foreign bonds, currency fluctuations can impact returns. A weakening foreign currency can reduce the investment's value when converted back to the investor's home currency.Country Risk:

This encompasses factors like political instability, economic challenges, or regulatory changes in the bond issuer's country, which can affect repayment ability or bond value.Call Risk:

Some bonds come with call provisions, allowing issuers to redeem them before maturity. This can force investors to reinvest at potentially lower rates, especially if interest rates have declined since the bond's initial issuance.

When considering bond investments, it's also crucial to understand two fundamental principles. First, there's a direct correlation between risk and potential returns: bonds with higher risk profiles typically offer higher yields, reflecting investors' demand for greater compensation when assuming additional risk. Second, the time horizon of a bond investment significantly impacts its risk exposure. Longer-term bonds are generally more susceptible to various risks, such as interest rate fluctuations and inflationary pressures. As a result, investors typically expect higher yields for committing their capital over extended periods.

Remember, while bonds generally offer more stability than stocks, they are not risk-free. A balanced approach, considering both the potential returns and the associated risks, is key to successful bond investing.

What's Your Take?

We'd love to hear from our readers about their experiences with bond investing. Have you encountered any of these risks in your own portfolio? How do you balance the need for income with the desire to minimize risk? Share your insights and strategies by replying to this email – your perspective could be invaluable to fellow readers navigating the complex world of bonds!

INCOME BUILDING

Cash Rates

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 4.99%

SPAXX (Fidelity Government Money Market Fund): 4.98%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 5.19%

VMFXX (Federal Money Market Fund): 5.25%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 4.70%

E*Trade: 4.65%

Fidelity: 4.65%

Merrill Edge and Merrill Lynch: —

Vanguard: 4.65%

ETFs

SGOV (iShares 0-3 Month Treasury Bond ETF): 5.23%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 5.17%

USFR (WisdomTree Floating Rate Treasury Fund): 5.26%

TFLO (iShares Treasury Floating Rate Bond ETF): 5.29%

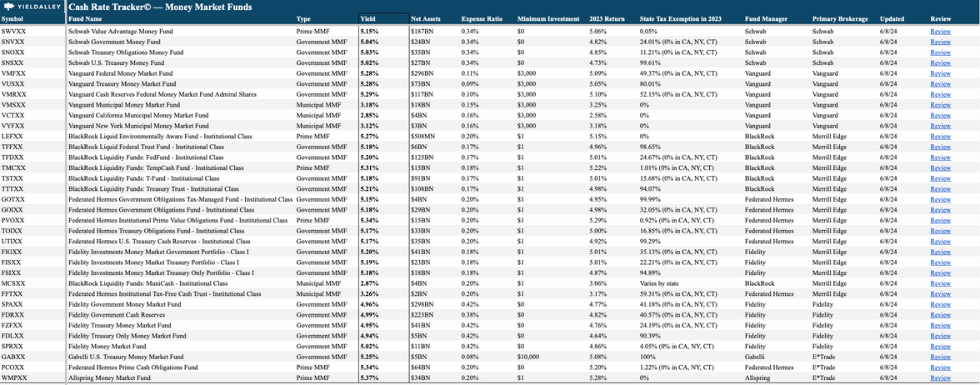

Want To Track the Highest Cash Yields?

Refer just one person to the YieldAlley newsletter for instant access to the YieldAlley Cash Rate Tracker©.

This simple spreadsheet lets you easily compare and track the best cash rates and investments.

Get all the details on the best money market funds and ETFs in a single spreadsheet.

BONUSES

Brokerage, Bank and Credit Card Bonuses

Brokerage Bonuses

E*Trade (still active): Up to $4,000 in bonuses for deposits made within 60 days of enrollment. The lower deposit bonuses are also excellent, with E*Trade offering a bonus of $100 for a deposit of just $50. Offer here.

Use promo code PROMO24.

$50+ will receive $100

$1,000-$24,999 will receive $150

$25,000-$49,999 will receive $150

tastytrade (still active): Offering up to $5,000 in bonuses. Lower deposit bonuses are attractive, with a $100 bonus for a deposit of $5,000 (2% return). Offer here.

Robinhood (still active): Offering a 1% bonus for transferring any table brokerage holdings. No maximum, but deposits must be held for two years after account opening. Offer here.

Bank Bonuses

BMO Harris (new) — Earn up to a $560 bonus when you open a new Smart Advantage or BMO Harris Premier checking account. Offer here.

Availability: Nationwide

Soft credit inquiry

U.S. Bank (active) — Earn up to a $450 bonus when you open a new Smartly checking account when you use promo code 2024JUL. Offer here.

Availability: Nationwide

Soft credit inquiry.

Axos Bank (active) — $500 when you open a new rewards checking account with promo code RC500 and certain requirements. Offer here.

Availability: Nationwide

Soft credit inquiry.

Credit Card Bonuses

American Express Marriott Bonvoy Brilliant Card — Get 185,000 Marriott Bonvoy points after $6,000 in spend within the first six months of account opening. Offer here through October 2, 2024.

American Express Marriott Bonvoy Bevy Card — Get 155,000 Marriott Bonvoy points after $5,000 in spend within the first six months of account opening. Offer here through October 2, 2024.

Barclays jetBlue Plus Card (active) — Get 80,000 JetBlue points after $1,000 in spend within the first 90 days of account opening. Offer here.

Chase Ink Preferred (active) — Get 120,000 Ultimate Rewards bonus points when you spend $8,000 in the first three months after account opening. Offer here.

Capital One Venture (active) — Enjoy $250 on Capital One Travel in your first year and earn 75,000 bonus miles after spending $4,000 in the first 3 months. Offer here.

American Express Hilton Surpass Card (active) — 150,000 points Hilton Honors points after spending $2,000 in 3 months. Get an additional 50,000 points after spending a total of $10,000 within the first 6 months. Offer here.

Picture of the Week