Hello, YieldAlley readers! In this issue:

4 Wide Moat Dividend Stocks On Our Radar

U.S. Markets Scale New Peaks as Trump Softens Trade Stance and AI Investment Surges

Fidelity's unlimited 2% cashback credit card

And more!

NEWS

Standout Stories

📰 Here’s What Catchy Headlines Miss About Retirement Planning (Think Advisor)

🔐Is It Time To Lock in 5% Yields? (A Wealth of Common Sense)

🏝️ How much money buys you happiness in retirement? (Financial Times)

🇨🇳 How China’s new AI model DeepSeek is threatening U.S. dominance (CNBC)

₿ President Trump: Executive order part of plan to make U.S. 'crypto capital of the planet' (USA Today)

MARKET THOUGHTS

U.S. Markets Scale New Peaks as Trump Softens Trade Stance and AI Investment Surges

ECONOMY

The University of Michigan's Consumer Sentiment Index, which measures how optimistic Americans feel about their finances and the economy, fell to 71.1 from 74.0 in January - the first decline in six months. This decline (with 100 being the baseline) suggests consumers are growing more worried, primarily due to inflation fears and job concerns. Manufacturing showed encouraging signs, expanding for the first time in six months according to S&P Global's January data. The housing market offered a bright spot with existing home sales climbing 2.2% to 4.24M units in December, though 2023's full-year sales hit a 30-year low as high mortgage rates and home prices kept many buyers sidelined.

STOCKS

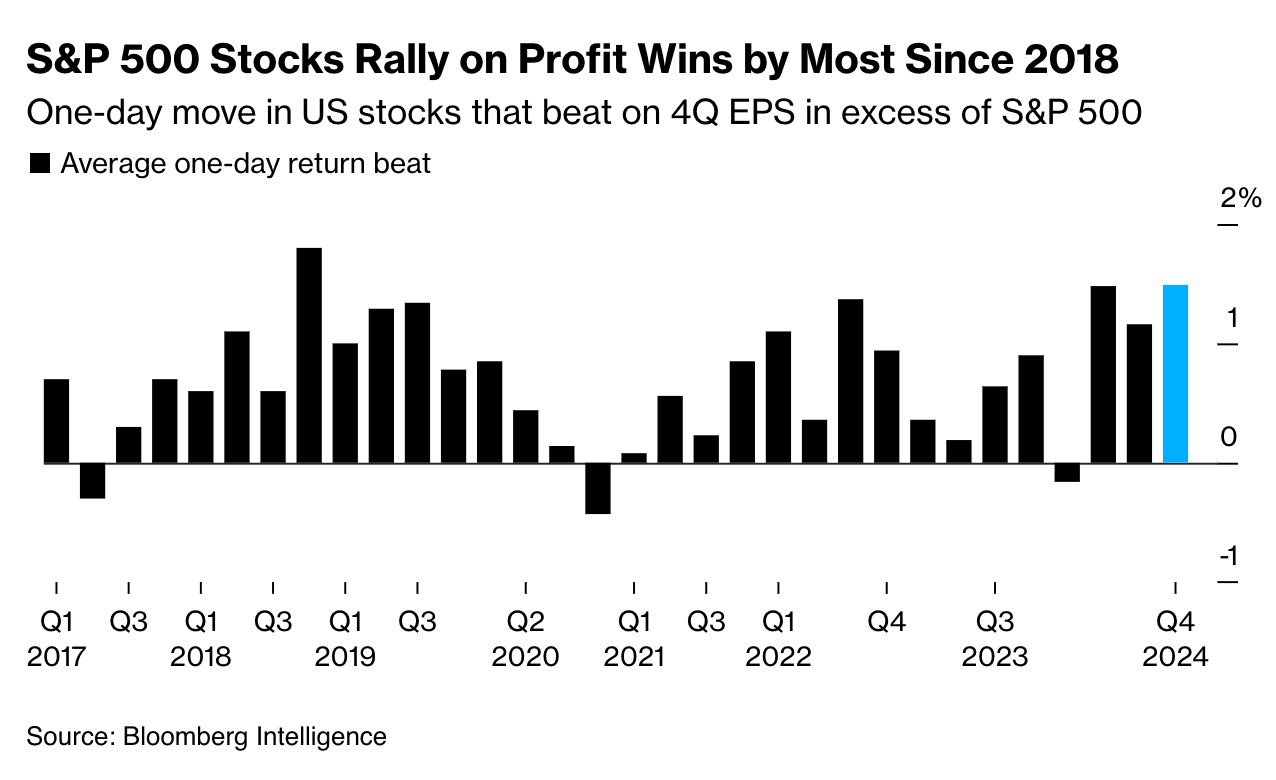

The S&P 500, a broad measure of America's largest companies, reached new all-time highs before pulling back Friday. Growth stocks (typically faster-growing companies, often in tech) outpaced value stocks (typically more established companies with steady earnings) for the first time this year. Markets responded positively to President Trump's more measured approach on trade, particularly his decision to review rather than immediately impose tariffs on China. A major boost came from the announcement of a $500B artificial intelligence infrastructure project involving Softbank, OpenAI, and Oracle. The Dow Jones Industrial Average, tracking 30 major U.S. companies, gained 4.42% year-to-date, while the broader S&P 500 rose 3.73%.

FIXED INCOME

In the bond market, where prices and yields move in opposite directions, Treasury yields moved slightly higher. Municipal bonds (issued by states and local governments) performed better than Treasuries, despite a high volume of new bonds being issued. Corporate bonds saw strong demand, with new investment-grade offerings (from companies with strong credit ratings) being well-subscribed. High-yield bonds, which typically offer higher returns but carry more risk, advanced after the inauguration, with heavy trading activity but limited new issuance creating more buyers than sellers in the market.

INCOME BUILDING

4 Wide Moat Dividend Stocks On Our Radar

In an environment of elevated market valuations and persistent inflation in 2025, dividend investors would do well to focus on companies with durable competitive advantages. From Morningstar's top dividend picks, four companies stand out to us for having a wide moat while offering attractive yields and undervaluation.

Johnson & Johnson (JNJ) offers a 3.35% dividend yield with a recently declared quarterly dividend of $1.24 per share for Q1 2025. The company's diverse revenue base and exceptional cash flow support both its wide moat rating and dividend sustainability. A key near-term catalyst centers on the $8.2 billion talc settlement offer, awaiting a federal judge's decision in January 2025. Recent strategic moves, including FDA approval for SPRAVATO and the Intra-Cellular Therapies acquisition, demonstrate continued focus on portfolio expansion in key therapeutic areas.

Merck (MRK) presents a 3.24% yield, supported by a quarterly dividend of $0.81 for Q1 2025. The company's robust patent portfolio and economies of scale create significant barriers to entry, supporting its wide moat designation. Some analyst valuations suggest potential undervaluation of up to 47%, with a fair value estimate of $228. The expansion of Gardasil approval in China and commitment to supplying 115 million doses to developing markets by 2025 highlights the company's growth trajectory in key markets.

PepsiCo (PEP) combines defensive characteristics with growth potential, offering a 3.59% yield. The company's marketing dominance and extensive distribution network underpin its wide-moat status. Recent developments include the $1.2 billion acquisition of Siete Foods, expanding its presence in healthier snack options. While the FTC's price discrimination lawsuit presents a near-term challenge, Morningstar expects Pepsi’s dividend payments to increase by 7% every year over the next decade.

Mondelez International (MDLZ) rounds out our selection with a 3.25% yield. The company's portfolio of iconic brands and operational efficiency improvements support its wide moat rating. The company's brand portfolio extends far beyond Oreo and Cadbury, and its Clif Bar acquisition has established a strong foothold in nutrition bars. Management's recent approval of a $9 billion share repurchase authorization effective January 2025 signals confidence in future performance. Trading at a P/E ratio of 20.3x versus an estimated fair P/E of 23.8x, the stock appears undervalued, with fourth-quarter results due February 4, 2025. Morningstar believes the stock is worth $75, with shares currently trading at around 20-20% lower.

These four companies share crucial characteristics beyond their wide moats: low Morningstar uncertainty ratings (except Merck's medium), demonstrated commitment to shareholder returns, and current undervaluation. In an environment where quality increasingly matters, these wide-moat dividend payers offer a compelling combination of current income and potential appreciation.

INCOME BUILDING

Cash Rates

Government Money Market Funds (7-Day Yields)

SNVXX (Schwab Government Money Fund - Investor Shares): 4.08%

SPAXX (Fidelity Government Money Market Fund): 4.01%

TTTXX (BlackRock Liquidity Funds: Treasury Trust - Institutional Class): 4.22%

VMFXX (Federal Money Market Fund): 4.28%

Brokered CD Rates (6-Month Rate)

Charles Schwab: 4.30%

E*Trade: 4.30%

Fidelity: 4.30%

Merrill Edge and Merrill Lynch: —

Vanguard: 4.20%

ETFs (30-Day Yields)

SGOV (iShares 0-3 Month Treasury Bond ETF): 4.31%

BIL (SPDR Bloomberg 1-3 Month T-Bill ETF): 4.23%

USFR (WisdomTree Floating Rate Treasury Fund): 4.26%

TFLO (iShares Treasury Floating Rate Bond ETF): 4.25%

BONUSES

Brokerage, Bank and Credit Card Bonuses

Fidelity's 2% cashback credit card offers an appealing combination of features for existing Fidelity customers looking to automatically invest their rewards. The card offers unlimited 2% cashback on all purchases with no annual fee or foreign transaction fees. Currently, targeted mail and email offers include a $150 sign-up bonus after spending $1,000 in the first 90 days. All rewards must be deposited into eligible Fidelity accounts, including IRAs, HSAs, and 529 plans, making it particularly attractive for those focused on long-term investing.

The application process is straightforward through Fidelity's website, though the card is actually issued by Elan Financial Services. Approval typically requires excellent credit (mid-high 700s), and approved cardholders receive their cards within approximately 4 business days. The card includes standard Visa Signature perks like travel assistance, concierge service, and rental car coverage up to $75,000.

For those without Fidelity accounts or seeking more flexible redemption options, alternatives include the Citi Double Cash card (offering 1% on purchase plus 1% on payment, with a $200 bonus after $1,500 spend in 6 months) or the Wells Fargo Active Cash (2% unlimited rewards with a $200 bonus after $500 spend in 3 months). The Fidelity card may not be ideal for those preferring category bonuses or airline miles, but it presents a compelling option for existing Fidelity customers who value simplicity in their rewards structure and automatic investment of their cashback.

Picture of the Week